Welcome offer

The Platinum Card® is the Best Premium Travel Card in Canada.

With this welcome offer, you can earn up to 100,000 Membership Rewards points:

- 70,000 Welcome Bonus points after you charge $10,000 in net purchases to your Card in your first 3 months of Cardmembership

- 30,000 points when you make a purchase between 14 and 17 months of Cardmembership

With this card, you get:

- 2 points per dollar for dining purchases

- 2 points per dollar on travel purchases

- 1 point per dollar on all other purchases

You can use your Membership Rewards points in many ways:

- Transfer points to airline partners: Aeroplan, Avios (British Airways / Qatar Airways), Flying Blue, Delta Skymiles, etc.

- Transfer points to hotel programs (Hilton Honors, Marriott Bonvoy)

- Redeem points for statement credits to offset any travel purchase charged to your Card (1,000 points = $10)

- Redeem points for statement credits towards other purchases (1,000 points = $10)

- And more!

With this card, you also have advantages for your travels:

- $200 Annual Travel Credit

- $200 Annual Dining Credit

- $100 NEXUS Card Statement Credit

- Free, unlimited access for you and one additional traveller to over 1,200 airport lounges in more than 130 countries

- Hilton Honors Gold Elite status (complimentary breakfast at all Hilton hotels)

- Marriott Bonvoy Gold Elite status

- Access to the Fine Hotels & Resorts program

Last but not least, the Platinum Card® is distinguished by the numerous insurance coverages offered: theft and damage for rental cars, travel accident of $500,000Emergency medical expenses (out-of-province or out-of-country), lost or stolen baggage, flight delays and misdirected baggage, hotel or motel burglary, Purchase Protection, Purchase Security.

Like all American Express Canada Cards, there is no minimum income requirement.

The Platinum Card® clearly stands out from the competition because of the various benefits it provides for frequent travelers. I will try to assign a value to each of them.

Access to airport lounges

It’s something I personally love (and I know many of the Facebook group members do too!).

The benefit

The Platinum Card® provides free unlimited access to the cardholder and a travel companion at most of the lounges listed below.

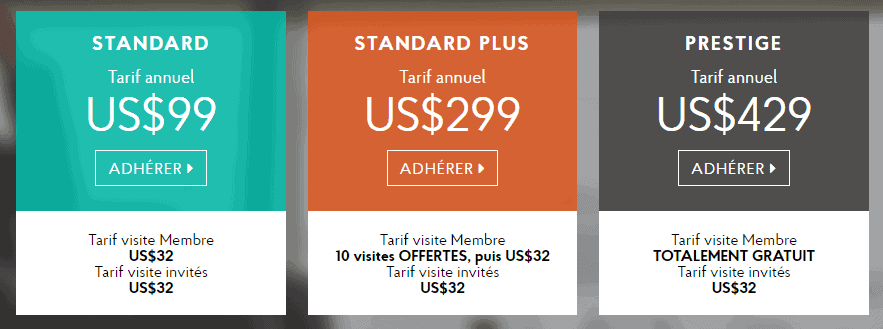

When we look at just the Priority Pass membership included for the Platinum Card® holder, we are talking about a benefit that has a value of US$429 / year.

And American Express has a special agreement with Priority Pass to add a travel companion to this pass (which would have cost US$ 32 / visit otherwise)!

That’s not taking into account access to all the other types of lounge around the world:

Here are the conditions of access for each type of lounge:

| Lounge | Details |

| Priority Pass | Complimentary and unlimited access for the holder AND a guest to 1300 lounges worldwide |

| Executive Lounges by Swissport | Complimentary access for the Cardmember and his spouse 2 children under the age of 21 by presenting the Platinum Card Ex: National Bank Lounge in Montreal, Aspire in Amsterdam, Gatwick… |

| V.I.P. International Airport Lounge Jean-Lesage from Quebec City |

Complimentary access for the Cardmember and a travel companion 2 children under the age of 18 by presenting the Platinum Card |

| Plaza Premium Lounges | Complimentary access for the Cardmember and his spouse by presenting the Platinum Card Ex: Numerous Plaza Premium lounges in Montreal (Air France), Toronto, Vancouver, Edmonton, Winnipeg… |

| Delta Sky Club | Complimentary access for the cardmember upon presentation of the Platinum card and a Delta Airlines boarding pass |

| Airspace Lounges | Complimentary access for the Cardmember and his spouse 2 children under the age of 21 or 2 travel companions by presenting the Platinum Card San Diego and Cleveland Airports |

| Escape Lounges | Complimentary access for the cardmember & 2 travel companions by presenting the Platinum Card Oakland Airports, Minneapolis… |

| The Centurion Lounge | Complimentary access for the cardmember & 2 travel companions by presenting the Platinum Card Miami, Las Vegas, La Guardia, San Francisco, Hong Kong… |

| International American Express Lounges American Express |

Complimentary access for the Cardmember |

The value of airport lounge access

Being reasonable in my estimates, thanks to this advantage of access to airport lounges offered by the Platinum Card®, I estimate saving $40 per person each time we pass through an airport (for drinks/meals).

