Summary of the controversy

As every year in September, media such as La Presse echo an R3 Marketing report with Léger Marketing – LoyauT – pointing the finger at Aeroplan and AIR MILES, declaring them “at the end of their lives”.

This is not the first time that R3 Marketing has released this type of annual report, carried out following a survey of 5,000 Canadians (including 3,000 Quebecers).

Who is R3 Marketing?

R3 Marketing defines itself as “relationship marketing and loyalty experts“.

These experts provide their services to private companies for:

- develop a new loyalty program

- optimize the existing program

- diagnosing and evaluating the performance of a program

- analyze best practices

R3 Marketing is not the first company to criticize coalition programs.

Before it, there was DataCandy – declaring itself“a provider of gift card and loyalty solutions”– and working closely with R3 Marketing,sponsoring the LoyauT report for example.

It is therefore not surprising that this type of report is oriented in the direction of the development of their business. By announcing:“AIR MILES and Aeroplan are atthe end of their life”, this company helps to attract the attention of the media… who grab the ball at the leap!

What is a coalition program?

A coalition program is a loyalty program bringing together different brands. Aeroplan, AIR MILES or CAA are coalition programs:

- Aeroplan with Air Canada, Costco.ca, Home Hardware, Costco…

- AIR MILES with Jean Coutu, Shell, IGA…

- CAA with Couche-Tard, Newlook…

In addition, there are the major financial partnerships of financial institutions:

- Aeroplan with American Express, CIBC and TD

- AIR MILES with American Express and BMO

- CAA with the BNC

The Aeroplan and AIR MILES programs are massively established in Canada with between 5 and 10 million members.

A decline in the market share of coalition programs

While R3 Marketing’s report serves as a“throw a cat among the pigeons”,there is no doubt about coalition and loyalty programs.

Today, brands want to have direct contact with their consumers. That’s why we’ve seen the rather successful growth of grocery store programs like PC Optimum or Metro&me, or programs that give quick and regular rewards like Tim Hortons’ FidéliTim, or SAQ Inspire which is particularly successful.

PC Optimum is also… a coalition program. But it is a private coalition program owned by Loblaws.

The fact that partner retailers in this type of program have limited access to customer data results in a decrease in performance, as it becomes very difficult for program managers to make relevant and personalized offers to their members

Hans Laroche and Paul Lafortune - R3 Marketing

By entrusting loyalty management to coalition programs, brands do not have this direct relationship.

In addition, coalition programs have themselves created a bad reputation in recent years:

- The expiration of the AIR MILES or Aeroplan miles that caused a lot of ink – before both programs came back on top of it

- The withdrawal of some major brands such as Aeroplan’s Esso or Uniprix from Aeroplan

- Aeroplan’s setbacks with its divorce from Air Canada (to finally be bought by Air Canada)

Let's try to make a fair assessment of things!

However, these loyalty card are still well established in the wallet of Canadians:we see this every day in the milesopedia member community.

AIR MILES events such as Shop the Block are a hit and Air Canada’s current #avecaeroplan campaign is successful with thousands of posts shared on social media.

And consumers appreciate the value of their Aeroplan miles, just look at the many testimonials from milesopedia members!

In addition, beyond thunderous statements about Canada’s two major programs, the LoyauT report highlights a growing interest among Canadians in loyalty programs, including credit card affiliated with loyalty programs.

Complementary programs

Whether they are from an individual brand or a coalition of brands, loyalty programs are anchored in the lives of Canadians.

The study by R3 Marketing shows this by noting that Canadians hold a dozen loyalty cards in their real or virtual wallets.

It is therefore not the domination of a loyalty program over the others, but rather a complementarity of the different programs. With the growth of brand-specific loyalty programs, the penetration rate of coalition programs such as AIR MILES or Aeroplan is therefore expected to decline.

Still, both these programs are indeed present in the daily lives of Canadians thanks to their many partnerships in progress… and to come.

