PC Financial Launches The PC Money Account

After offering three credit cards, PC Financial is now launching a prepaid Mastercard similar to the one marketed by Stack (both in terms of fees and visuals)!

The great perk is to get PC Optimum points for current transactions, for those who pay with their debit card. However, the use of a credit card for groceries, gas or drugstores is often much more rewarding in points.

Earning PC Optimum points

10 to 25 PC Optimum points per dollar on each purchase

With PC Money and your PC Optimum membership account, you could earn 10 points per dollar on each purchase and up to 25 points per dollar for purchases at Pharmaprix/Shoppers Drug Mart.

As PC Optimum states in its terms and conditions, these are actually bonus points, compared to the PC Optimum points you would normally have earned as a member:

- Earn 5 regular PC Optimum points plus a bonus of 5 PC Optimum points per dollar of your purchases with your PC Money™ Account.

- All PC Optimum members earn 15 points per dollar on eligible purchases at Shoppers Drug Mart and Pharmaprix. When you use your PC Money™ Account, you will earn an additional 10 points per dollar of your purchases.

Up to 50,000 points as a welcome bonus

As part as PC Money Account Launch, you could earn up to 50,000 PC Optimum points as a bonus:

- Earn 10,000 bonus PC Optimum™ bonus points when you make your first purchase of $50 or more, using a valid PC Money™ Account, within three months of account approval.

- Earn one bonus of 10,000 bonus PC Optimum™ points when you link a bank account with another financial institution to your PC Money™ Account and receive a success message upon verifying your external account online.

- Earn a bonus of 1,000 PC Optimum™ points for each of up to five bill payments of $50 or more to unique payees, per calendar month, made using a valid PC Money™ Account.

- Earn a one‑time bonus of 25,000 PC Optimum™ points when you set up automatic payroll or pension direct deposit into your PC Money™ Account for the first time and complete at least three direct deposits into the account within the three consecutive months following setup.

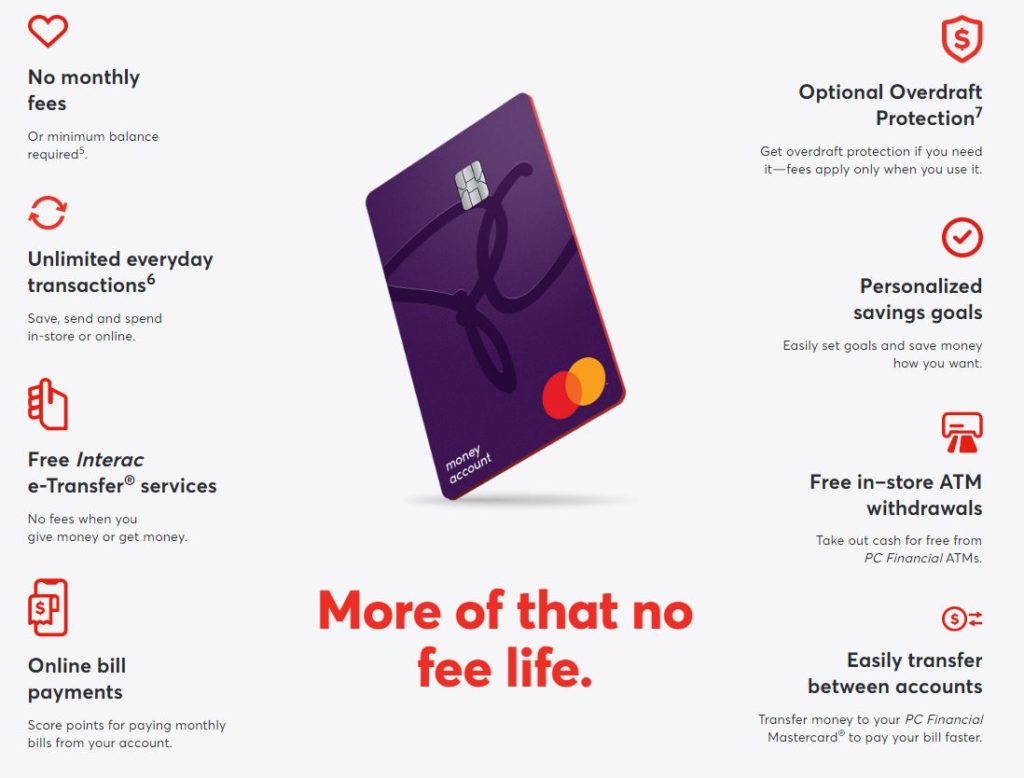

The benefits of the PC Money Account

Here is the list of benefits offered by the PC Money Account:

