Earn points

With Card Welcome Offers

The easiest way to earn American Express Membership Rewards Points is by applying to one of the membership rewards cards and getting a welcome bonus.

Welcome offers are different between each card and are offered to new cardmembers:

American Express Cobalt® Card

The American Express Cobalt® Card is the best credit card from American Express, whether you want points for travel or cash back.

The welcome bonus is distributed monthly for the first 12 months. You’ll earn 1,250 Membership Rewards points for every $750 in purchases charged to your card during the month (whether in the 1X, 2X, 3X or 5X category). That’s up to 15,000 Membership Rewards points.

You can easily use these points as statement credits for everyday or travel purchases. The value is the same for both: 1,000 points = $10.

Or you can transfer them into Aeroplan points, Avios (British Airways/Qatar Airways), Flying Blue, Marriott Bonvoy or Hilton Honors.

With the American Express Cobalt® Card, you can earn between 1 and 5 points per dollar:

| Category | Points per dollar |

| Grocery stores (Metro, IGA, Sobeys, Super C, etc.) | 5 |

| Food delivery | 5 |

| Restaurants and bars | 5 |

| Convenience stores | 5 |

| Streaming subscriptions | 3 |

| Gas station | 2 |

| Transportation | 2 |

| Travel | 2 |

| Other | 1 |

This is a 1 to 5% return on all these purchases.

For example, if you spend $1,000 per month on groceries and/or restaurants and/or food delivery, you’ll earn $50 cash back per month, or $600 cash back per year with this card for this category of purchases!

And if you decide to transfer your points to other programs like Aeroplan, you could get even more value!

In addition, this card provides excellent insurance coverage: rental car theft and damage, baggage delay, lost or stolen baggage, flight delay, $250,000 travel accident, hotel or motel burglary, Mobile Device Insurance, Purchase Security, Purchase Protection Insurance.

Like all American Express Canada Cards, there is no minimum income requirement.

American Express® Green Card

Do you want a cash back credit card with no annual fee that earns travel points? Here is an option for you: the American Express® Green Card.

By signing up for the American Express® Green Card, you can earn 10,000 Membership Rewards Welcome Bonus Points when you charge $1,000 in purchases to your Card in the first 3 months of Cardmembership. This is a $100 value for travel or any purchase on the Card. You can also transfer your points to airline partners (Aeroplan, British Airways Executive Club, Flying Blue, etc.) and hotel partners (Marriott Bonvoy, Hilton Honors).

That’s a nice welcome bonus for a credit card with no annual fee.

You’ll also have access to online promotional offers to earn points or rebates on your purchases with this no annual fee credit card.

Like all American Express Canada Cards, there is no minimum income requirement.

American Express® Gold Rewards Card

Earn up to 60,000 Membership Rewards points with this welcome offer for the American Express® Gold Rewards Card. That’s a $600 value for travel or any purchase on the Card.

You can also transfer your points to airline partners such as Aeroplan, Avios (British Airways / Qatar Airways), Flying Blue, and hotel partners (Marriott Bonvoy, Hilton Honors).

With this Card, you get many benefits like:

- $100 annual travel credit

- Priority Pass membership and 4 complimentary Plaza Premium visits per year

- $50 NEXUS credit

You earn 2 points per dollar for travel purchases, and at:

- gas stations

- grocery stores

- drugstores

And 1 point per dollar everywhere else.

Like all American Express Canada Cards, there is no minimum income requirement.

American Express Platinum Card®

The Platinum Card® is the Best Premium Travel Card in Canada.

With this welcome offer, you can earn up to 100,000 Membership Rewards points:

- 70,000 Welcome Bonus points after you charge $10,000 in net purchases to your Card in your first 3 months of Cardmembership

- 30,000 points when you make a purchase between 14 and 17 months of Cardmembership

With this card, you get:

- 2 points per dollar for dining purchases

- 2 points per dollar on travel purchases

- 1 point per dollar on all other purchases

You can use your Membership Rewards points in many ways:

- Transfer points to airline partners: Aeroplan, Avios (British Airways / Qatar Airways), Flying Blue, Delta Skymiles, etc.

