How to redeem cash back to reduce your credit card balance

Have you signed up for a CIBC Dividend Credit Card and received a welcome bonus of several hundred dollars?

Here’s how to redeem cash back on a CIBC Dividend Visa Card.

Redeem cash back in 4 clicks

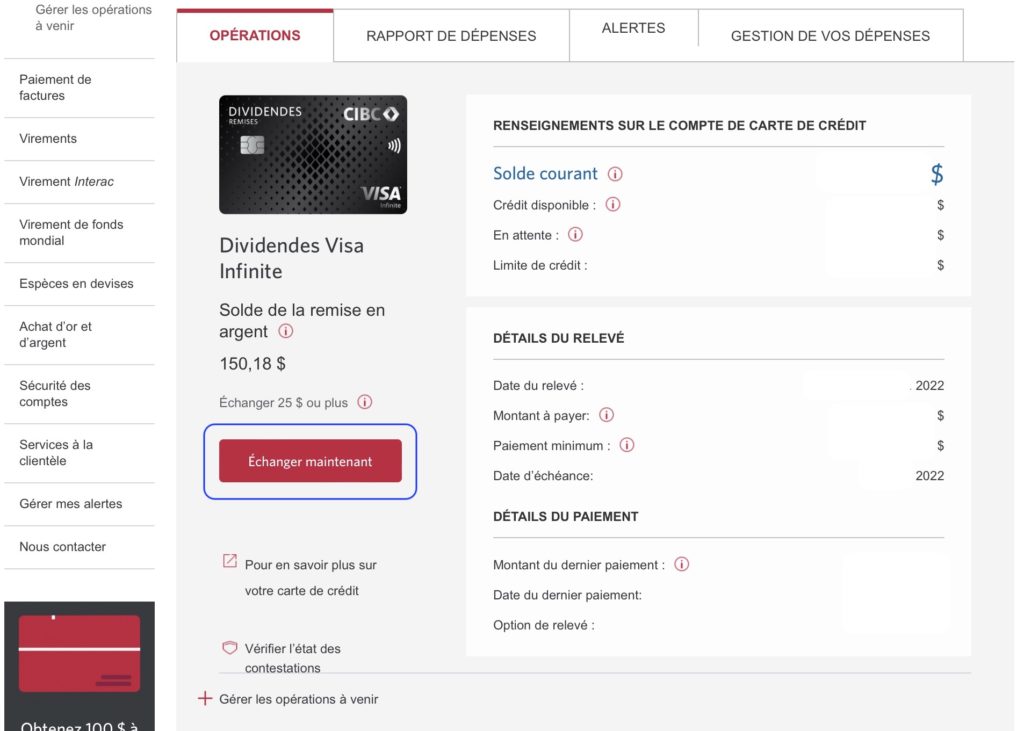

First, log in to your profile in CIBC Online Banking.

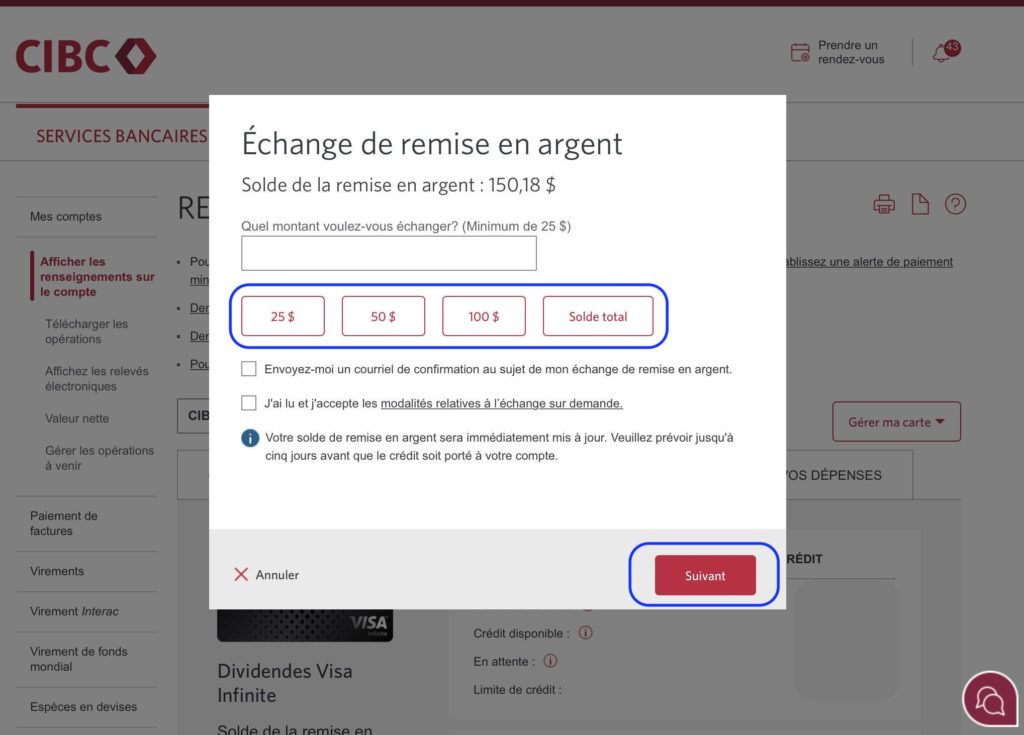

The exchange can be done at any time during the year and it is not necessary to wait until the statement is issued to do so. The only requirement is that you have a balance of at least $25.

