Since 2015, we’ve written a lot of articles on milesopedia about points & miles: how to earn them and most importantly… how to use them the best way! We are always happy when readers take a few minutes to tell us about their experience!

A trip to the American West and Honolulu with points & miles

Melanie L. has been a milesopedia reader for years, and is a regular contributor to the“Travel for free (or almost free…!) with your points & miles” Facebook group.

Foreword: Melanie’s knowledge

Here is her “postcard” that she sent us:

My knowledge: Before discovering Milesopedia, I was often snooping on the web looking for good deals, especially on English websites not adapted to Quebecers.

So I stumbled upon an offer from the now defunct Chase Marriott Visa card while planning a trip to Florida in 2016.

It was only afterwards that I got really interested in hotel points and found Milesopedia.

As is often the case, our readers find us after having browsed many English-speaking sites – mostly American – and are very happy to discover the only serious French-speaking source of information on loyalty programs, adapted to Canadians!

Melanie’s goal: hotel nights

Melanie decided to focus on hotel points.

My goal: After returning from a trip to California in late September 2017 for which I had paid for 5 of my 8 nights with Marriott Bonvoy and Best western Rewards points, I became completely addicted to points.

Having literally fallen in love with the West Coast of the United States, my friend and I decided in October 2017 to start accumulating Marriott Bonvoy points in order to plan another trip, but longer this time. The main objective: to completely pay for overnight stays with points.

When you see the savings you can make with points, especially on hotel stays… you can’t do without them!

We have therefore focused on Starwood Preferred Guest, Marriott Rewards and Best Western Rewards points(Editor’s note: Starwood Preferred Guest and Marriott Rewards are now one program: Marriott Bonvoy).

Since I am not yet familiar with the accumulation of air miles and since flights in North America in economy class are quite affordable, I did not want to spread myself too thin. We are planning a 21-night trip paid entirely with points.

Melanie has done her lessons: she has set a clear goal and is sticking to it! And his strategy is perfect: it is often said that a hotel room can accommodate 1,2,3 – 4 people… while an airplane seat cannot!

It was therefore relevant here to focus on the accumulation of hotel points in the various chains easily accessible to Canadians: Marriott Bonvoy and Best Western Rewards.

Credit cards underwritten: Melanie’s game plan

Melanie and her friend already had cards that they were able to take advantage of the last benefits they had to offer:

In our existing portfolio, we each already had the Chase Marriott Visa card from our last trip to California in 2017 (Editor’s note: this card no longer exists in Canada). My card anniversary was in March 2018, so I was able to get my free night’s stay in March 2018.

In addition, following the announcement of the withdrawal of this card from the Canadian market, another night’s stay was offered by Chase / Marriott Bonvoy to all cardholders. My friend also received an extra night, so we had a total of 3 category 1-5 nights to use.

Next, Melanie and her friend tackled the subscriptions for several cards.

Best Western Rewards

The Best Western Rewards MasterCard is probably the easiest credit card to obtain in Canada and the bonus is easily unlocked: only one purchase is required!

What’s more, this card is free! This is how Melanie and her friend were able to accumulate many Best Western points… for free!

We each signed up for this card when it was on promotion offering 40,000 points (Editor’s note: it’s been over a year since the card was on promotion: it now offers a 20,000 point bonus).

Between the bonuses and spending on each of our cards, we had a total of 90,000 points between us. It was very easy for me to transfer his points to my account by calling Best Western Rewards.

Marriott Bonvoy

Next, Melanie and her friend tackled the accumulation of starpoints (now Marriott Bonvoy points) via American Express Marriott Bonvoy cards.

In October 2017, I signed up for <a class=”thirstylink” title=“the Marriott BonvoyTM American ExpressMD Card” href=”https://miles.dev.kylespiller.com/go/amex-marriott”>Marriott BonvoyTM American ExpressMD Card to get the 20,000 starpoints that I was able to convert into 60,000 Marriott Bonvoy points. I then referred my friend to get another 5,000 points so that he could also get 20,000 starpoints.

In March 2018, he referred me for the Marriott BonvoyMD* Corporate Credit Card from American Express, so he got the 5,000 referral points and I got the 20,000 bonus points upon signing up.

I then sponsored him for the Marriott BonvoyMD* Corporate Credit Card from American Express, so 5,000 points for me and another 20,000 for him. I also sponsored 2 friends, which allowed me to get 10 000 extra points. Total SPG point accumulation: 105,000 SPG or 315,000 Marriott Bonvoy points and this in April 2018 or 6 months after the first subscriptions.

Melanie made perfect use of the sponsorship system then present on these cards. Now, sponsorship is made a bit complicated on the American Express side which requires spending $3,000 for the same welcome bonus unlike the offer we are proposing which only requires spending $1,500.