- Transfer points to hotel programs (Hilton Honors, Marriott Bonvoy)

- Redeem points for statement credits to offset any travel purchase charged to your Card (1,000 points = $10)

- Redeem points for statement credits towards other purchases (1,000 points = $10)

- And more!

With this card, you also have advantages for your travels:

- $200 Annual Travel Credit

- $200 Annual Dining Credit

- $100 NEXUS Card Statement Credit

- Free, unlimited access for you and one additional traveller to over 1,200 airport lounges in more than 130 countries

- Hilton Honors Gold Elite status (complimentary breakfast at all Hilton hotels)

- Marriott Bonvoy Gold Elite status

- Access to the Fine Hotels & Resorts program

Last but not least, the Platinum Card® is distinguished by the numerous insurance coverages offered: theft and damage for rental cars, travel accident of $500,000Emergency medical expenses (out-of-province or out-of-country), lost or stolen baggage, flight delays and misdirected baggage, hotel or motel burglary, Purchase Protection, Purchase Security.

Like all American Express Canada Cards, there is no minimum income requirement.

American Express® Business Gold Rewards Card®

Earn up to 40,000 Membership Rewards points with this limited-time welcome offer for the American Express Gold Rewards Card for small businesses:

- 40,000 Membership Rewards points after $7,500 in purchases in the first 3 months

- 10,000 bonus points when you charge $20,000 in net purchases to your Card account each calendar quarter (up to 40,000 Membership Rewards points)

With this Card, you earn 1 Membership Rewards point per dollar on your purchases.

You can then use your points in many ways:

- Statement credit for travel purchases

- Statement credit for all purchases

- Transfer to partner programs (Aeroplan, British Airways Executive Club, Delta Skymiles, Flying Blue, Marriott Bonvoy, Hilton Honors, etc.)

- Book your flight with American Express Travel at a special rate

Also, as a cardmember, you get many advantages such as up to 55 interest-free days to maximize your cash flow.

Finally, you are covered with reliable insurance for your travels and purchases.

Like all American Express Canada Cards, there is no minimum income requirement.

Business Platinum Card® from American Express

Earn up to 120,000 points with this welcome offer for the Business Platinum Card® from American Express:

- 80,000 Membership Rewards® points after you charge $15,000 in net purchases to your Card in your first 3 months of Cardmembership

- 40,000 points when you make a purchase between 14 and 17 months of Cardmembership

You can use your Membership Rewards points in many ways:

- Transfer points to airline partners: Aeroplan, Avios (British Airways / Qatar Airways), Flying Blue, Delta Skymiles, etc.

- Transfer points to hotel programs (Hilton Honors, Marriott Bonvoy)

- Redeem points for statement credits to offset any eligible purchase charged to your Card (1,000 points = $10)

- And more!

120,000 points have a minimum value of $1,200 for a statement credit and much more if you transfer your points to a partner.

With this Card, you earn 1.25 Membership Rewards points per dollar on all purchases. What’s more, you’ll enjoy a host of travel and business benefits:

- Complimentary and unlimited access for you and an additional traveller to over 1,300 airport lounges worldwide.

- $200 Annual travel credit

- $100 Card Statement Credit for Nexus

- Marriott Bonvoy Gold Elite status

- Hilton Honors Gold Status

- Access to the Fine Hotels & Resorts program

- Up to $120 in eligible Wireless Credits each year

With this Card you can maximize your cash flow with up to 55 interest free days. It is a card that is particularly appreciated by contractors when making large purchases in home improvement stores, for example.

Last but not least, the Business Platinum Card® from American Express is distinguished by the numerous insurance coverages it offers: theft and damage for rental cars, travel accident from $500,000Emergency medical expenses (out-of-province or out-of-country), lost or stolen baggage, flight delays and misdirected baggage, hotel or motel burglary, Purchase Protection, Purchase Security.

Like all American Express Canada Cards, there is no minimum income requirement.

With expenses and bonus categories

Aside from the welcome bonus, the best way to earn membership rewards is by using your card to pay for all your purchases.

It is thus possible to earn between 1 and 5 Membership Rewards points per dollar depending on the categories of purchases.

You’ll have to be strategic in the earning of Membership Rewards points!

