Having a good credit score is one thing, but knowing how to read your credit report is another! In Canada, there are two credit bureaus: Equifax and TransUnion.

Once a year, you can request your credit report free of charge. You’ll receive a copy of your file in paper or electronic form, depending on the delivery option you choose. However, Equifax also offers a monthly subscription (starting at $24.95) for daily access to your up-to-date Equifax credit report. This subscription also includes credit and identity monitoring tools. Note that this subscription is non-binding, and you can stop it at any time.

In short, this article explains how to read the details of your Equifax credit report. Note that we have also created a guide similar to this one for TransUnion.

Dashboard

To open a session, first go to the myEquifax page.

After opening your account with Equifax, you will access your dashboard displaying your credit score as well as essential information from your credit report such as :

- Alerts

- Equifax credit report status (lock)

- The number of lines of credit

- Credit utilization ratio

Equifax - Credit Rating

In myEquifax, under “Your Credit”, click on the “Credit Score” tab.

You can check your credit score every day. Note, however, that this usually changes once a month.

Equifax - Alerts

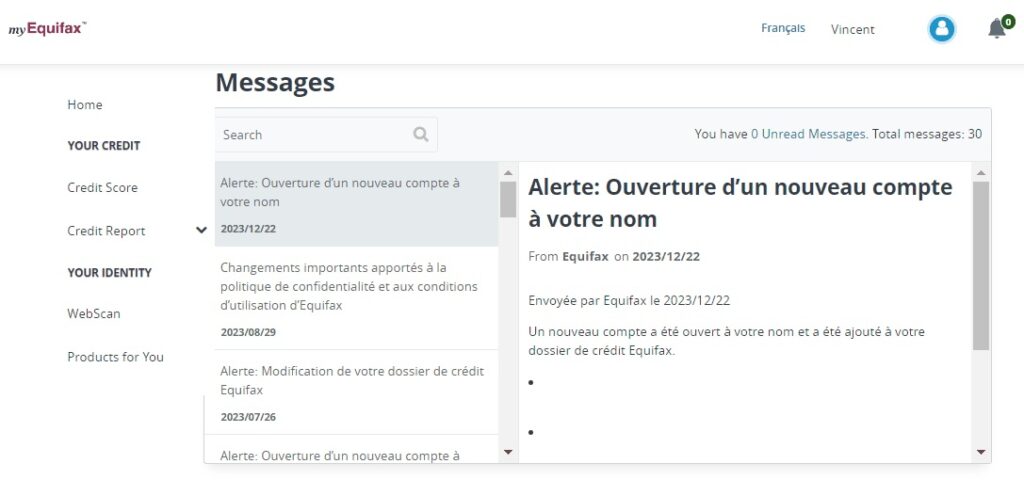

You will receive an e-mail when a new history request is made. A request can be created when your first credit card statement is issued, or when the financial institution reports the statement to Equifax.

