The Educfinance application stands out as an excellent, simple, yet comprehensive tool for tracking your finances without having to link bank accounts. With the data leaks and the risks of hacking, some people will prefer to analyze their numbers “offline” on an Excel file.

The program responds well to this desire. In addition to making financial management easier thanks to its very simple interface; it also allows you to save a lot of time compared to an Excel document.

Educfinance Application

The best way to manage your finances is to know where your money is going. Educfinance is a great tool to track :

- your income

- your expenses

- your assets

- your liabilities

- your projects

- the growth of your savings

The program can be downloaded on IOS and Android. The annual subscription to use Educfinance costs $39.99, but you have a free 7-day trial.

You can track your finances with Educfinance on your phone, on a tablet, or on a computer as the system syncs well from one platform to another. So no matter your preference, it’s a great app!

Educfinance's various management components

The projects

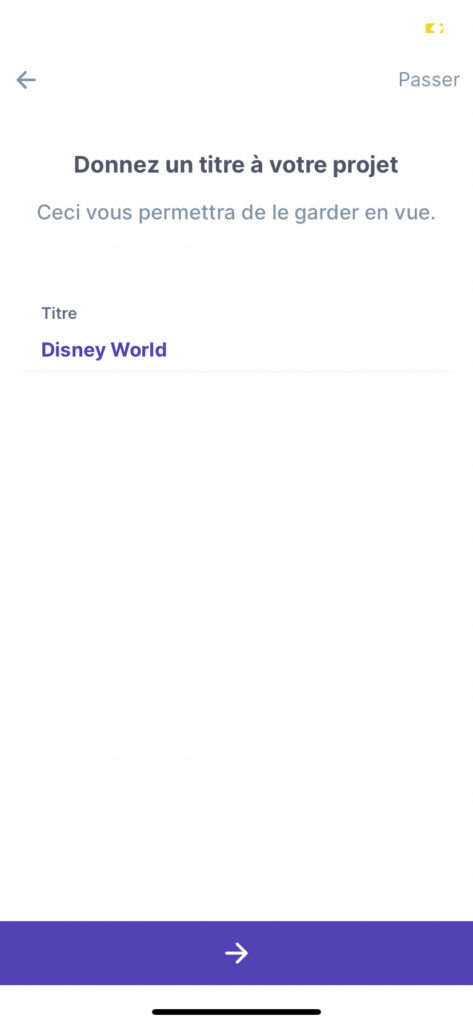

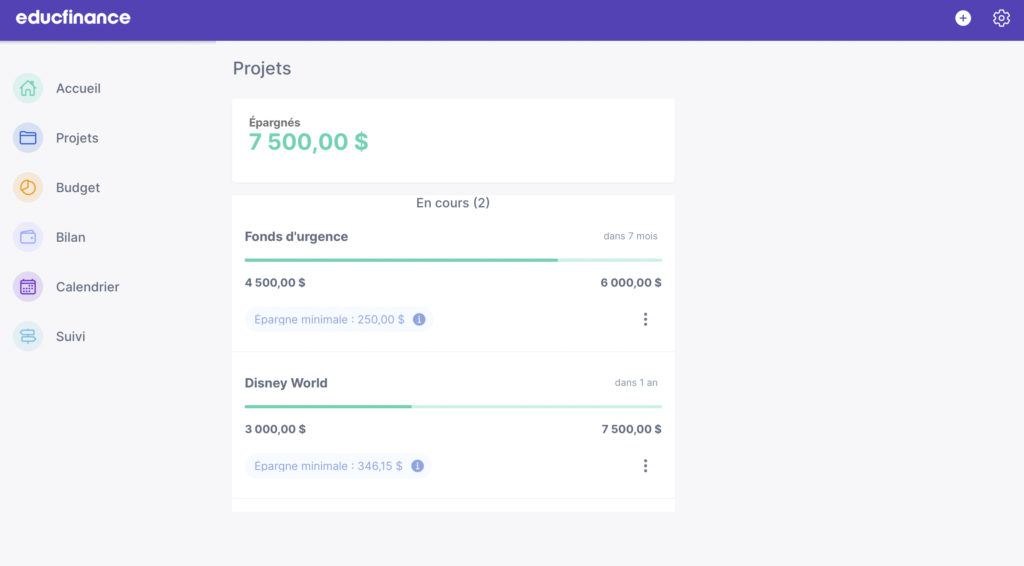

As soon as you launch the Educfinance application, you are asked to register a financial project that you would like to work towards. Plus you can add several different projects.

| Staff | Financial | Other |

| Going on a trip | Retiring | Going into business |

| Buying a property | Paying off debts | Undergo renovations |

| Buy a car | Building an emergency fund | Other |

| Saving for education |

This step is crucial. Just like managing and accumulating credit card points, the first step is always to set one or more goals to work towards as well as a deadline. By doing so, we can better plan a strategy to achieve these goals.

