American Express® AeroplanPlus®* Platinum Card

With the American Express® AeroplanPlus®* Platinum Card, you earn 40,000 Welcome Bonus Aeroplan miles after spending $3,000 in the first three months of Cardmembership.

For the business traveller, this card has many perks justifying its annual fee:

- Accelerate your earn rate to 1.5 miles for every dollar in purchases over $25,000 annually

- Receive an annual Partner Ticket benefit (once per year, you can redeem 15,000 Aeroplan Miles for a short-haul roundtrip Fixed Mileage Flight Reward in economy class and receive a second Partner Ticket for the same itinerary)

- Unlimited access to the Air Canada Maple Leaf Lounges

- Air Canada Priority Check-in

- Pearson Priority Security Lane

- Strong insurances

Earning Aeroplan miles

With the American Express® AeroplanPlus®* Platinum Card you earn:

- 1.25 Aeroplan Miles for every $1 of Card purchases up to $25,000 annually

- 1.5 miles for every dollar in purchases over $25,000 annually

It’s the most rewarding Aeroplan card for all purchases. With other cards, you can get more miles for some spending categories like groceries or gas. But for many professionals,lots of spending fall through the “other purchases” category with no increased earning rate.

With 1.25 Aeroplan Miles for every $1 of Card purchases up to $25,000 annually and 1.5 miles for every dollar in purchases over $25,000 annually, the American Express® AeroplanPlus®* Platinum Card solves that problem.

Annual Partner Ticket benefit

Once per year, you can redeem 15,000 Aeroplan Miles for a short-haul roundtrip Fixed Mileage Flight Reward in economy class and receive a second Partner Ticket for the same itinerary.

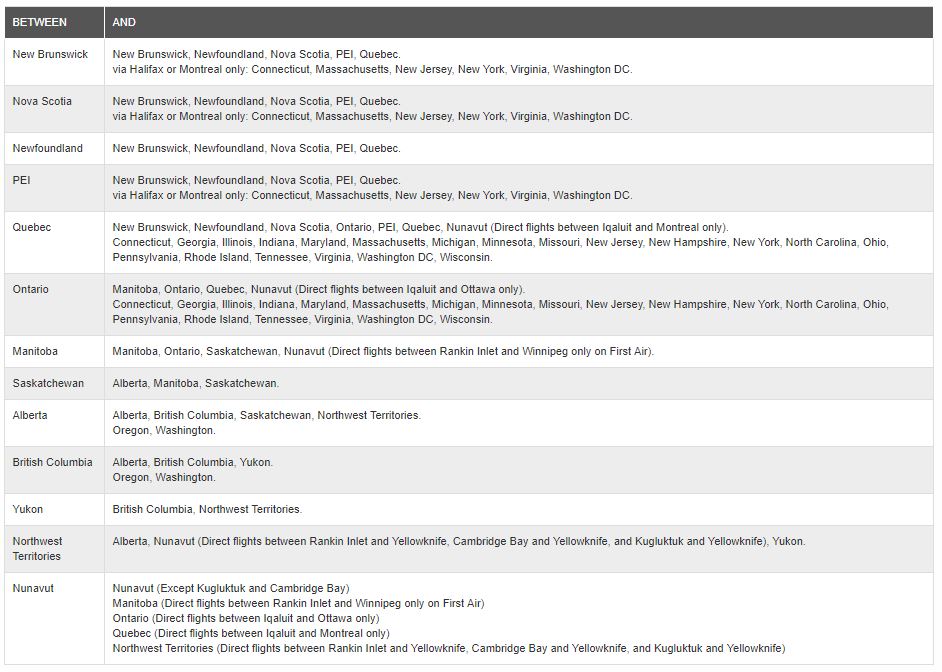

As explained in our ultimate guide about Aeroplan, a short-haul roundtrip Fixed Mileage Flight Reward covers many nearby destinations such as:

- Montreal / Quebec City to:

- New York

- Chicago

- Washington

- The Magdalen Islands

- Halifax

- Toronto

- Nunavut

Here’s the list of destinations:

This is a great perk if you redeem your Aeroplan miles each year for this type of flights.

Audrey and I, over the past few years, have used this perk for flights between:

- Montreal – New York

- Montreal – Chicago

- Montreal – Washington D.C.

This can be particularly rewarding for expensive flights like those to:

- The Magdalen Islands

- Halifax

- Charlottetown

- …

Unlimited access to the Air Canada Maple Leaf Lounges

There are many credit cards giving you access to airport lounges.

However, very few give unlimited access to Air Canada’s Maple Leaf Lounges, like the American Express® AeroplanPlus®* Platinum Card.

For a lot of Cardmembers renewing that card every year, this is a major perk of the American Express® AeroplanPlus®* Platinum Card.

For example, this is the case of business travelers, who travel on a regular basis… but not enough to achieve Star Alliance Gold status (providing access to Maple Leaf lounges).

And in some airports, The Maple Leaf lounges are a essentials because they are the only ones there!

At Montreal-Trudeau International Airport, Maple Leaf Lounges are the only ones within domestic flights terminal(Canada) and cross-border flights terminal (to the United States).

Priority Pass membership

With the American Express® AeroplanPlus®* Platinum Card, you get a free membership to Priority Pass, a network of more than 1,200 airport lounges around the world.

However, you’ll have to pay for each visit (US$ 27).

Other perks

American Express® AeroplanPlus®* Platinum Cardmembers get Air Canada priority check-in.

For those who frequently travel from Toronto-Pearson YYZ (or connecting there), the American Express® AeroplanPlus®* Platinum Card gets you Pearson Priority Security Screening at Terminals 1 and 3.

Conclusion

American Express® AeroplanPlus®* Platinum Card is the perfect card for:

- Frequent flyer / business traveler on Air Canada or Star Alliance airlines

- people who have significant expenses in the “Other Purchases” category and who wish to earn Aeroplan miles

The offer including 40,000 Aeroplan miles (after spending $3,000 in the first three months of Cardmembership) makes it possible for new Cardmember to try this card during the first year… and many will get a taste for it!

This publication is sponsored by Amex Bank of Canada. However, the opinions and views expressed on this blog are only mine.