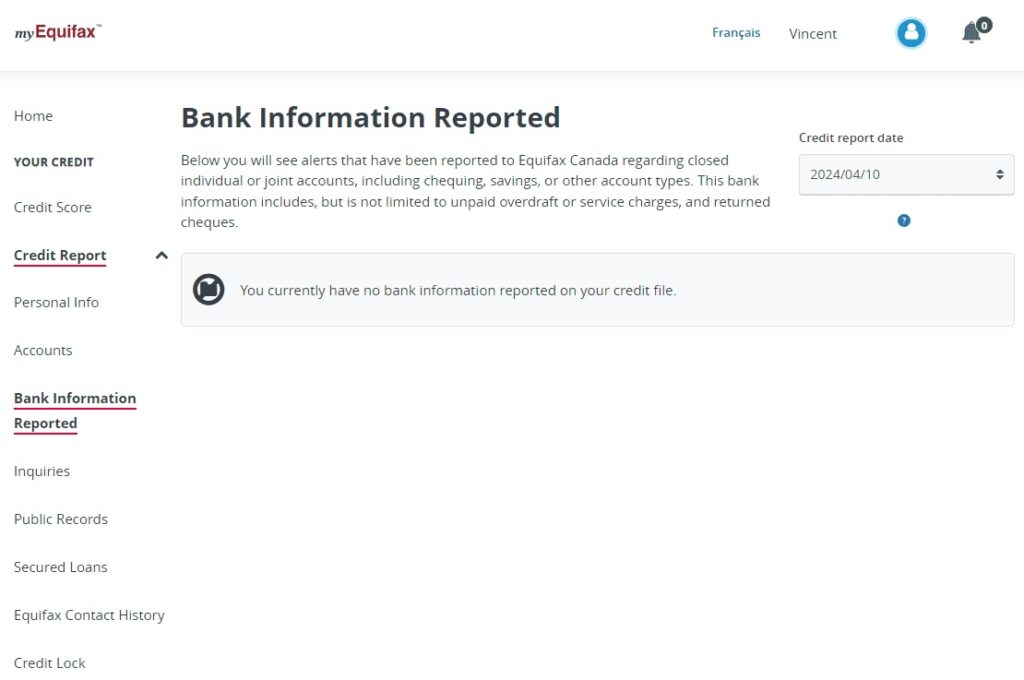

A closed account can also trigger an update. In myEquifax, under “Your Credit”, click on the “Credit Report” tab, then on “Bank Information Reported”.

To view the most recent alerts, click on the “bell” at the top right of the screen. You can see the details of current and archived alerts. Generally, an alert will influence your score up or down.

Equifax - Account analysis and usage rates

We can’t stress this enough: the points and miles hunter doesn’t go into debt to play the points game. That means paying off your credit cards in full by the due date, every month!

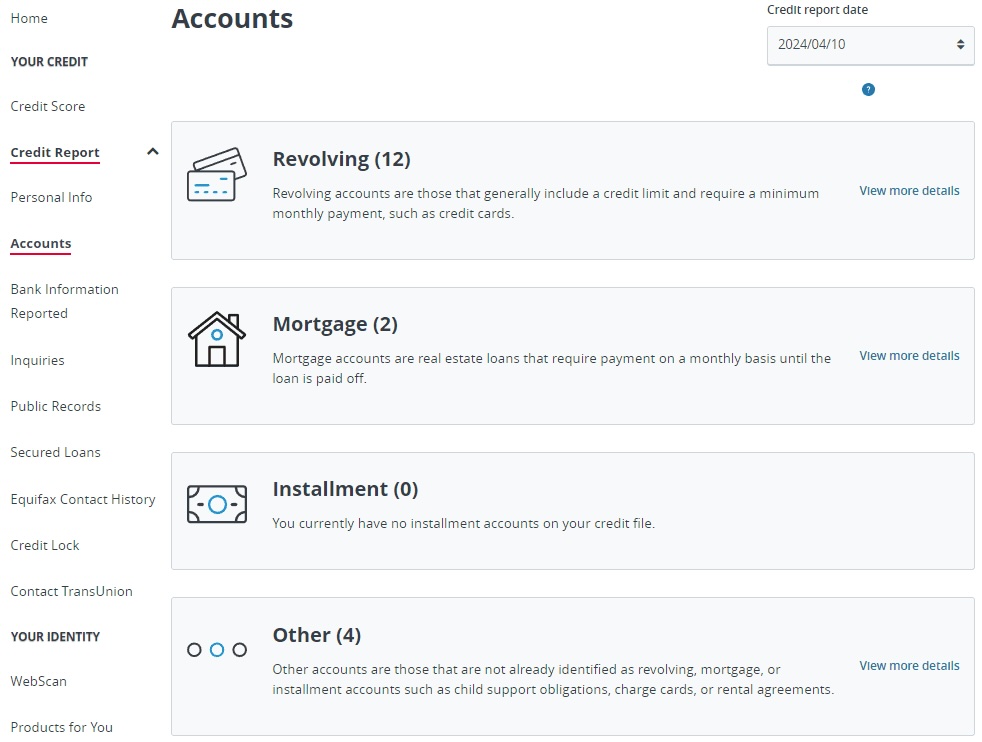

In myEquifax, under “Your credit”, click on the “Credit Report” tab, then “Accounts”.

This section lets you view all your accounts (credit cards, line of credit, mortgage, etc.), sorted by category:

- Revolving: accounts that include a credit limit and require a minimum monthly payment (e.g. credit cards, line of credit).

- Mortgage: home loans that require monthly payments until the loan is repaid.

- Installment: consumer credit that gives access to an initial lump sum and is repaid in fixed payments according to a predefined schedule (e.g. car loan, personal loan).

- Other: accounts that are not identified as revolving accounts, mortgages or installment loans (e.g., service providers, telecommunications).

