KOHO Mastercard Prepaid Card: Overview

In Canada, there are three plans for the KOHO Mastercard Prepaid card:

- KOHO Essential Mastercard Prepaid Card

- KOHO Extra Mastercard Prepaid Card (no foreign currency conversion charges)

- KOHO Everything Mastercard Prepaid Card (no foreign currency conversion fees)

In fact, we’ve named it the Best Prepaid Card in Canada for 2023. Not least because the KOHO Extra Mastercard Prepaid Card offers 1.5% at grocery stores, including Costco and Walmart! It’s one of the only cards to offer this for these chains.

What’s more, it doesn’t charge any conversion fees for foreign currency transactions.

And we’ve named the KOHO Mastercard Prepaid Card the Best Card for Newcomers to Canada in 2024.

This card requires no credit history in Canada, and you can build your credit score. And with this card, you’ll earn at least 3% interest on your entire balance!

The KOHO Card is halfway between a debit card and a credit card:

- Like the debit card, the KOHO Mastercard Prepaid Card allows you to spend only what you have in your account

- Like the credit card, the KOHO Mastercard Prepaid Card offers you rewards (in the form of cashback)

This type of card will not affect your credit score: getting one will have no impact. However, it won’t help you improve your credit score either.

KOHO prepaid cards have some things in common:

- Accepted worldwide through the Mastercard network (including at Costco)

- Cash back on some purchases

- Possibility of automatic savings

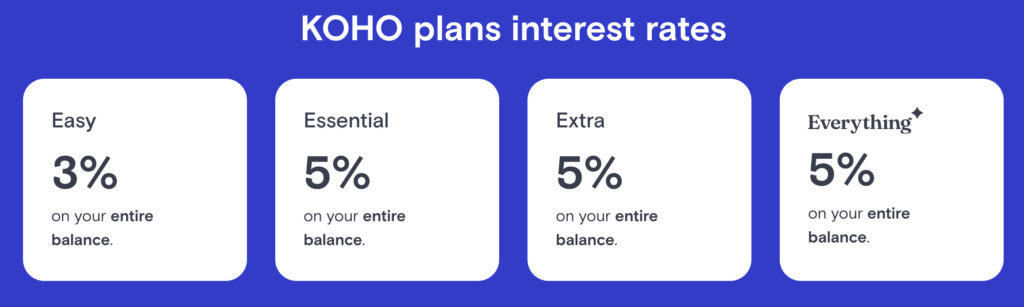

- Earn 3% to 5% interest on your available balance

- No interest charges on your purchases

- No fees at merchants charging fees to credit cardholders

- Possibility to buy online

- Bill Payments

- Joint accounts possible

- Available on Apple Pay

KOHO Extra Mastercard Prepaid Card

Special Offer:

- Enter the code KOHOMILES when applying for your card

- Get 3 months of the Extra Plan for free (a $9 discount per month) and $20 cash back

The features of the KOHO Extra Prepaid Mastercard (formerly known as the KOHO Premium Prepaid Mastercard) are as follows:

- Earn an extra 1.5% cashback on eating & drinking, billing & services, and groceries on top of minimum 0.25% cash back on all purchases. Plus, up to 50% extra cashback from select merchants.

- Accepted at Costco.

- Earn 5% interest on both your spending and savings account. Your funds will also be eligible for CDIC insurance. Interest rates are per year, calculated daily, paid monthly, and can change at any time without notice.

- $9/month or $84/year to access Extra Plan features.

- No Foreign Exchange fees on any purchases.

- Also get access to 1 free international ATM withdrawal per month.