On the Operations tab, click on Redeem Now.

A window will open to enter the amount to be redeemed. Select the desired amount and click on Next.

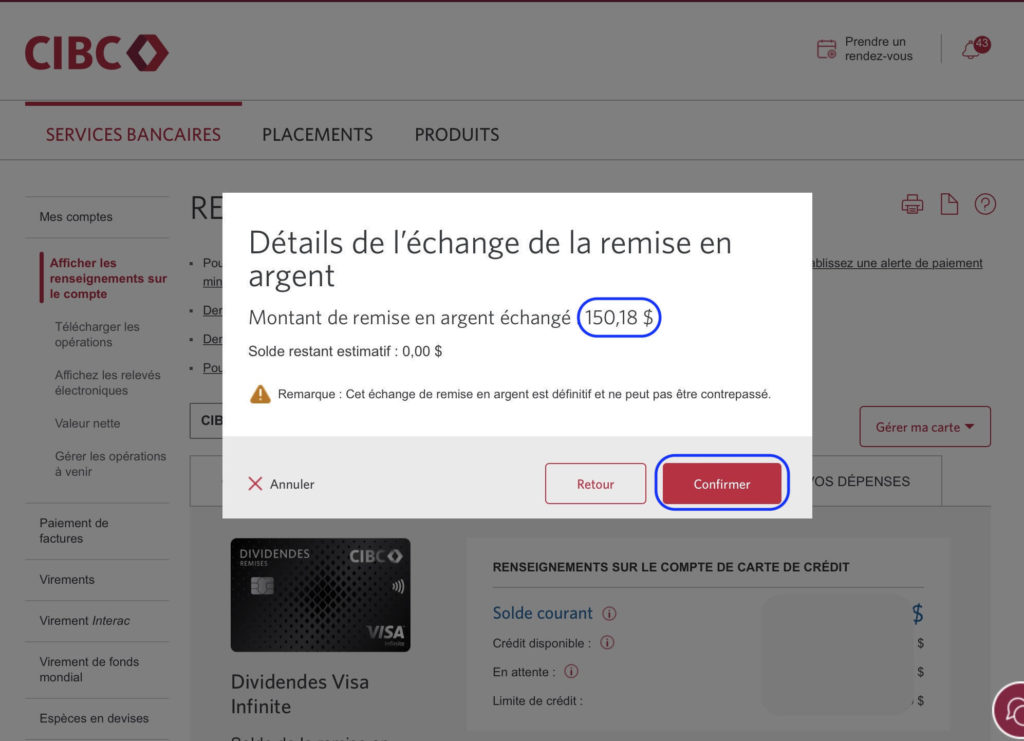

CIBC then wants confirmation of the amount redeemed, showing the remaining balance. All that remains is to click on Confirm.