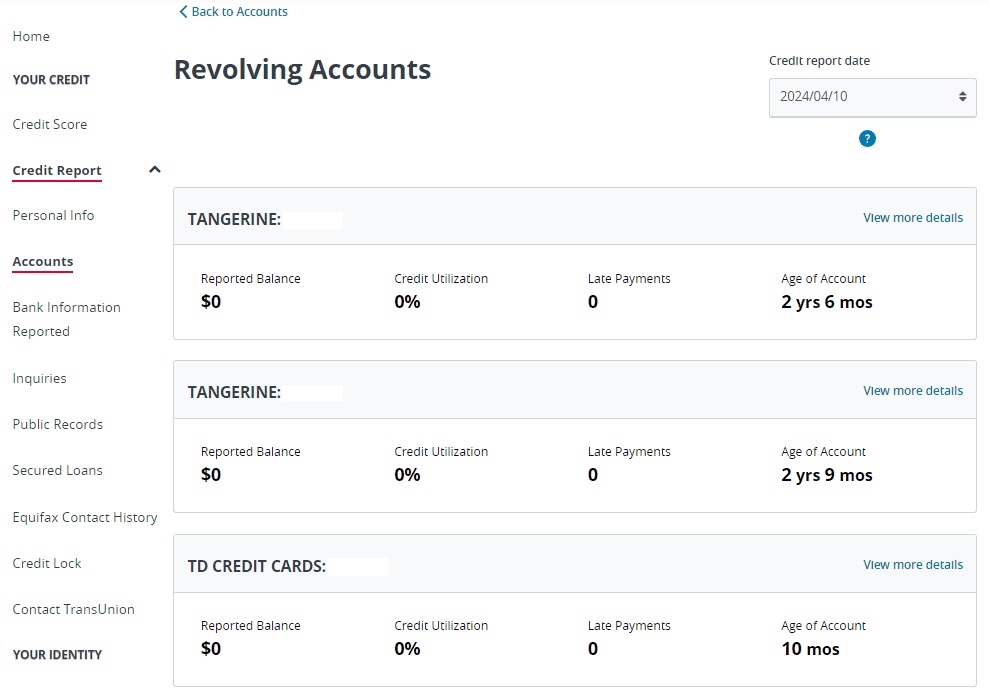

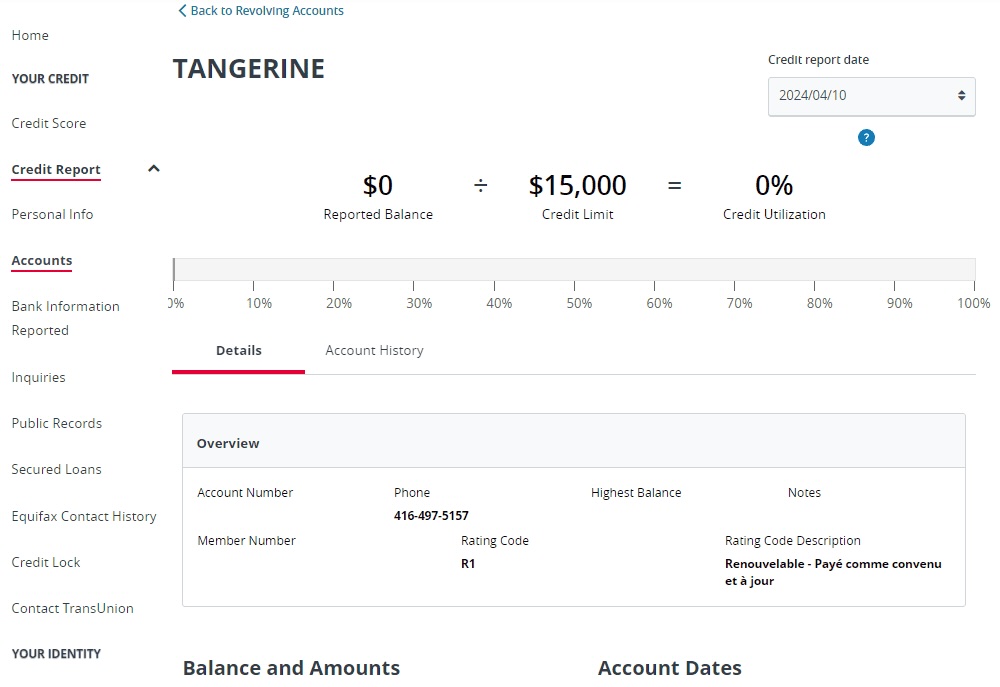

For more information on a credit type (e.g. Revolving), click on “Show more details”. For each credit line, you can see :

