National Bank offers a great product accessible to all travelers with the National Bank Platinum Mastercard®. What’s more, the purchase protection is among the best on the market!

National Bank Platinum Mastercard® - Welcome offer

Until October 31, 2024, with the exclusive promotion for Milesopedia readers, you can earn up to 25,000 points as a welcome bonus, as well as a annual fee waiver the first year for the primary cardholder ($70) and one additional cardholder ($35).

This National Bank welcome bonus is divided into tiers:

- 10,000 points after $2,500 in purchases in the first three months

- 10,000 points after $6,500 in purchases in the first twelve months

- 5,000 points if you take out payment protection for at least the first three months

Below, you’ll find a table to help you optimize this welcome bonus with your most common purchases: groceries. In fact, through these purchases, you’ll earn up to 2 points per dollar, making it easier to unlock your bonus points.

Don’t forget that you can also use the grocery store gift card trick to earn 2 points per dollar on these purchases. Alternatively, use one of our many tips for unlocking credit card welcome bonuses.

| Month | Purchases Grocery store or restaurant |

Points for purchases | Bonus points | Total |

| 1 | $834 | 1 668 | – | 1 668 |

| 2 | $833 | 1 666 | – | 1 666 |

| 3 | $833 | 1 666 | 10 000 | 11 666 |

| 4 | $445 | 890 | – | 890 |

| 5 | $445 | 890 | – | 890 |

| 6 | $445 | 890 | – | 890 |

| 7 | $445 | 890 | – | 890 |

| 8 | $444 | 888 | – | 888 |

| 9 | $444 | 888 | – | 888 |

| 10 | $444 | 888 | – | 888 |

| 11 | $444 | 888 | – | 888 |

| 12 | $444 | 888 | 10 000 | 10 888 |

| Total | $6,500 | 13 000 | 20 000 | 33 000 |

As you can see, in your first year, you can earn 20,000 welcome bonus points, on top of the 13,000 points you earn through grocery and restaurant purchases.

If you opt for payment protection, you’ll earn an additional 5,000 points (you can cancel payment protection after three months if you no longer want it).

In total, by making purchases and complying with all the conditions of this welcome offer, you could earn 38,000 NBC Rewards points.

Given that we value NBC Rewards points at $0.009, this offer is worth approximately $342 in points, representing a return of nearly 5.3% on your purchases.

National Bank Platinum Mastercard - Rewards

Earn NBC Rewards points

With the National Bank Platinum Mastercard, you can earn up to 2 points per dollar:

| Category | Cashback |

| Grocery and restaurant | 2 points per dollar* |

| Gas and EV charging | 1.5 points per dollar |

| Recurring bills | 1.5 points per dollar |

| À la carte Travel | 1.5 points per dollar |

| Other purchases | 1 point per $1.50 purchase |

*For the Grocery & Restaurant category, you can earn 2 points per dollar up to $1,000 in total monthly card purchases.

Once you’ve reached $1,000 in monthly purchases, you’ll earn 1.5 points per dollar in the Grocery & Restaurant category. This is still very good compared with other cards that only offer one point per dollar after the threshold has been reached.

How can I use my NBC Rewards points?

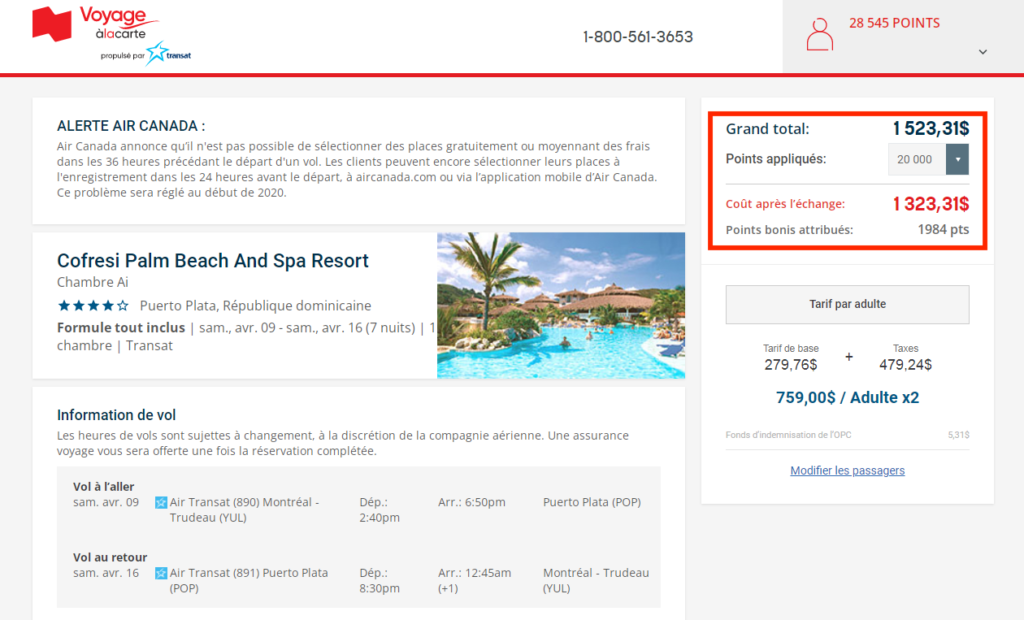

To redeem your NBC rewards points, you must log on to the National Bank’s À la Carte Rewards portal.