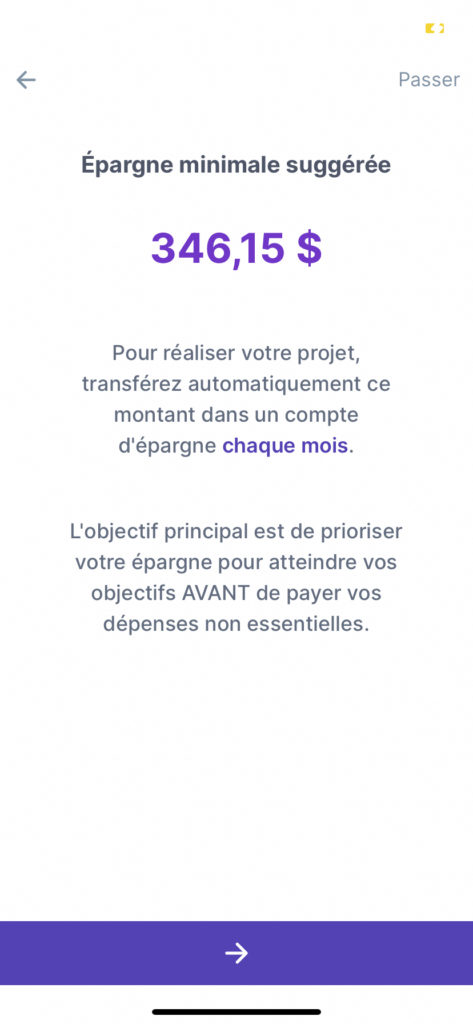

Educfinance allows you to visualize the amount of money you need to raise to reach your goal at the time you want. You can also select your savings frequency preference to get the right plan for your situation.

For example, many families have the goal of making a trip to Disney World. So you can watch your “Disney Savings” account grow. This is an integral part of the new points accumulation strategy for Disney.

It’s not like the now defunct gift card strategy, but the result will be the same and the trip just as magical.

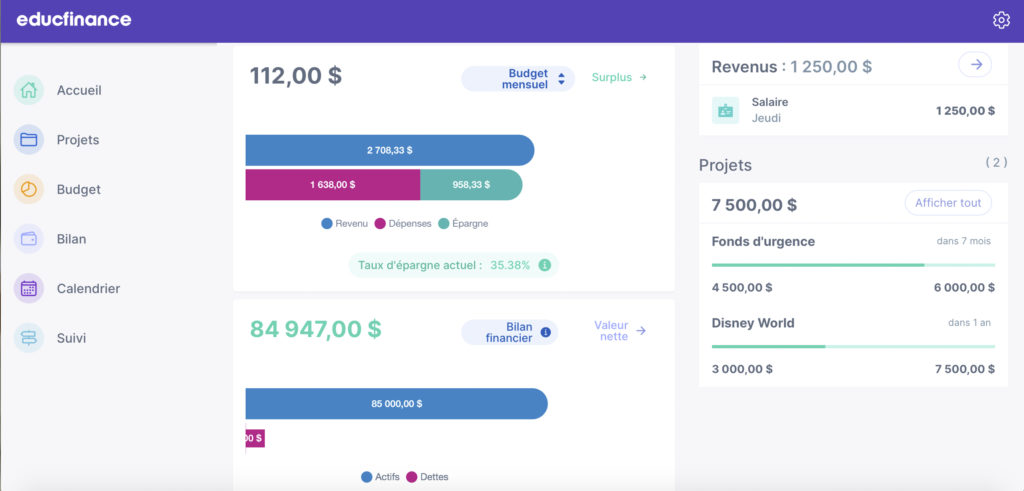

Similarly, if your ambition is to reach FIRE by age 40, you can see your progress with Educfinance. Additionally, the savings rate is clearly displayed on the home page to motivate you to beat it!