If the American Express CobaltMD Card is the ultimate accumulation card in certain 5X categories, we must not forget the other 2X accumulation categories offered by the American ExpressMD Gold Rewards Card.

However, if most of your purchases are made in other categories, Business Platinum Card® from American Express will be recommended due to its earning rate of 1.25 membership rewards per dollar.

With friends' referrals

American Express is the only institution that allows you to refer friends so they can open a card.

Offers are not always attractive compared to those offered on milesopedia.

Indeed, some offers may require spending up to twice as much money in 3 months to get an equivalent welcome bonus. Nothing to make good friends with…. !

However, it is an option to keep in mind… especially in a couple.

For the referrer, it is possible to get between 5,000 and 25,000 membership rewards points per referred card.

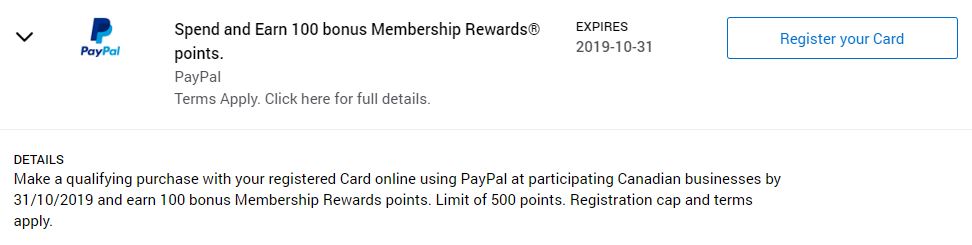

With AMEX's offers

American Express recently introduced “Amex’s offers” some of which earn membership rewards

With additional cardholders

American Express regularly offers a reward in membership rewards to provide an additional cardholder to your account.

Offers can range from 1,000 to 5,000 membership rewards.

Redeem points

Transfer points to other programs

To hotel partners

All cards offering membership rewards allow you to transfer their points to 2 hotel partners:

Here are the transfer ratio and duration:

| Program | Privilege points | Points earned | Deadline |

| Hilton Honors | 1 000 | 1 000 | 5 days |

| Marriott Bonvoy | 1 000 | 1 200 | 5 days |

To airline partners

All Membership Rewards cards can transfer their points to these airline partners.

American Express Canada is partnered with 6 airline rewards programs.

Here’s a list of each program, including transfer rates and processing times:

| Program | Membership Rewards points | Miles earned | Time limit |

| Aeroplan | 1 000 | 1 000 | 30 minutes |

| Air France KLM Flying Blue | 1 000 | 750 | 3 days |

| British Airways Executive Club | 1 000 | 1 000 | 3 to 5 days |

| Delta Skymiles | 1 000 | 750 | 30 minutes |

| Asia Miles | 1 000 | 750 | 3 to 5 days |

| Etihad Guest | 1 000 | 750 | 3 to 5 days |

Redeem for flights

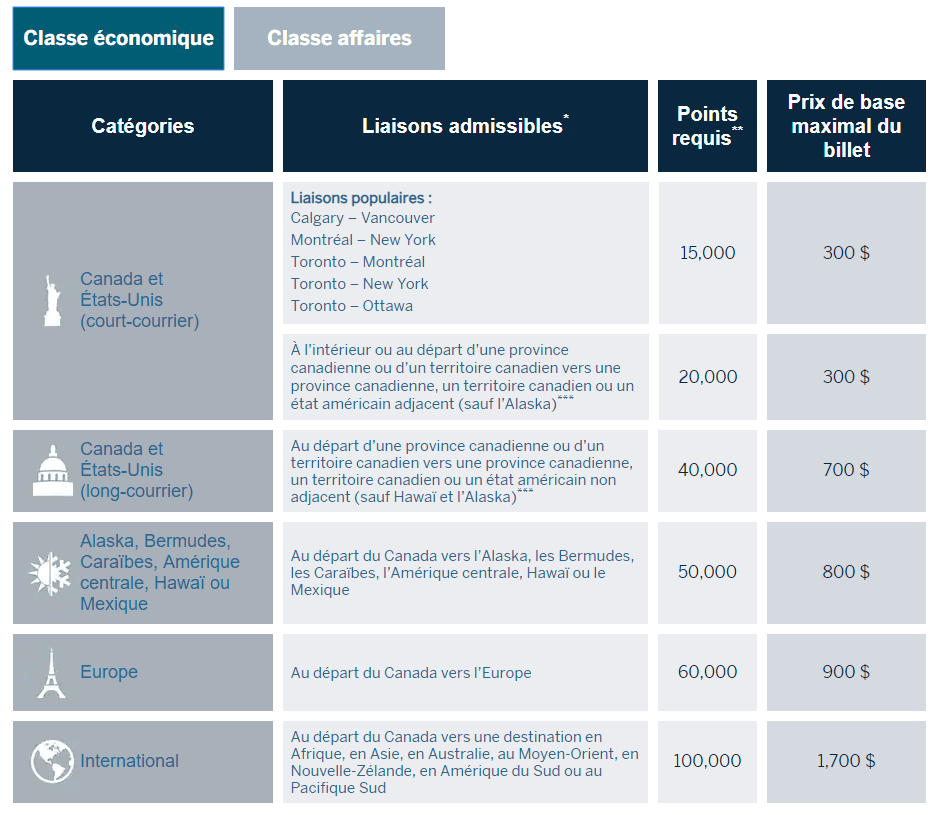

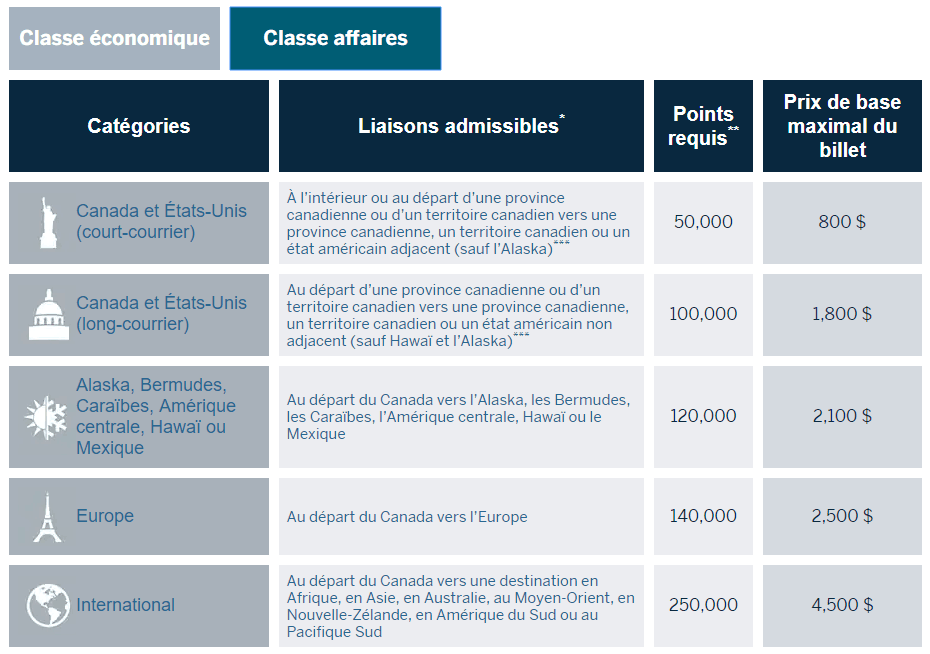

American Express Fixed Points Travel Program

American Express’ fixed point travel program is a fare schedule for some economy class flights:

And on some business class flights:

To book this type of flight, you will have to go to the American Express Travel portal.

