Intuit TurboTax - Everything you need to know about how it works

Known as Canada’s best-selling tax software, Intuit’s TurboTax allows you to do your taxes in simple, step-by-step fashion. But how does TurboTax work exactly?

The following article will give you a better understanding of the software by discussing its advantages and its range of online and downloadable editions.

What exactly is TurboTax?

First, it’s good to know that thousands of Canadians use TurboTax every year. It is precisely a personal tax filing and tax return software. It is designed to give you all possible credits and deductions according to your personalized needs.

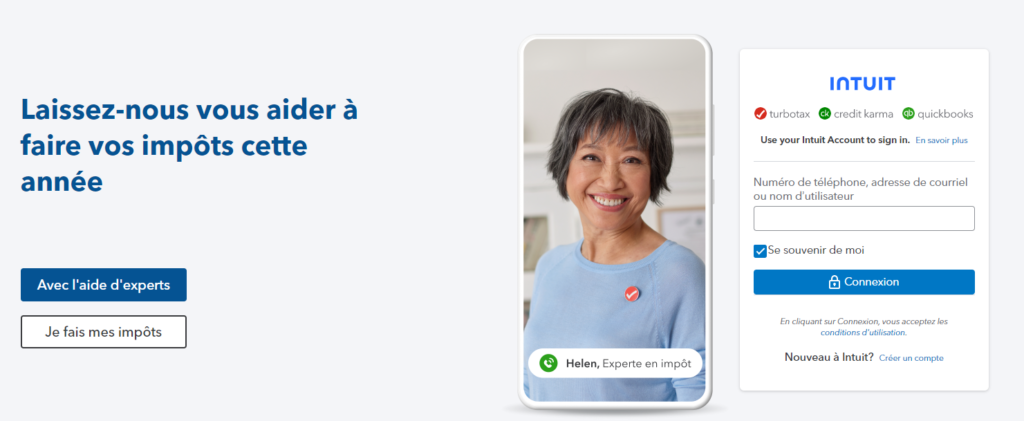

In addition, experts are available online if you need help. He or she will be able to give you sound advice and answers to all your questions. Also, a final review can be done before your return is sent.

How does the software work?

There are several ways to use TurboTax software, including online, with a CD, or with downloaded editions. Here are the 4 steps to follow when using the online software:

- Answer a few questions about yourself

- Import your tax slips directly from the CRA

- Look for tax savings opportunities for maximum payback

- Let the experts verify your tax return (100% accuracy guarantee)

If you don’t have the time or motivation to finish your return, you can save your data and complete it later. Note that the online software is the only option for Mac users.

On your own

How does TurboTax work for stand-alone use? It’s pretty simple! In fact, there are three online options available to you:

- Free

For simple tax returns, the free version is what you need. From COVID-19 refunds to RRSP contributions, this option has no hidden fees. Imports of CRA slips and TurboTax information from the previous year are also included.

- De Luxe

For only $20.99, opt for the Deluxe Edition. With all the inclusions of the free version, an optimization of the tax return and an automatic search of more than 400 credits are offered to you. Ideal for families or individuals, you only pay when you submit your tax return !

- Premier

Do you have investments or rental properties? This edition will help you get all the extra credits and deductions you can claim.

For a total of $34.99 per income tax return, here’s what the Premier version offers:

- Income and expenses from stocks, bonds and cryptocurrencies

- Income and expenses of rental property

- Capital gains and losses

- Foreign income

With the help of an expert

If you prefer to have the help of a tax expert, here are your options:

- Assist & Review Basic

For simple returns, this version covers employment, employment insurance and pension income. For a total of $39.99 per return, you can claim the credits for students and dependents, as well as the deduction for RRSP contributions.

- Assist & Review Deluxe

As for the De luxe consulting magazine, it allows for the optimization of deductions and credits. For $69.99, it covers donations, medical expenses and employment expenses in addition to automatically searching 400 credits.

- Assist & Review Premier

This version is for those with investments and rental properties. Including all the inclusions of the Deluxe version, the Premier version deals with all income and expenses of stocks, bonds and cryptocurrencies, but also capital gains and losses.

Intuit TurboTax - Benefits

- Secure software

The developers of the software have made sure that its security is of high quality. With multi-factor authentication and data encryption, you can be sure that your private data is kept safe!

- Easy to use

About half of Canadians feel intimidated by the idea of filing their own tax return. To remedy the situation, TurboTax has designed a very simple and easy to follow process for anyone who wants to file it themselves.

- Customer Support System

To ensure a better understanding of the software, users have access to an online forum, telephone support and training videos. Support is always available, even for the free version.

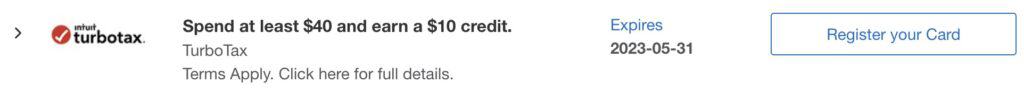

Intuit TurboTax - Take advantage of Amex offers

At tax time, American Express Cardmembers can take advantage of an online offer for the TurboTax tool.

Consider checking your AMEX offers online regularly! If you don’t have an American Express credit card, check out the best American Express credit card offers available today.

FAQ

What about downloaded editions?

Downloaded editions are available for those who do not have Internet access or who are less comfortable with the network.

By choosing the edition you are most interested in, you download it to your computer with a 16-digit license code and you can open it from your desktop.

Here is the range of downloadable editions:

- Basic (by batch of 4 tax returns)

- Deluxe (by lot of 8 tax returns)

- Premier (in batches of 12)

- Individuals and companies (per batch of 12 tax returns)

How do I install the CD and the downloaded editions?

CD: Take it step by step by following the Intuit TurboTax tutorial.

Downloaded editions: Listen carefully to how to install the TurboTax software here.

Can I download the software to multiple computers?

You can download TurboTax to a computer and install it 3 times with the same license code. A maximum of 20 tax returns is allowed!