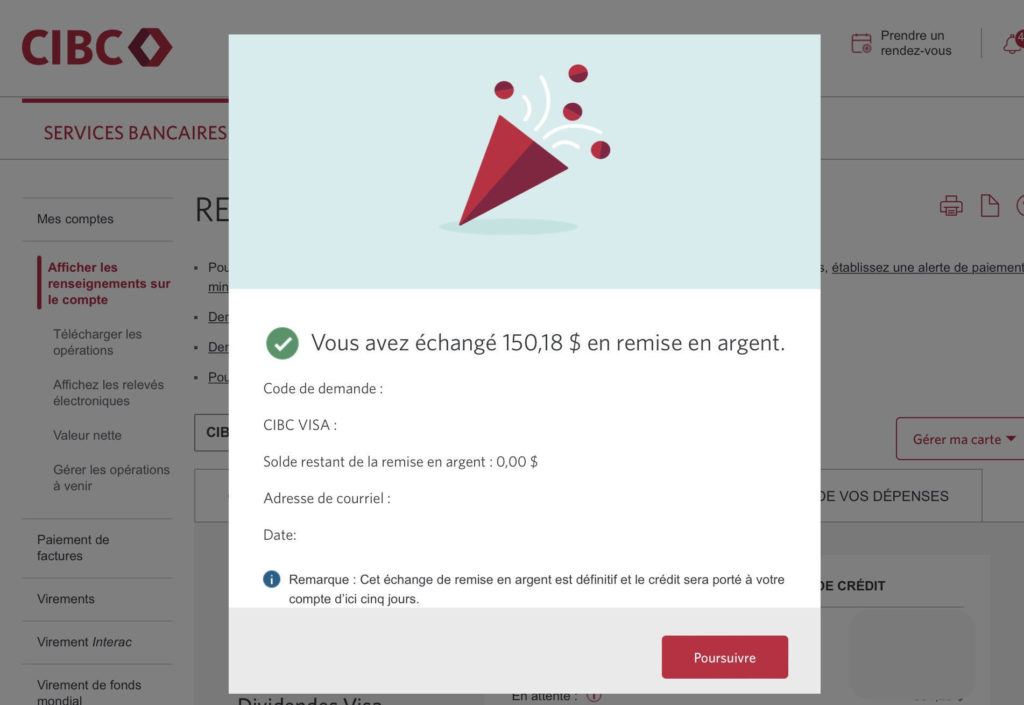

Congratulations!

The CIBC Cash Back redemption transaction is confirmed. With this, I will have $150 less to pay on my CIBC credit card balance.

Also, a confirmation email will be sent within minutes.

Then, your cash back redemption is posted to the account within five days. But in my experience, it is quite fast with one to two days delay.

It may be slower if there are upcoming holidays.

CIBC Dividend Cash Back Credit Cards

CIBC Dividend® Visa Infinite* Card

The CIBC Dividend® Visa Infinite* Card is one of the best Visa credit cards with cash back in Canada.

Right now, with this welcome offer, get a 10% welcome bonus in the form of up to $250 cash back (period covered by your first 4 statements) and an annual fee rebate for the first year†!

With this CIBC Cash Back Credit Card, you get:

- 4% cash back on gas, EV charging, and grocery purchases†

- 2% cash back on eligible transportation, dining purchases and recurring payments†

- 1% cash back on all other purchases†

For example, if you spend $1,000 per month on groceries and/or gas and/or electric vehicle charging, you’ll earn $40 cash back per month or $480 cash back per year with this card for this category of purchases!

And that’s not counting the other purchases you’ll make with this card and the advantages it offers (particularly in terms of insurance).

And this CIBC Cash Back Credit Card offers many insurance coverages:

- Auto Rental Collision/Loss Damage Insurance

- $500,000 Common Carrier Accident Insurance

- Out-of-Province Emergency Travel Medical Insurance

- Purchase Security and Extended Protection Insurance

CIBC Dividend Platinum® Visa* Card

If you don’t meet the income requirements for the CIBC Dividend® Visa Infinite* Card, you could apply for the CIBC Dividend® Platinum Visa* Card. The minimum annual income required for this card is $15,000 (household).

With this offer, get a 10% welcome bonus in the form of up to $250 cash back (period covered by your first 4 statements) and an annual fee rebate for the first year!†

With the CIBC Dividend® Platinum Visa* Card, you get:

- 3% cash back on eligible gas, EV charging, and grocery purchases.†

- 2% cash back on eligible transportation, dining purchases and recurring payments†

- 1% cash back on all other purchases†

And this CIBC Cash Back Credit Card offers some insurance coverage:

- Auto Rental Collision/Loss Damage Insurance

- $500,000 Common Carrier Accident Insurance

- Purchase Security and Extended Protection Insurance

CIBC Dividend® Visa* Card

The CIBC Dividend® Visa* Card is one of the best no-fee Visa cashback credit cards in Canada.

For a limited time, earn an annual interest rate of 9.99% on purchases† and 20.99% on cash† for 10 months†.

Plus, get :

- 2% cash back on eligible grocery purchases†

- 1% cash back on eligible gas, EV charging, transportation, dining purchases and recurring payments†

- 0.5% cash back on all other purchases†

This no-annual-fee CIBC credit card offers certain insurance coverages:

- $100,000 Common Carrier Accident Insurance

- Purchase Security and Extended Protection Insurance

CIBC Dividend® Visa* Card for Students

The CIBC Dividend® Visa* Card for Students is one of the best cash back Visa credit cards for students in Canada. For a limited time, earn 10% cash back up to $100 on your first 4 monthly statements.

With this CIBC Student Credit Card, you get:

- 2% cash back on eligible grocery purchases†

- 1% cash back on eligible gas, EV charging, transportation, dining purchases and recurring payments†

- 0.5% cash back on all other purchases†

What’s more, with this CIBC Student Credit Card, you benefit from a free free membership to SPCmembership, for instant savings on over 450 in-store and online transactions.

And this CIBC Student Credit Card offers some insurance coverages:

- $100,000 Common Carrier Accident Insurance

- Purchase Security and Extended Protection Insurance