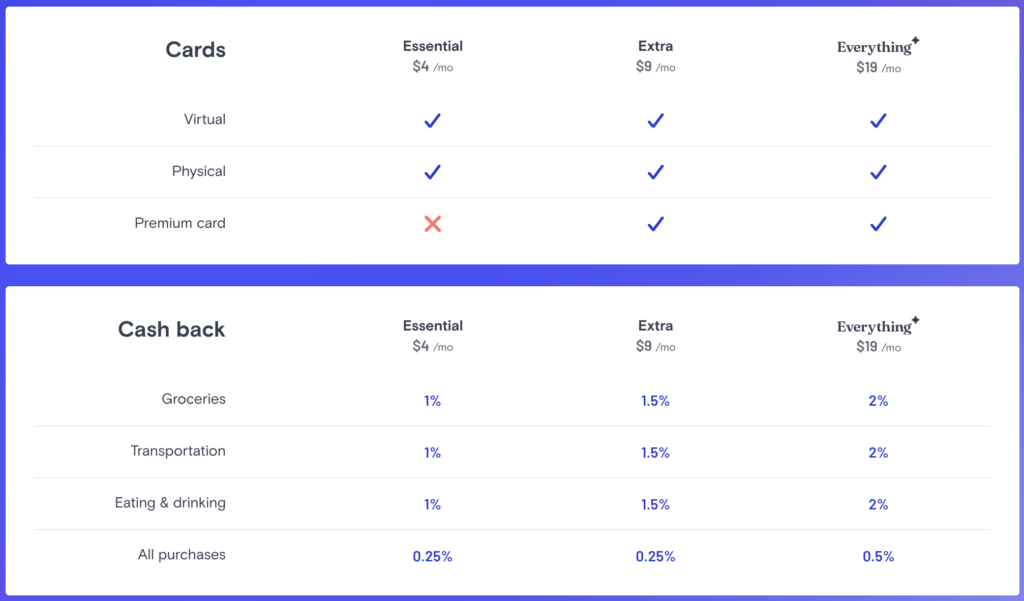

KOHO Prepaid Mastercard - KOHO packages

There are three KOHO plans to suit your needs:

Here are some tables showing the features of these KOHO plans:

KOHO Prepaid Mastercard - Up to 5% interest with a high-interest savings account

KOHO has increased its savings rates to 3% on its free plan and 5% on all its paid plans.

Here’s how to save:

- Choose the KOHO plan that’s right for you;

- Add funds to your new account;

- Join Earn Interest in the app, then start earning money.

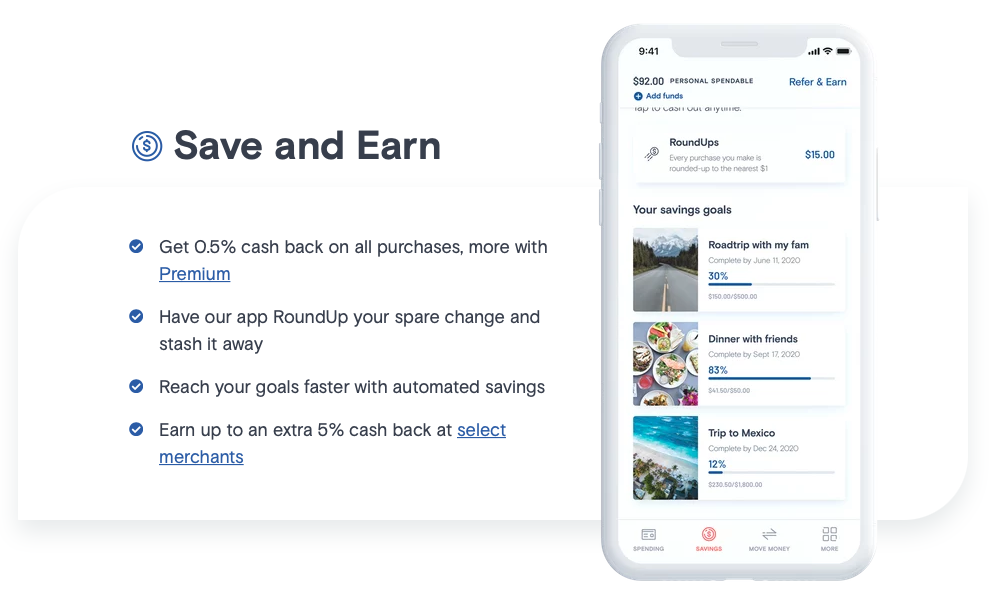

Automatic savings and cash back

The automatic savings program

Both KOHO Mastercard prepaid cards offer an automatic savings program.