Whatever your savings goals are, it is important to define and prioritize each. This is called “paying yourself first”. Educfinance allows you to add as many projects as you want and the application will calculate the total amount of money you need to put aside to accomplish all your projects.

This way, you can see if it’s feasible with your salary and readjust by increasing your income, decreasing certain expenses to save money or venturing into the world of credit cards. Credit card rewards offer huge savings and you can even invest with the points!

The numbers: revenues, assets, and liabilities

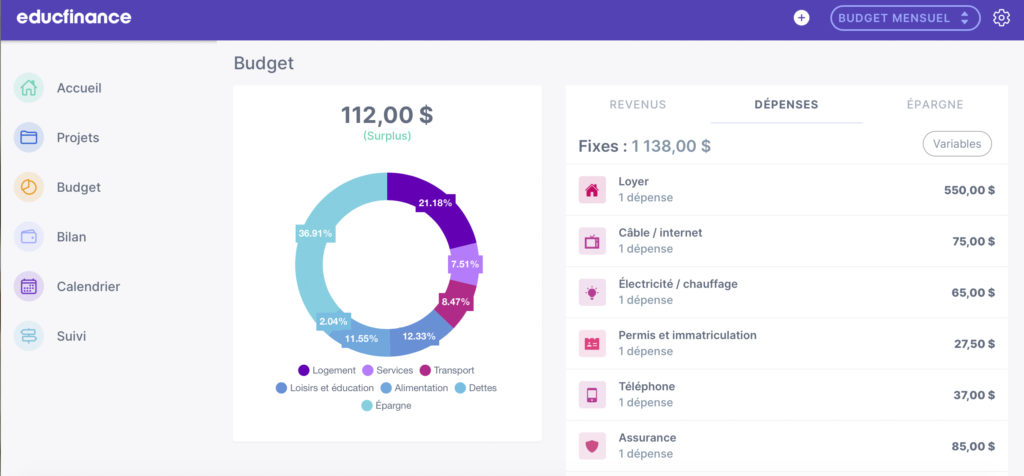

Educfinance takes you through a portrait of your sources of income, your assets and your fixed financial obligations (expenses and debts).

In the expenses tab, the fixed and variable costs are clearly separated. Plus, by entering data on annual recurring payments, you can see the monthly implication of these expenses in the budget!

For example, driver’s licenses and registration are paid on a one-time basis, but Educfinance identifies the amount to be set aside each month. You can therefore set aside these monthly amounts in anticipation of these payments.

This way, you can have a balanced budget throughout the year. These expenses are one-time, but they come back every year. So, setting aside a monthly stipend for these outliers will help you avoid budget fluctuations.

When you can easily visualize your fixed expenses, you can quickly identify where your money is going.

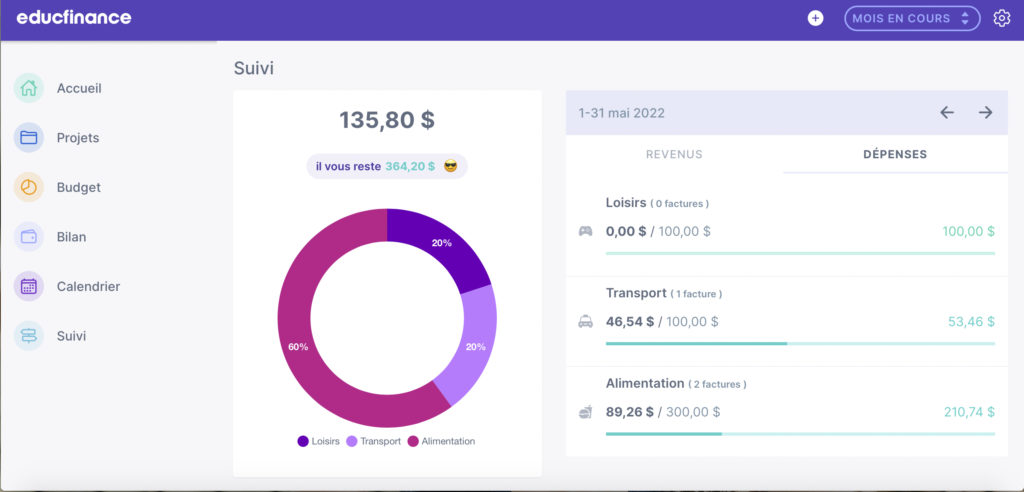

Budget calculator and financial statement

You can then assign a certain amount for variable expenses and Educfinance will calculate the remaining amount for each category as the month progresses. By recording your spending in this way, you can identify the best credit cards based on your spending habits to maximize your rewards!