That’s not counting the rest you get versus waiting in some terminals (especially with young children)!

Hotel status Benefit

American Express has partnered with various hotel programs to gain access to higher statuses by being a Platinum Card® holder.

The benefit

Of all the hotel programs, I consider only the status offered by the Platinum Card® on the Hilton Honors side to be of value.

It is the only one to offer breakfast in most of the group’s hotels.

Unfortunately, Marriott Bonvoy’s Elite Gold status has lost its lustre, with the program now reserving the benefit of complimentary breakfasts for Elite Platinum members.

I would have liked to see American Express offer Platinum Elite status, or at least status nights to reach that level of status faster.

| Program | Status | Key benefits |

|

Elite Gold | Room upgrade 2 p.m Late departure 10 points for every eligible U.S. dollar and 25% more points than base members Premium Internet access |

|

Gold | Complimentary breakfast Room upgrade 80% more points than base-level members Premium Internet access 2 free bottles of water per stay |

|

Gold | Room upgrade Early check-in and late check-out 25 points per US dollar spent 15% discount on food and drinks 2 free bottles of water per stay |

The value of hotel statuses

The value of this Platinum Card® benefit is relative. It will be based on the number of stays made in these different hotels each year. If your preference is Hilton Group hotels, getting free breakfast for each of your nights can be a great benefit!

At an average rate of $20 per breakfast per person for ten nights stay per year, this could mean savings of $400 a year.

But if you stay at Marriott hotels instead, the value of this benefit is lessened.

$200 Annual Travel Credit

If there’s one easy-to-quantify benefit of the Platinum Card® it’s the $200 annual travel credit.

The benefit

When you apply for the Platinum Card®, you’ll receive a $200 annual travel credit to be used via American Express Travel services. This may be:

- A flight

- A hotel

- A car rental

- A travel package

Then, each year, when you renew your Platinum Card® membership fee, you get this credit again. In this article, I explain how the Annual Travel Credit works.

The value of the travel credit

Having the opportunity to travel several times a year, it’s easy for me to use the $200 annual Platinum Card® credit. So it’s worth $200, for trips I would have bought anyway!

$200 annual dining credit

Another easy-to-quantify benefit of the Platinum Card® is the $200 annual dining credit.

The benefit

When you sign up for the Platinum Card®, you get a $200 annual dining credit.

This credit is applied to your restaurant bill based on a list of American Express restaurants.

Then, every year on January 1, you get this credit again.

The value of the annual dining credit

Having the opportunity to dine at good restaurants in Montreal, I can easily use the Platinum Card® $200 annual dining credit. So it has a value of $200 for a meal in a good restaurant, which I would have done anyway!

Instead of using my American Express Cobalt® Card (which earns me 5 points per dollar at all restaurants), I’ll use my American Express Platinum Card®.

$100 NEXUS credit

The Platinum Card® comes with another benefit for travellers: the $100 NEXUS Card Statement Credit. Simply charge your NEXUS membership (every 4 years) onto your Platinum Card® to get this credit.

The Membership Rewards program

In addition to the travel benefits, it is important to note the excellent earning rate of Membership Rewards points through the Platinum Card®:

- 2 Membership Rewards points per dollar spent in restaurants and bars

- 2 points for every $1 in Card purchases on eligible travel

- 1 Membership Rewards point per dollar per dollar of other purchases

Here is an example of earning rate:

| Restaurants | Travel | Other | |

| Purchases | $10,000 | $ 15 000 | $10,000 |

| Membership Rewards | 20 000 | 30 000 | 10 000 |

| Total | 60,000 Membership Rewards points | ||

The Platinum Card® – like the American Express Cobalt® Card – allows you to use your Membership Rewards points in a multitude of ways, “without being caught” with Aeroplan points:

Bottom Line

For sure, the Platinum Card® is not for everyone and remains a card for travelers.

However, suppose you have travel plans and can take advantage of its various benefits ($200 annual travel credit, $200 Annual Dining credit, airport lounge access, status, etc.) and Membership Rewards points accumulation categories. In that case, this is THE card to get in anticipation of those trips!

Benefits easily exceed the annual fee (especially in the first year with a welcome bonus).

For me, it remains an essential card alongside my American Express Cobalt® Card!

This post was not sponsored. The views and opinions expressed in this review are purely my own. American Express is not responsible for maintaining or controlling the accuracy of the information published on this website. For complete and up-to-date product information, click on the Apply Now link. Terms and conditions apply.