Purchases made with your KOHO card are rounded to the nearest $1, $2 or $10 (you choose the amount). For example, if you activate the automatic savings program and purchase $2.25, $0.75, $1.75, $2.75 or $7.75 (whichever you choose), it will automatically be set aside for you!

You can see in your KOHO app how much you have saved at any time. Note that this money can be accessed anytime: if your available balance is less than the amount of the purchase you wish to make, the funds will be withdrawn from your savings account.

The Cash Back Program

KOHO Mastercard prepaid cards offer a cash-back program on your everyday purchases. You’ll see the cash back in your Savings tab within 1-2 business days of the original authorized purchase.

The cash back you earn depends on the KOHO plan you choose.

| Package | Cash Back |

| Essential | 1% cash back on groceries, meals, beverages and transportation |

| Extra | 1% cash back on groceries, meals, beverages, transportation, recurring bills and services 0.25% cash back on other purchases |

| Everything | 2% cash back on groceries, meals, beverages, transportation, recurring bills and services 0.5% cash back on other purchases |

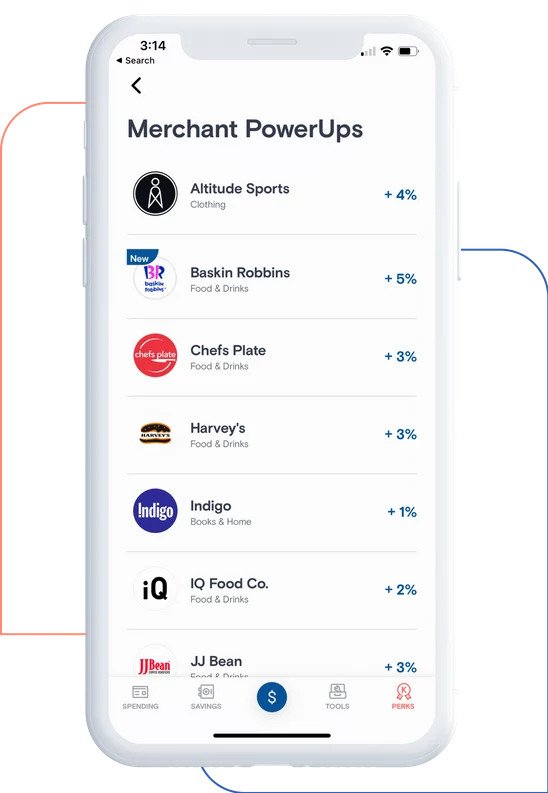

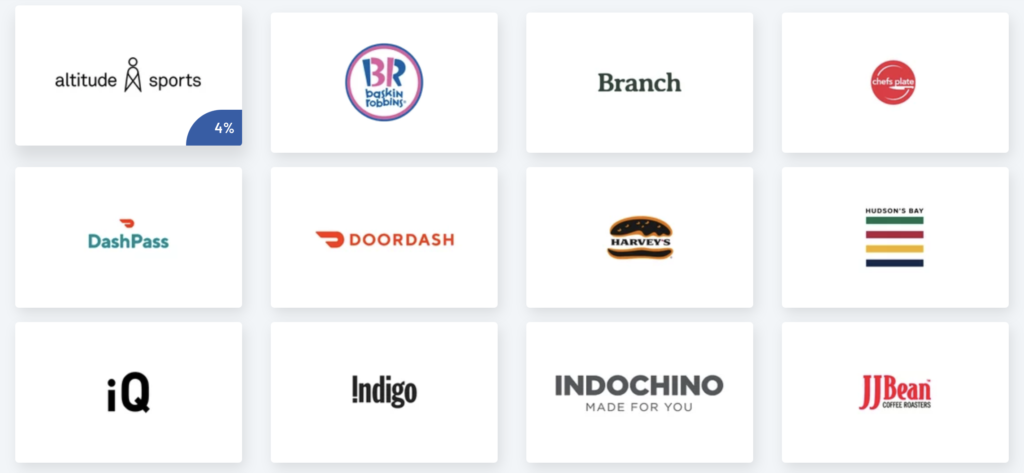

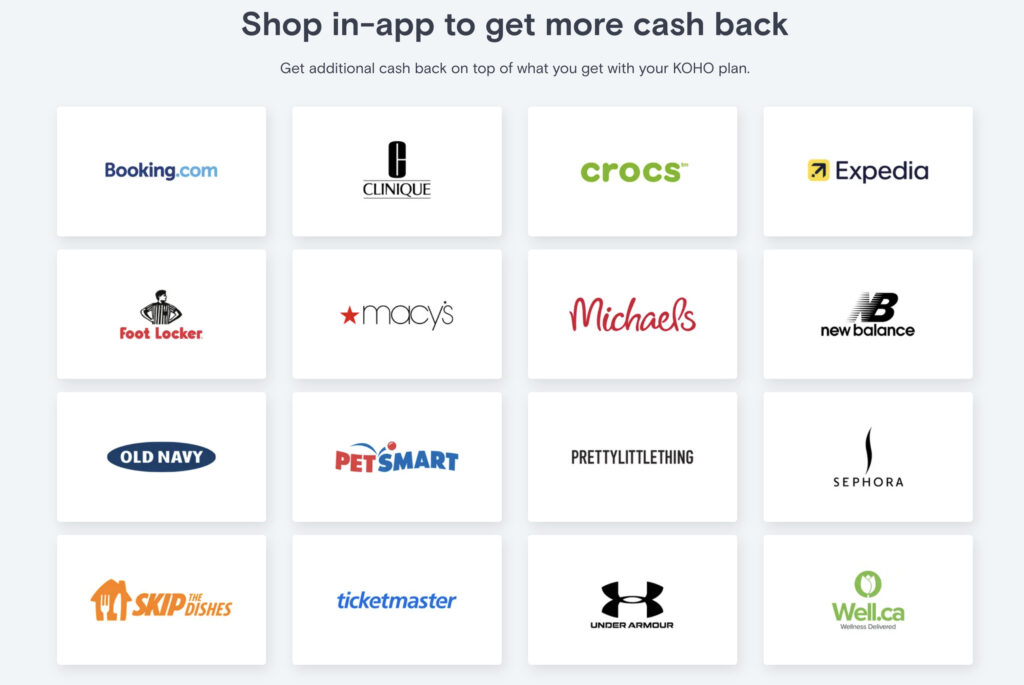

You can earn cash back on more purchases through KOHO partner merchants like:

- Altitude Sports

- Chefs plate

- DashPass/DoorDash

- Harvey’s

- Hudson’s Bay

- Indigo

- Pizza Pizza

- And more!

For example, with Altitude Sports, you can get 4% extra cash back. This is in addition to the base rate, for a total of 4.25% cash back!

With Harvey’s, it’s 3% extra cash back. With the Everything plan, you’ll get 5% at Harvey’s, in addition to the 2% cash back on restaurants!

KOHO online shopping portal: partner merchants via the app

By opting for a KOHO Essential, Extra or Everything plan, you’ll be able to access an online shopping portal, directly via your KOHO app, to earn up to 50% cash back on your purchases.

All you have to do is click on the merchant’s link directly in the KOHO application before making your purchase. You will then receive your cash back within 30 to 60 days.

There are over 1,000 brands in the KOHO online shopping portal, some of which offer up to 50% cash back!