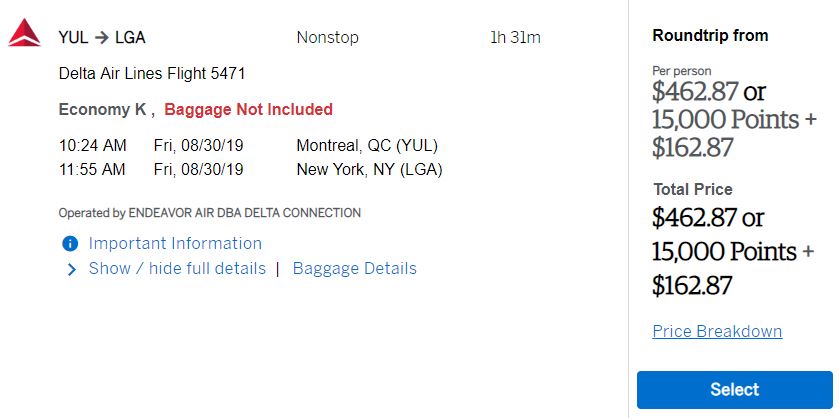

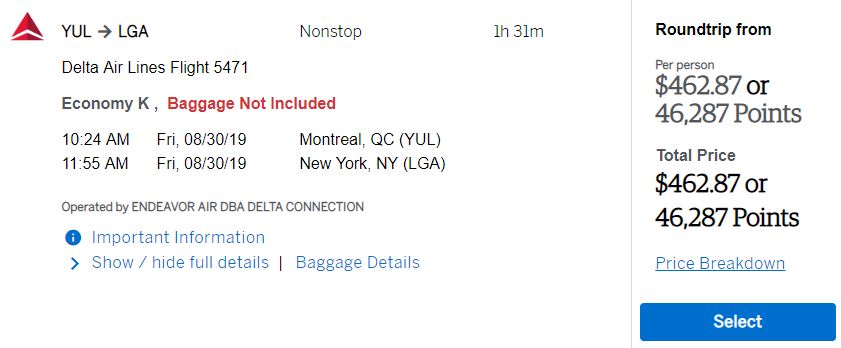

Let’s take the example of a round trip flight between Montreal and New York.

In this example, the flights costs $462.87.

Here, with the Fixed Points Travel Program, you can redeem 15,000 Membership Rewards points and pay $162.87 in taxes.

Thus, 15,000 membership rewards save $300.

So 1,000 membership rewards = $20.

American Express Flexible Points Travel Program

The points redemption option of the flexible points travel program allows you to redeem your Membership Rewards points for all or part of the fare, including taxes, fees and carrier surcharges, at a ratio that entitles you to a $10 statement credit for every 1,000 points.

Let’s take the same Montreal – New York round-trip with the flexible points option.

In this example, the flight still costs $462.87.

Here, with the flexible point travel program, it is possible to redeem 46,287 membership rewards to cover the full ticket.

To compare with fixed points, 15,000 membership rewards save $150.

So 1,000 membership rewards = $10.

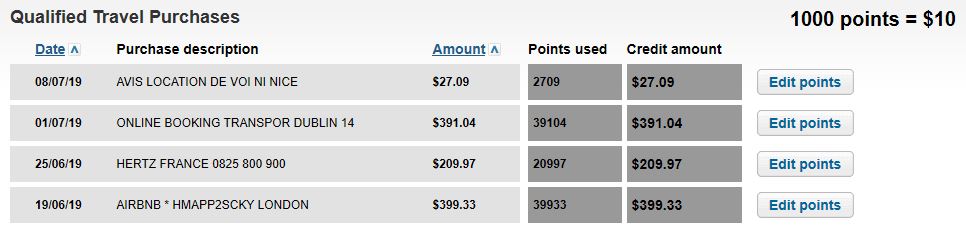

Statement credit for travels

American Express membership rewards can be applied to the account for any travel purchase charged on the card.

Here, 1,000 Membership Rewards points = $10.

For all current purchases

American Express membership rewards can be applied to the account for any current purchase charged on the card.

Here, 1,000 Membership Rewards points = $10 as of May 31, 2021.

Annual Fee Statement credit

A little-known option: redeem your Membership Rewards Points as a statement credit for your Card Annual Fee.

For example, when you renew the American ExpressMD Gold Rewards Card, you could use 25,000 Membership Rewards points to pay the $250 fee.

Here, 1,000 Membership Rewards points = $10.