- Reported balance

- Credit utilization

- The number of late payments

- Age of account (history)

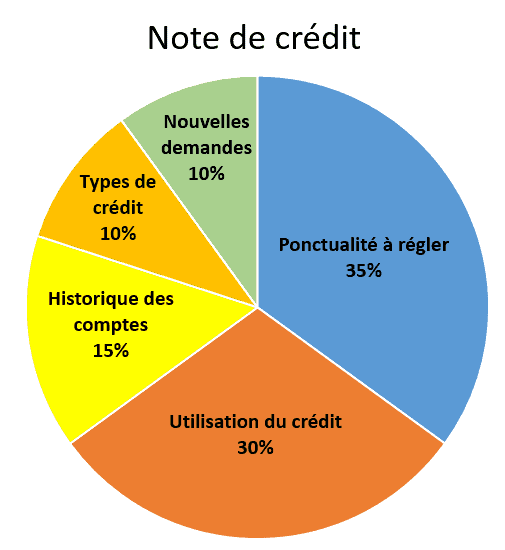

Credit score components

As a reminder, your credit score is made up of various components. These include punctuality, credit utilization ratio and account history, which account for 35%, 30% and 15% of the credit score respectively.

Here’s a simple example to explain the utilization ratio:

- Mr. Miles has a credit card with a $5,000 limit. He charges $2,500 a month to his card. Its utilization ratio in relation to the credit bureau is 50%.

- Mrs Points has 2 credit cards with limits of $5,000 each (for a total of $10,000). Each month, she charges $2,500 to one of these 2 cards. As a result, its utilization ratio in relation to the credit bureau is only 25% (which is below the recommendation not to exceed 30% utilization).

In short, it’s better to have several credit cards with several credit limits… even if it means leaving them in a drawer. Your credit utilization ratio will drop!

Equifax - Credit Information

Still in the accounts tab, if you wish to obtain more information or verify the accuracy of the information, click on “View more details”. For each account, you can see :

- Credit utilization

- Account overview

- Balance and amounts

- Account dates

- Payment history

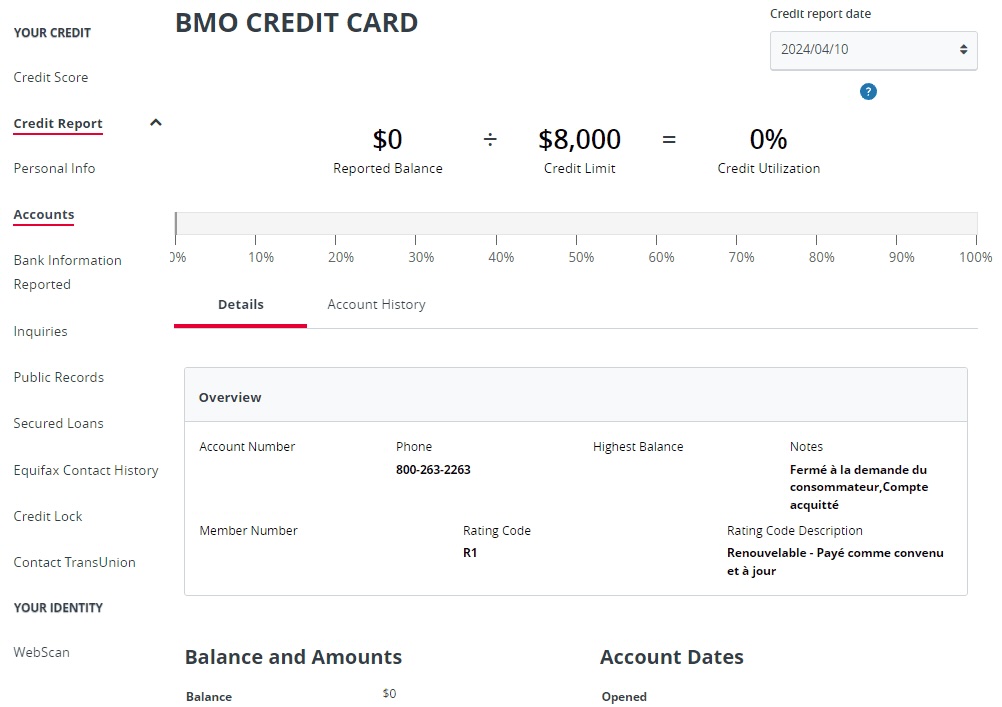

Note that all accounts reported to the credit bureau are displayed, whether open or closed.