Membership Rewards points transferable to Marriott Bonvoy points

Melanie and her friend then chose to set their sights on the American Express Cobaltᵐᶜ Card:

In January 2018, I signed up for the American Express Cobaltᵐᶜ Card so that I could earn Select Membership Rewards points and then convert them as I once did to SPG at a 2:1 rate and then Marriott at a 1:3 rate.

Since then, American Express Membership Rewards points can be transferred to Marriott Bonvoy points at a 1:1.2 (or 5:6) rate.

Since I needed a total of 405,000 Marriott points before the August 2018 merger of the 2 SPG and Marriott Bonvoy programs, I was still 90,000 Marriott points short to cover 16 Marriott nights because the other 4 are with Best Western points.

So it took me 60,000 Membership Rewards points to get there. This was quite easy with the bonus of 2500 points per month and 3 referrals!

The American Express Cobaltᵐᶜ Card is particularly interesting for those who do their grocery shopping in stores that accept American Express (such as Metro / Super C in Quebec) or make good use of gift cards obtained in grocery or convenience stores (Couche-Tard) to accumulate 5 points / dollar.

Tip: even though we don’t live at the same address, I was able to put our SPG, Marriott and Best Western points accounts at mine while leaving our respective addresses on our credit card accounts.

This is the only way I can transfer points between members and finally transfer everything into my Marriott account!

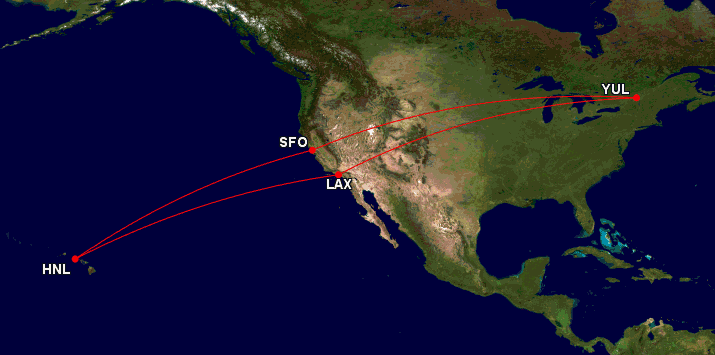

The route set up by Melanie for her trip

Let’s get to the interesting part: Melanie and her friend’s trip!

Having been a travel consultant in a previous life, I have a good base. So in March, I’m looking at the possibilities that are available to us from Montreal. In April, I find a flight YUL-SFO-HNL-LAX-YUL with United Airlines for the modest sum of 701,00$ CAD each.

I am testing several dates, in order to check the different rates. Going to Hawaii in addition to California, charms me to no end! Also, we want to go through Death Valley Park and go to Las Vegas.

A very nice multi-destination course! After all, why not combine several trips into one?

Here is the itinerary booked with direct flights:

- Montreal – San Francisco on September 19

- San Francisco – Honolulu on September 24

- Honolulu – Los Angeles on September 29

- Los Angeles – Montreal on October 9

And Melanie adds details about her road trip in the American West:

When we arrive in Los Angeles, we rent a car and leave for San Diego for 3 nights. Then we will sleep in Ridgecrest. The next day we cross the Death Valley National Park, to finally reach Las Vegas at the end of the day for 2 nights.

Leaving Las Vegas, we will sleep in Barstow, halfway to the Mojave Desert. Then Laguna Beach and Manhattan Beach where we will end our trip on October 9th.

Hotels booked by Melanie

After booking her flights and planning her itinerary, Melanie moves on to booking her hotels:

I stay 5 nights in San Francisco and 5 nights in Honolulu to maximize my points and get the5th night free.

Good strategy to save 20% in points! Read the full strategy for this benefit in this article to find out how to get the fifth night free at Marriott Bonvoy.

Here is the list of hotels reserved by Melanie and her friend:

| Hotel | Points / Certificate / Money | Nights | Program |

| Marriott Montreal Airport Terminal Our report on this hotel |

Category 4 25,000 points vs 454.93 CA$. |

1 | Marriott Bonvoy |

| Courtyard by Marriott San Francisco Union Square |

5* category 140,000 points vs 2 383.63 US$ |

5 | Marriott Bonvoy |

| Courtyard by Marriott Waikiki Beach |

Category 5 140,000 points vs 1 394.49 US$ |

5 | Marriott Bonvoy |

| Residence Inn by Marriott San Diego Downtown/Gaslamp Quarter |

Category 5 105,000 points vs 1 281.36 US$ |

3 | Marriott Bonvoy |

| Best Western China Lake |

20,000 points vs 100.75 US$ |

1 | Best Western Rewards |

| Best Western Casino Royale |

56,000 points vs 362.79 US$ |

2 | Best Western Rewards |

| Best Western Desert Villa Inn |

16,000 points vs 101.74 US$ |

1 | Best Western Rewards |

| Renaissance ClubSport Aliso Viejo Laguna Beach Hotel |

Category 5 2 certificates vs 454.30 US$ |

2 | Marriott Bonvoy |

| Residence Inn by Marriott Los Angeles LAX/Manhattan Beach |

Category 5 1 certificate vs 236.92 US$ |

1 | Marriott Bonvoy |

| Total | 410,000 Marriott Bonvoy points 92,000 Best Western points 3 Marriott certificates vs 6 315.98 US$ and 454.93 CA$ or about 8 800 CA$. |