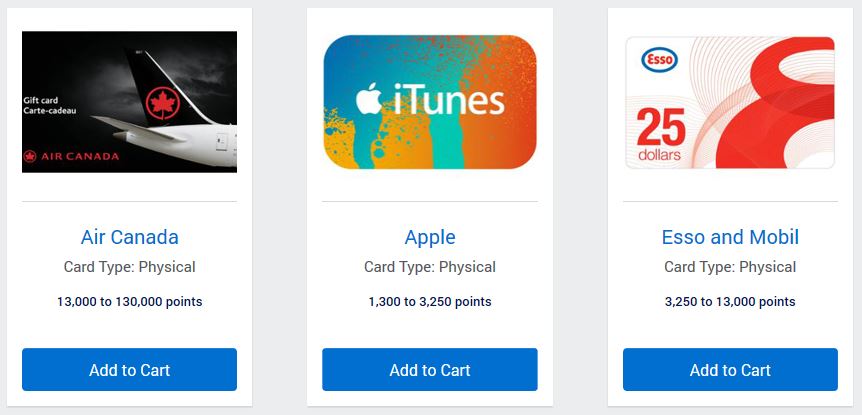

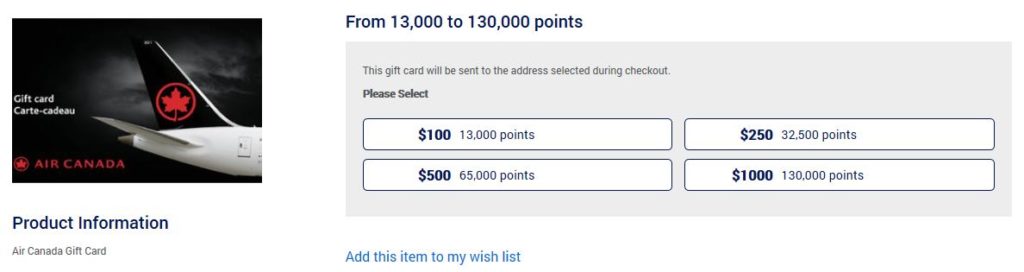

Gift cards

You can redeem your Membership Rewards Points on American Express’ online store. The first option is gift cards. There are dozens of them.

For example, an Air Canada gift card:

You could use 13,000 Membership Rewards points to get a $100 gift card.

Here, 1,000 Membership Rewards points = $7.70.

For products

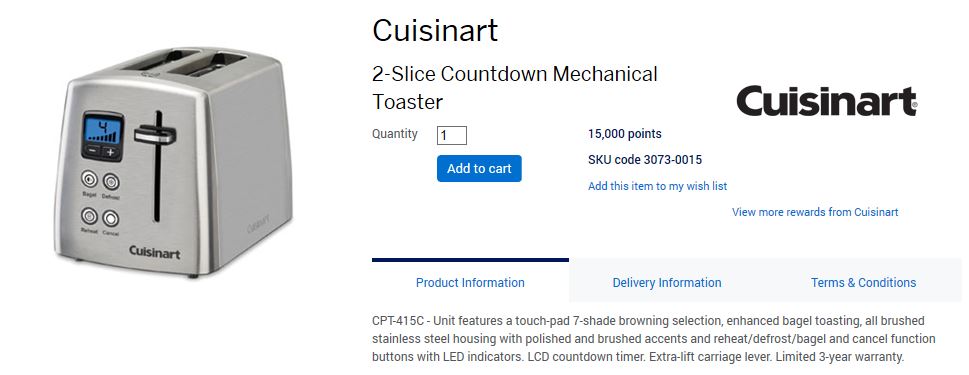

The second option on the American Express store is for products. Hundreds of them exist.

This toaster costs $75 in stores.

Here, 1,000 Membership Rewards points = $5.

Redeem your points on Amazon.ca

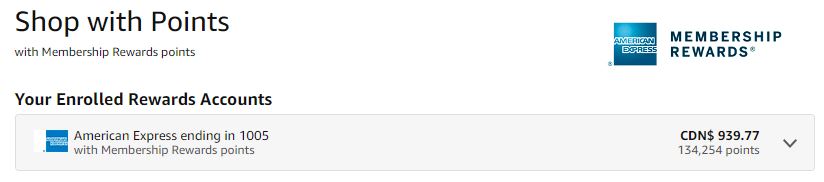

Another little-known option: redeem its membership rewards on Amazon.ca.

Here, 1,000 Membership Rewards points = $7.