- No monthly fees

- Unlimited everyday transactions

- Free Interac e-Transfer® services

- Online bill payments

- Free in–store ATM withdrawals (PC Financial ATMs)

PC Money Account Service fees

Here is a summary of the PC Money Account fees:

| Services | Fee |

| Unlimited In-Store Purchases | Free |

| Unlimited Online Purchases | Free |

| Unlimited ATM Withdrawals at PC Financial ATMs | Free |

| Unlimited bill payments | Free |

| Non-Sufficient Funds (NSF) | $ 40.00 |

| Domestic ATM withdrawal (not PC Financial ATM) | $ 1.50 |

| International ATM withdrawal (Mastercard Network) | $ 3.00 |

| Foreign Exchange Transaction Fee | 2,5 % |

| Send Interac® e-Transfer | Free |

| Receive Interac® e-Transfer | Free |

| Cancel Interac® e-Transfer | $3.50 |

| Optional Overdraft Protection Fee | $ 5.00 |

| Optional Overdraft Protection Interest (Per annum) | 19 % |

| Bill Payment Trace | $15.00 |

| Bill Payment Recall | $24.00 |

| Rush Card Replacement | $ 5.00 |

| Card Replacement (1st Free per Year) | $ 5.00 |

| Printed Copy of Previous Account Statement | $ 5.00 |

| Inactivity Fee (yearly) | $20.00 |

| Assisted Transaction via Customer Service Representative (per transaction) | $1.00 |

Bottom Line

PC Optimum continues to expand its range of services to its customers. After credit cards, it’s the turn of this PC Money prepaid card that tries to find a slot into the PC Optimum members’ wallet.

PC Financial wants to attract debit card customers or those who can’t get credit cards.

If you are a PC Optimum member, there is no reason not to get this prepaid card as no credit hit is required. And this is an opportunity for you to get more PC Optimum points!

Frequent questions about PC Money Account

What is a PC Money™ Account?

The PC Money™ Account is an account that works like debit, and rewards you every time you use it to make a purchase. Accepted everywhere Mastercard® is, this no monthly fee account gives you unlimited everyday transactions and rewards you with 10 PC Optimum points on every $1 you spend on purchases.

How does the PC Money™ Account differ from a conventional debit account?

The PC Money™ Account is an online self-service money management account. his means you can pay bills (including pre-authorized withdrawals for things like gym memberships and utility bills), and transfer funds between banks. You earn PC Optimum points every time you use your card to make a purchase online or in-store. You can use your card everywhere Mastercard® is accepted, including online and when travelling abroad. However, you can’t write or deposit cheques, or use your card with merchants that don’t accept Mastercard® payments.

How do I transfer funds into my account from another financial institution?

You can transfer funds by linking an external account, or by sending yourself an Interac e-Transfer®. Sending yourself an Interac e-Transfer® is the fastest way to fund your account. Linking an external account may take up to 3 business days.

Do I earn PC Optimum points on my PC Money™ Account?

Your PC Money™ Account earns you 5 regular PC Optimum points plus 5 bonus PC Optimum points* for every $1 of your purchases, everywhere Mastercard® is accepted. Don’t forget to link your card with your PC Optimum account to earn more points with your personalized offers at participating stores.

*Earn 5 regular PC Optimum points plus a bonus of 5 PC Optimum points per dollar of your purchases with your PC Money™ Account. President’s Choice Bank reserves the right to cancel, change or extend regular and bonus points earning rates as of September 30, 2021. PC Optimum points will be deducted for any returns. Account must be in good standing at time of qualifying transaction and awarding of points. Minimum redemption is 10,000 PC Optimum points (worth $10 in rewards) and in increments of 10,000 points thereafter at participating stores where President’s Choice® products are sold. Some redemption restrictions apply; visit pcoptimum.ca for details, participating stores and full loyalty terms and conditions.

Are my money and account secure?

Yes President’s Choice Bank is a member of the Canada Deposit Insurance Corporation (CDIC), which means your deposits are eligible for insurance up to a maximum of $100,000 per financial institution. We also use 2-factor authentication and encryption, helping keep your account and money secure. If you suspect suspicious activity on your account, you can easily lock and unlock your card, online or through the PC Financial app.