You can also verify that closed accounts were closed “at your request” and have been paid.

For example, here is a credit card that has been held for 2 years and 6 months. We can see that it has been closed at my request and that the account has been paid up (see “Closed at customer’s request, Account paid up”).

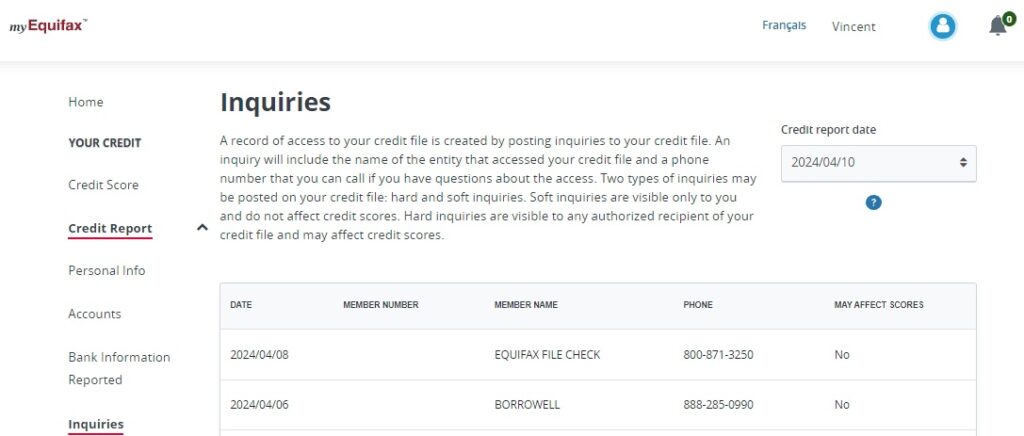

Equifax - Request access to your credit file

In myEquifax, under “Your credit”, click on the “Credit Report” tab, then “Inquiries”.

This is where inquiries about your credit history appear. Some banks, such as American Express and Scotiabank, use TransUnion. Other financial institutions, such as CIBC and TD, use Equifax instead. Please note, however, that once your account has been opened, it will be transferred to both credit bureaus.

Here are the definitions of a “hard hit” and a “soft hit” and the differences between them:

- A “hard hit” is triggered by a new credit application: card application, mortgage application, request for overdraft authorization on your checking account, etc. This “hard hit” will have an impact on your score and will remain on your file for 3 years.

- A “soft hit” is a regular inquiry made by a lender. It will not affect your credit score.

Note that American Express “hard hits” are displayed on the TransUnion folder, not Equifax.