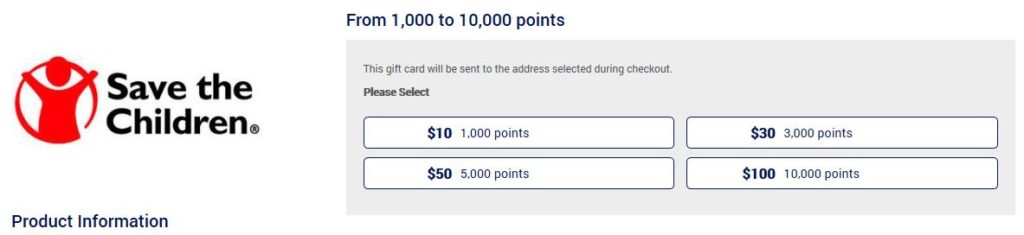

For charitable donations

Finally, it is possible to donate your Membership Rewards Points.

Here, 1,000 Membership Rewards points = $10.

Manage

Points value

As you may have seen above, there are many ways to redeem American Express Membership Rewards Points.

The value of 1 membership reward is estimated between 0.5 and 5.0 cents per point depending on the redeems (from the purchase of a toaster to the transfer to Aeroplan to travel in business class).

So we decided to rate the membership reward at 1.7 cents per dollar in order to be conservative.

This means that the American ExpressMD Gold Rewards Card welcome bonus is worth around $400.

Points expiracy

Membership rewards do not expire, as long as you keep a card active and in good standing.

It may be worthwhile to have a card like the American Express CobaltMD Card, whose fee is one of the least expensive, in order to maintain an active Membership Rewards points account.

Or the American Express® Green Card (no annual-fee card).

Combine Membership Rewards Points between your Cards

You can combine Membership Rewards Points from several cards in one Membership Rewards account.

The condition: all cards must be in your name.

It is therefore impossible for a couple or friends to transfer Membership Rewards points from one account to another. Read our article here.

To request a combination of membership rewards on a single account, you will need to contact American Express (by phone, secure messaging or chat).

Posts

FAQ

What is the Membership Rewards Program from American Express?

American Express offers many Membership Rewards Cards.

The Membership Rewards points earned can be redeemed for many rewards:

- Travel

- Products

- Gift cards

You can also convert Membership Rewards to airline programs such as Aeroplan, British Airways Executive Club, Delta Skymiles, or hotel loyalty programs such as Marriott Bonvoy or Hilton Honors.

What is the value of an American Express Membership Rewards Point?

Milesopedia rates an American Express Membership Rewards Point at 1.7 cents. If you have 50,000 Membership Rewards Points, this has an approximate value of $850.

Does it take an annual income to apply for an American Express credit card?

No, American Express does not require a minimum income for any of its credit cards.

How to earn Membership Rewards Points from American Express?

There are many ways to earn American Express Membership Rewards points with:

- American Express Card Welcome Offers

- Purchases and bonus categories

- Referral of friends

- online promotional offers

- Additional cards

How many Membership Rewards Points are offered with Card welcome bonuses?

Welcome bonuses are different for each credit card and are offered to new cardmembers: Depending on the promotion and the card, these bonuses vary from 10,000 to 50,000 points.

What other benefits are offered by Membership Rewards American Express Cards?

In addition to excellent insurance coverage, some Membership Rewards credit cards offer benefits such as unlimited access for the Cardmember and one guest to over 1,200 airport lounges and a $200 annual travel credit.

How and where to use the Membership Rewards Points from American Express?

There are many ways to use your American Express Membership Rewards points for:

- transfers to other programs (hotel and airline)

- flight ticket purchases

- travel purchases (e.g. airbnb and car rental)

- daily purchases

- annual fee

- gift cards

- products

- shop on Amazon.ca

- charitable donations

To which airline and hotel partners can I convert my Membership Rewards Points?

American Express Canada has 6 airline partners:

- Aeroplan

- Air France KLM Flying Blue

- British Airways Executive Club

- Delta Skymiles

- Alitalia Millemiglia

- Asia Miles

- Etihad Guest

And 2 hotel partners:

Do the Membership Rewards Points from American express expire?

American Express Membership Rewards points do not expire as long as you maintain an active and valid credit card.