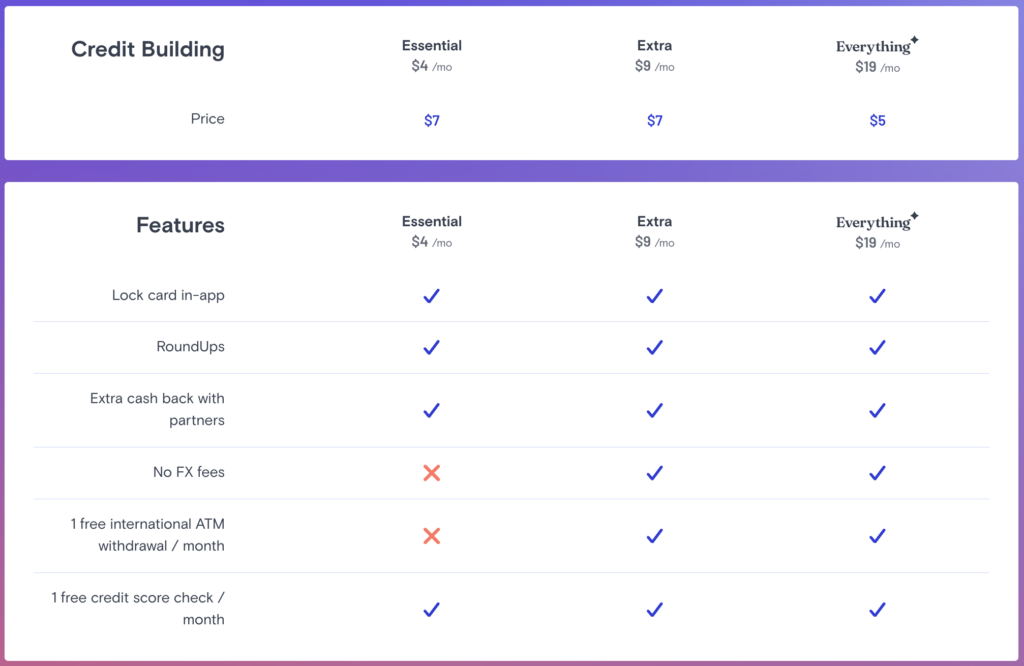

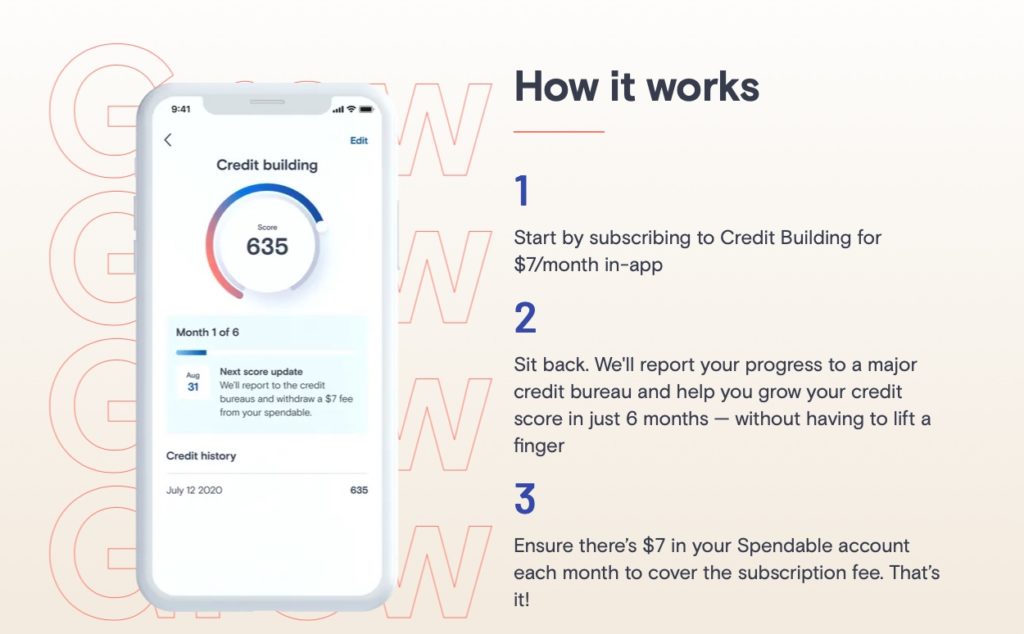

KOHO Prepaid Mastercard - Credit Enhancement / KOHO Credit Building

Usually, prepaid cards do not report your account activity to credit bureaus such as Equifax and Transunion. To counter this, KOHO has a credit-building option.