Then, you will be able to take note of the different expense items and, over time, readjust yourself if you often exceed your budget.

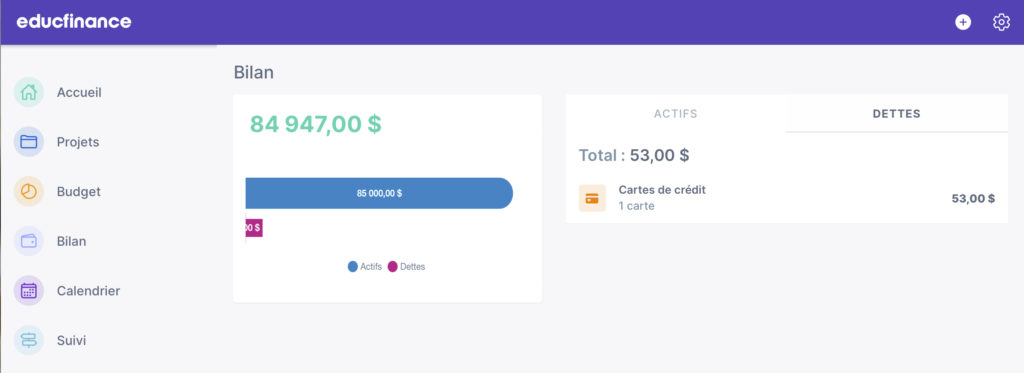

The financial balance sheet allows you to know your net worth and to visualize the debts to be eliminated if necessary. This is an excellent tool to update when aiming for financial independence.

The calendar

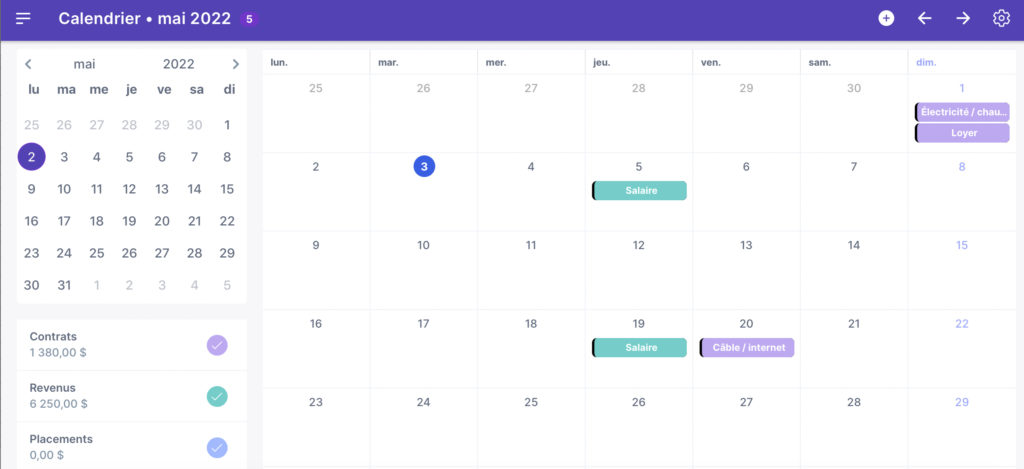

People usually know when their payday is. However, deadlines for various financial obligations are scattered throughout the month and having a calendar can go a long way in keeping track of them.

Personally, I schedule automatic debits for most amounts due, but viewing it all on a calendar makes sure I have plenty of money in the account the day before payment!

Other essential tools by Educfinance

The founder of Educfinance, Mr. Youcef Ghellache, also offers

- an excellent webinar on financial literacy

- an essential toolkit for building a solid foundation in finance

- a great community that helps each other out with all things money-related

Finally, Youcef is organizing Quebec’s largest event on financial freedom on May 29, 2022!

Conclusion

Educfinance is an excellent tool for managing and tracking your finances. Its simplicity allows you to spend less time monitoring and more time finding other sources of income!

Finally, don’t forget to enable notifications; Educfinance will send you weekly reminders to keep you up to date!

And if you want to save money on your travels or in your daily life, subscribe to our free newsletter.