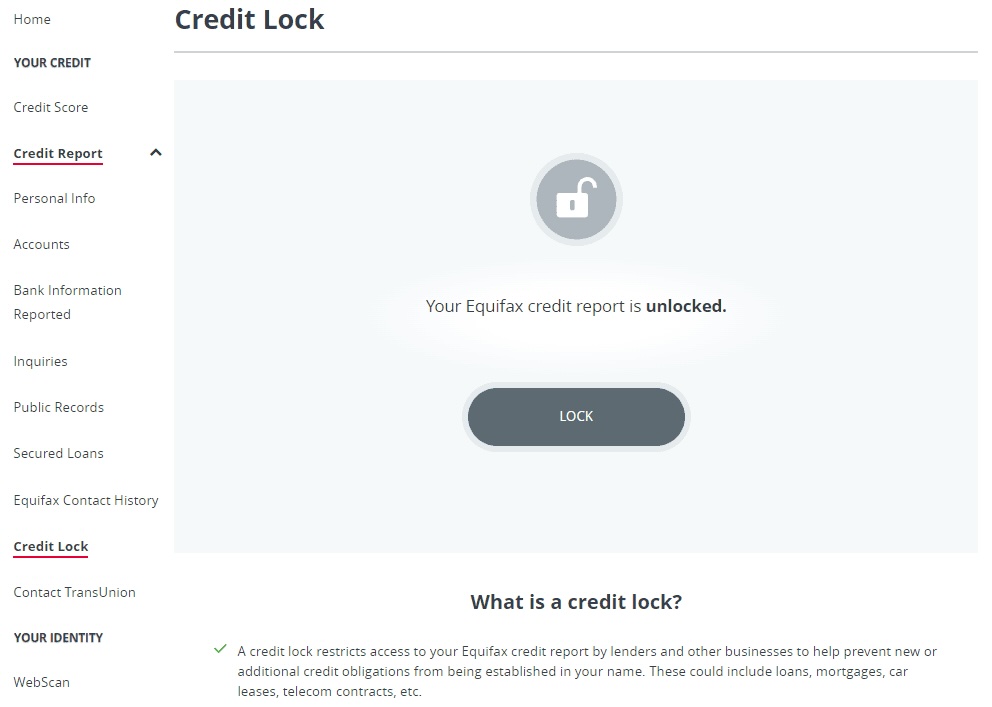

Equifax - Credit file lock

In myEquifax, under “Your credit”, click on the “Credit Report” tab, then “Credit Lock”.

This is where you can check the status of the credit report lock option, lock or unlock it. Locking your credit report limits lenders’ access to your Equifax credit report. However, don’t forget to unlock your credit report to apply for new credit cards or to increase your current credit limits.

For more information, read this guide: “Secure your file with a credit lock“.

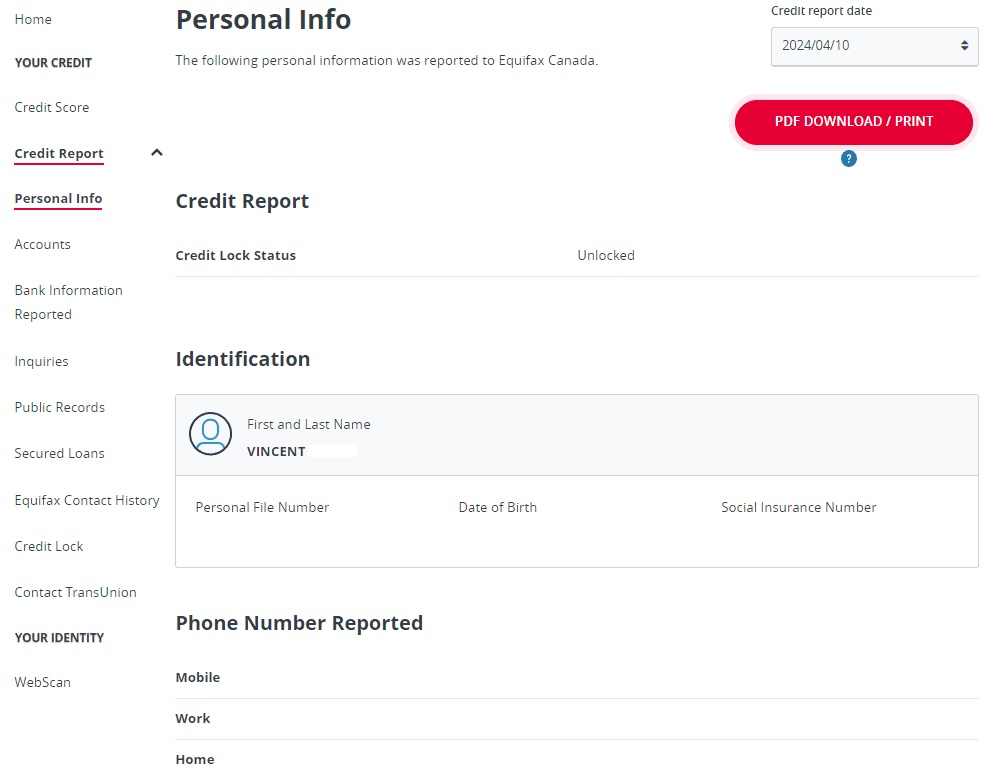

Equifax - Personal Information

The information section may be less important than the other sections, but you should still pay attention to it to check if any of the information is wrong.

You can see :

- Status of credit file lock option

- Identification information (name, date of birth, social insurance number)

- Phone number

- Addresses

- Jobs

This information is used to identify you when you apply for a new credit card. So check their accuracy.

Bottom Line

In short, it’s important to request the details of your credit report once a year, in particular to check the accuracy of the information. You can get your report in paper or electronic format.

For more information or additional services such as credit and identity monitoring, you can take out a subscription (for a fee).

For more information on your credit file or to contact customer service, visit theEquifax website.