For $10 a month for 6 months, you can subscribe to KOHO Credit Building.

When you sign up, Koho will deposit $225 of dedicated credit enhancement funds into a separate account from your expenses (so you won’t have access to it). Each month, Koho will recover $75 of these dedicated funds and report it to Transunion as a positive action for your credit score.

For clarity, your total balance on KOHO will not change when KOHO adds the dedicated funds. Your only job is to make sure your regular account contains $10 each month to cover the subscription fee, and KOHO will do the work of establishing your credit score behind the scenes.

This credit building feature operates on a six-month cycle (so you can subscribe once every six months). You must already have a KOHO Mastercard Prepaid Card to benefit from it.

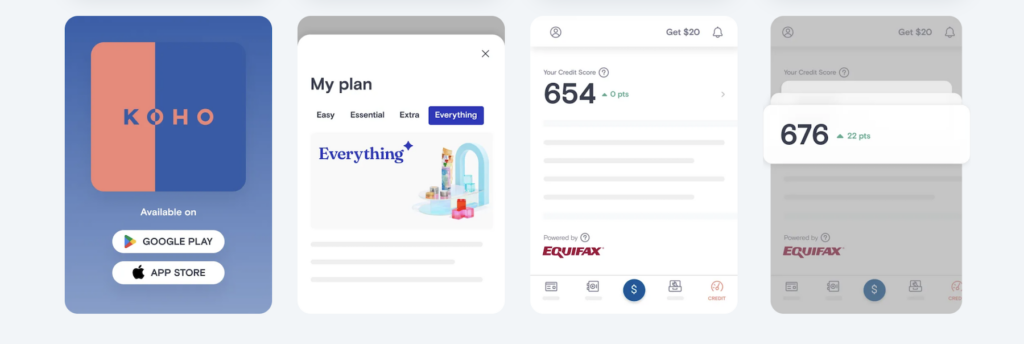

KOHO Prepaid Mastercard - Free credit score

Do you want to check your credit score? KOHO gives you access to this information free of charge. Simply create a KOHO account and take advantage of a 30-day trial period.

Here’s how it works:

- Download the KOHO application, then create an account;

- Choose the Essential, Extra or Everything plan for a free 30-day trial;

- Discover your credit score with Equifax.

Please note that your score will be updated once a month. After the free trial, you’ll need to pay the monthly subscription fee for one of the plans to obtain your credit score.