21 |

* Following the merger between Marriott and Starwood, the hotel has been downgraded. So I cancelled my 160,000 point reservation so I could re-book it at 140,000 points. A nice saving of 20 000 points 🙂

Melanie’s car rentals

After planning the hotels, Melanie looked for a way to save money on her car rentals:

Having completed the accumulation of our points needed for my hotels (departure goal) at the end of May 2018, I couldn’t see myself spending the next 3 months doing nothing! So I tackled my car rentals using credit cards with travel points!

Here are the two rentals made by Melanie:

- Honolulu: 5 days – $289.68 (Alamo – Jeep Wrangler)

- Los Angeles: 10 days – $628.75 (Alamo – Mustang convertible)

To make these car rentals, I signed up for the following two cards on the same day in June 2018 to minimize the impact at the credit bureau:

|

|

|

| Name / Card | The MastercardMD BMO World EliteMD |

The Visa Infinite Passport Card Scotiabank |

| Annual fee | Promo: $0 |

139$ |

| Bonus | 35,000 points BMO Rewards |

25,000 points Scotia Rewards |

| How to earn eUpgrade Credits | when you wear 3 000$ of purchases in the first 3 months |

when you wear 1,000 in purchases in the first 3 months |

| application | Subscribe | Subscribe |

After making $3,000 in purchases on my card to unlock the 35,000 point BMO Rewards bonus in August (a $250 value), I called BMO Rewards to make the reservation with Alamo for my Jeep Wrangler in Honolulu because it is not a product offered on their portal and it was the cheapest for what I was looking for. I was able to apply 40,800 BMO Rewards points to cover my entire rental, a savings of $289.68.

It’s easy to forget: but it can be helpful to call BMO Rewards to make a reservation:

Please note that if you book with an agent over the phone for a product that is offered on their portal, you will be charged a $27 booking fee. However, as in my case, this did not appear in their portal, so it is free. They can reserve anything that is not on BMO rewards.

I have done the same thing in the past and regarding car rentals, BMO Rewards deals with several wholesalers such as Auto Europe, who are known to offer the best rates on the market.

For my 10 day car rental in Los Angeles, I applied 34,219 Scotia Bonus points which credited the account with $342.19 since $1000 = $10 in travel expenses.

The application for the Scotiabank Passport™ Visa Infinite* Card gave me a good start by offering 25,000 points or $250. Moreover, it allowed me to avoid foreign currency conversion fees (2.5% additional savings).

To find out how to apply Scotia Rewards points to your travel purchases, read this article!

Finally, I used the select Membership Rewards points from the American Express Cobaltᵐᶜ Card to pay for miscellaneous charges at the Marriott hotels we stayed at such as parking which totaled a sum of $404.87 (or 40,487 points!)

To learn how to apply American Express Membership Rewards points to your travel purchases, you can read this article!

Earnings calculations with points & miles

Let’s make a detailed point by recalling:

|

|

|

|

||

| Points used | 410 000 points |

92 000 points |

40 487 points |

40 800 points |

34 219 points |

| Market value | about CA$8,000 |

about 800 CAD |

404.87 CAD | 289.68 CA$. | 342.19 CAD |

| Cumulative contributions | 440$ | $0 | $120 | $0 | 139$ |

| Net valuation | 8,000 – 440 =CA$7,460 |

800 CAD | 404.87$ – 120$ 284.87 CA$. |

289.68 CA$. | 342.19 – $139 = $203.19 |

| Savings per night / day | 439 CA$ / night | 200 CA$ / night | 14 CA$/ day | 58 CA$ / day | 20 CA$ / day |

| Total | 9,037.74 saved with points & miles or $430 / day |

||||

Bottom Line

Melanie and her friend were therefore able to take a beautiful trip to the American West and Honolulu thanks to their points & miles!

This trip will have cost them CA$ 985.56 (in credit card fees + car rental balance) when its value was 10 123$!

The points & miles will have allowed them to save …. 90 %! Hats off to Melanie!

If you too have a travel project and would like help, go to the facebook group “Travel for free (or almost…!) with your points & miles – milesopedia”!