Then, you can use your points to book a trip (+ monetary complement if required) through the “À la Carte” Travel agency. The rates are the same to those you will find at any travel agency.

What’s more, you can also earn NBC rewards points through this travel agency. By doing so, it will be the best use of points at a rate of 10,000 points per $100 of statement credit.

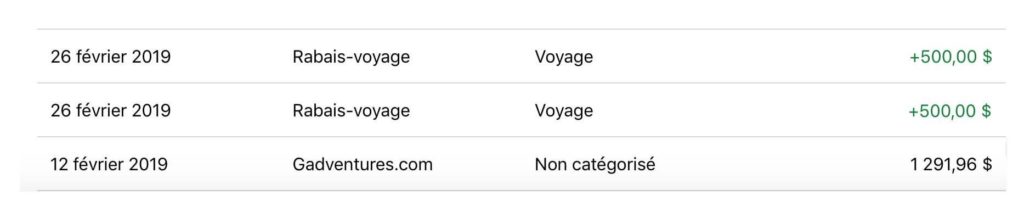

It’s also possible to use your NBC Rewards points as a statement credit for any travel expenses you’ve charged to your credit card (redemption must be made within 60 days of the expense being charged to the credit card account).

This gives you the freedom to book as you see fit, for example with Airbnb, organized tours, excursions and so on.

The exchange rate for this type of use is

- 12,000 points for a $100 credit or;

- 11,000 points for a $100 credit when redeeming over 55,000 points in the same transaction

The best way to use your points is to book your trip through the À la carte NBC online travel agency: you’ll earn a $100 credit for every 10,000 points redeemed. Here are the details of the other options available to you:

| Rewards | Points for $100 |

| Exchange with the dedicated NBC à la carte travel agency | 10 000 |

| Flexible travel rebates (from 55,000 points redeemed) |

11 000 |

| Flexible travel rebates | 12 000 |

| Extras À La Carte RRSP or TFSA contribution Reimbursement of your all-in-one line of credit or mortgage loan |

12 000 |

| Gift-card | 12,000 – 13,500 |

| Statement credit | 25 000 |

National Bank Platinum Mastercard - Insurance

Regarding protection, the National Bank Platinum Mastercard stands out compared to other cards of the same type.

You can find the insurance contract here.

Travel Medical Insurance (outside province of residence)

The National Bank Platinum Mastercard offers $5,000,000 in emergency travel medical coverage.

| Age | Maximum trip time frame |

| 76 years or less | 10 days |

Trip Cancellation / Trip Interruption Insurance

For most of its insurance coverages, the National Bank Platinum Mastercard is one of the only credit cards in Canada to cover you, even if you charge only part of the cost of your trip to your card.

The following expenses will be reimbursed (…) provided that a portion or the entire cost of the trip was charged to the account

Banque Nationale du Canada

| Insurance | Coverage |

| Trip cancellation (before departure) | Up to $1,000 per insured person |

| Trip interruption (after departure) | Up to $1,500 per insured person |

The main differences regarding insurance coverage of the National Bank Platinum Mastercard are the duration of the trip and the amounts eligible for cancellation/interruption coverage.

When we analyze this data, we can see that this card is perfect for people who like to make several short trips.

For a family of 3, the price for equivalent travel insurance for a week in an all-inclusive package can climb to over $200!

Insurance in case of theft or loss of luggage

The National Bank Platinum Mastercard covers you if at least part of the cost of your trip has been charged to your account.

| Insurance | Coverage |

| Lost or Stolen Baggage Insurance | Up to $1,000 per person |

Flight delay insurance

The National Bank Platinum Mastercard covers you if at least part of the cost of your trip has been charged to your account.

| Insurance | Coverage |

| Flight delay of more than 4 hours | $250 per day (maximum of $500 per insured person) |

Insurance in case of baggage delay

The National Bank Platinum Mastercard covers you if the full cost of travel on a common carrier has been charged to your account.

| Insurance | Coverage |

| Baggage insurance in case of delay | Up to $500 per person (over 6 hrs) |

Car Rental Insurance

The National Bank Platinum Mastercard covers you if you use your card (or NBC Rewards points) to pay the full cost of your car rental.

Similarly, personal belongings in the vehicle are protected.

| Insurance | Coverage |

| Vehicle rental (48 days or less) | Vehicle valued at up to $65,000 |

Insurance for your purchases

The National Bank Platinum Mastercard is one of the only credit cards in Canada to offer 180-day purchase protection (6 months from the date of purchase). Other credit cards offer only 90 days (3 months).

What’s more, the National Bank Platinum Mastercard is one of the only credit cards in Canada to triple the coverage period on new items covered by an original manufacturer’s warranty valid in Canada.

| Insurance | Coverage |

| Against theft or breakage for 180 days | Up to $60,000 |

| Get up to triple the manufacturer’s warranty | Up to 2 additional years |

Bottom Line

The National Bank Platinum Mastercard is a great card to own, especially if you don’t qualify for the premium National Bank credit cards.

Actually, the insurance offered for short trips is excellent, and the purchase insurance is identical to its big sister, the National Bank World Elite Mastercard.