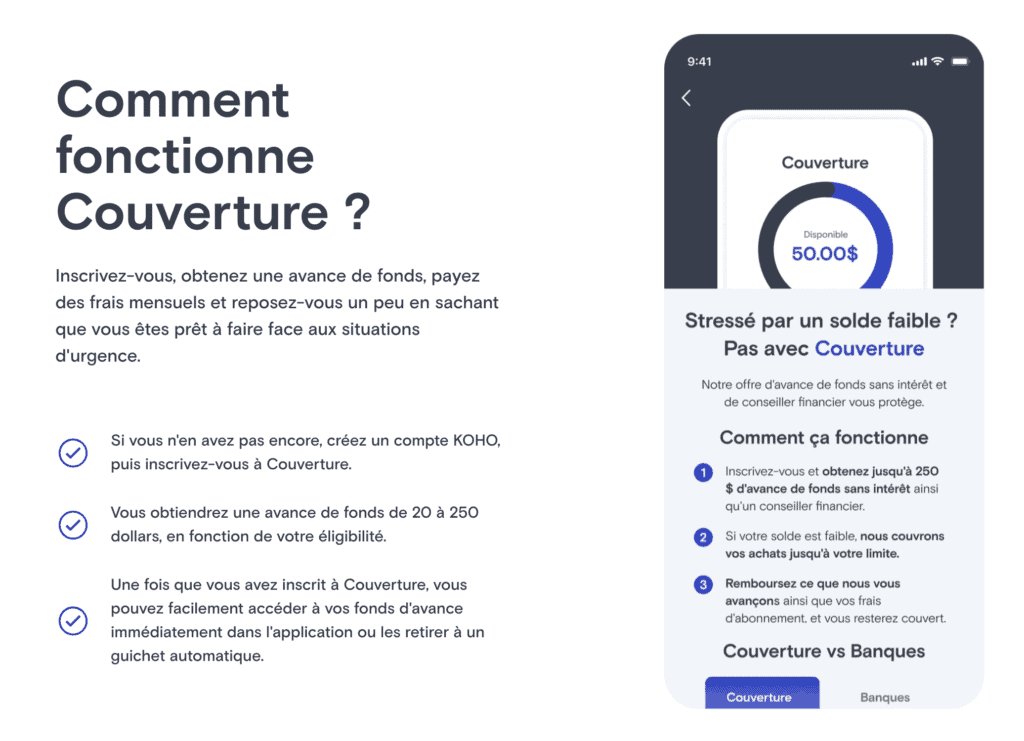

KOHO Prepaid Mastercard - Cash advance

The KOHO Cover program gives you access to an interest-free cash advance of up to $250. Access to this overdraft protection service costs $2 per month.

KOHO Prepaid Mastercard - KOHO / KOHO Card fees

KOHO charges a monthly fee for the KOHO Mastercard Prepaid Card according to the plan chosen.

There are no interest charges, insufficient funds charges or wire transfer fees. Here is a summary table of the other costs:

| Package | Monthly fees | Foreign Exchange Fees | Free international ATM withdrawals |

| Essential | $0 or $4 | 1,5 % | 0 |

| Extra | $9 | 0 % | 1 per month |

| Everything | $19 | 0 % | 1 per month |

KOHO Prepaid Mastercard - Get a fee waiver

The Essentiel package is available free of charge to new users, provided they perform one of the following two actions:

- Receive a recurring direct deposit such as a paycheck or government benefits;

- Each month, transfer at least $1,000 to your KOHO account.

KOHO Prepaid Mastercard - Conclusion

Credit cards offer more rewards – and some have no conversion fees for foreign currency transactions – KOHO is aimed at a different audience.

The KOHO Mastercard Prepaid Card, with no annual fee, can appeal to those who want to control their budget while earning cash back. One thinks, for example, of young people and students. This formula will disappear on April 20, 2024: if you get this card and opt for the Easy Plan (with no annual fee) before this date, you can keep this formula.

The KOHO Extra Mastercard Prepaid Card is designed for those who spend a lot in the 1.5% categories and regularly pay in foreign currencies (to enjoy the no foreign transaction fee benefit). Especially since the 1.5% grocery category also works at Costco and Walmart!

For either of these cards, you can get a $20 welcome bonus and 3 months of the Extra package for free by adding the code KOHOMILES when you sign up.

Otherwise, if you prefer credit cards, you can check our recommendations:

Frequently Asked Questions about KOHO

Has the KOHO Premium Mastercard Prepaid Card become the KOHO Extra Mastercard Prepaid Card?

Yes, the KOHO Extra Mastercard Prepaid Card used to be called the KOHO Premium Mastercard Prepaid Card. It’s still the same card but with a new name and more features.

Is the KOHO Prepaid Card a credit card?

No, as the name suggests, the KOHO Prepaid Card is a prepaid card. There are no credit limits or inquiries made on your credit report.

What is the KOHO card from KOHO Financial?

The KOHO Prepaid Card is a prepaid card from KOHO Financial. With this card, there are no credit limits and no inquiries on your credit file.

How do I activate the KOHO Bank KOHO card?

To activate the KOHO Prepaid Card, go to your KOHO mobile application or the KOHO website.

How do I use KOHO?

You can use KOHO for any purchase. Top up your KOHO prepaid card before making a purchase.

How to contact KOHO?

To contact KOHO, simply go to your KOHO mobile app or the KOHO website. You can also write to KOHO at support@koho.ca.