Coalition partners

Both AIR MILES and Aeroplan programs compete for privileged partnerships with brands. And you have to admit that AIR MILES wins this battle:

- a grocery banner (IGA)

- a gas station banner (Shell)

- a pharmacy banner (Jean Coutu)

Aeroplan has lost ground with the exit of Esso and Uniprix.

However, let’s not sell the bear’s skin before one has killed the beast: Air Canada is in the process of implementing a new loyalty program on the bases provided by Aeroplan – supported by American Express, CIBC and especially TD – and the possibility of major brands joining this programme in 2020 would not be impossible.

In addition, AIR MILES and Aeroplan have taken an increasingly important place on the web, as buyers have begun to change their consumption habits (from buying in stores to buying online).

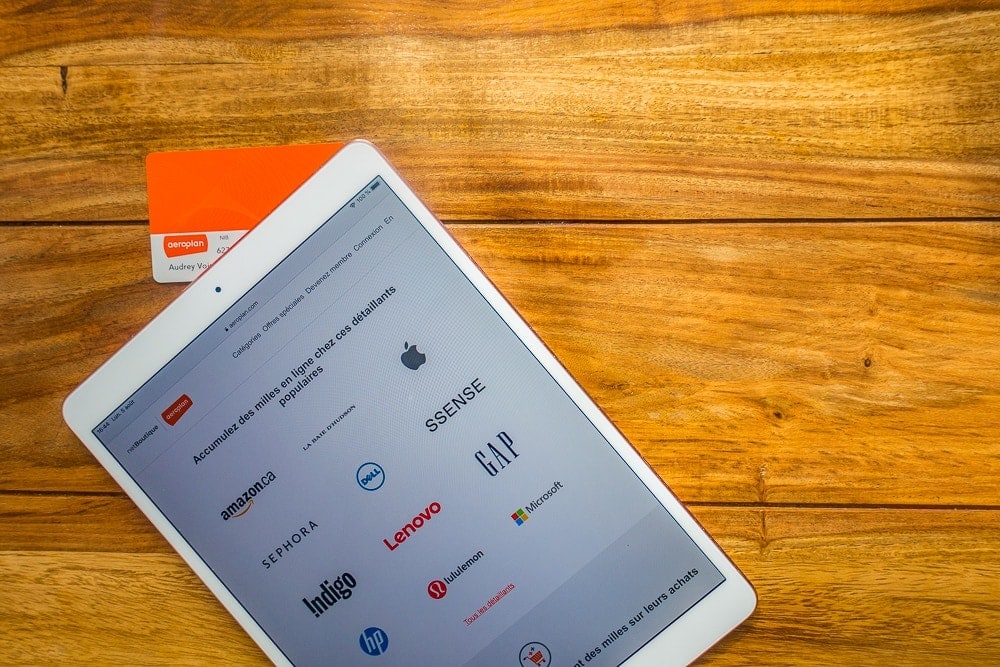

This has been understood by both AIR MILES (with airmileshops) and Aeroplan (with the netBoutique). And the exclusivity of one program or another does not apply here: giants like Amazon.ca or Apple are partners with both programs.

After all, these are affiliate platforms, with AIR MILES and Aeroplan paying their members miles in exchange for business advisors’ commissions collected from partner merchants.

Airmilesshops.ca and eStore have thus become increasingly important in the consumption habits of members of both programs.

Conclusion

No, coalition programs are not “end-of-life”, they are in an adaptation phase as new players arrive. It is thus normal to see a decline in their market share. But to claim that they are “at the end of their life” would be far too much to advance and underestimate the resources of the actors behind these programs!

Running a loyalty program is very expensive for a company and it is easy to understand why many of them prefer to let a coalition program manage that portion of loyalty.

Loyalty programs are in constant evolution. One thing is obvious: Canadians love loyalty programs,whether they’re from a particular brand (to get their 10th free coffee or a discount on their grocery store) or a coalition (to increase their points and miles wallet through all their purchases to get dream rewards faster)!

So let’s stop seeing the negative side, but let’s look at the life of these programs and adapt to new trends! That’s all we do every day on milesopedia!