Understanding how points are calculated allows you to avoid pitfalls, but also to exploit certain flaws related to the parameters allowing calculations.

The transaction you just made at IGA with your BMO AIR MILES Mastercard may seem simple, but IGA and BMO do not have the same information to credit your AIR MIL ES miles and the number of miles credited will likely be different on your two statements.

In this article, I want to show you the nuances to know about points.

Merchant points

Whether you buy in-store or online, when a merchant credits you with points for your purchases, they have a lot of information about what you’ve bought, starting with the information about each product on your bill.

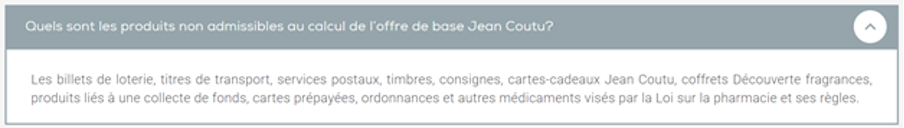

Exclusions

Since they have access to the transaction details, a merchant can therefore exclude certain lines when calculating the number of points obtained. Often, the same exclusion rules will also apply to senior and employee discounts.

The exclusions are something that you have to watch out for, even if you have to go and read the fine print. There are several categories of exclusions, each with its own history and rules of application.

Statutory and regulatory exclusions

Some products cannot be discounted by laws or regulations. This legally prevents the merchant from giving you points on these products.

Also included in this exclusion category are:

- tobacco

- lottery tickets

- and even in some cases products where floor prices apply, such as milk or beer.

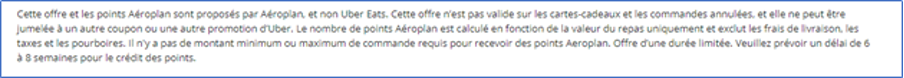

Fees and taxes

The merchant can also decide to exclude certain lines from the transaction on which he makes no (or little) profit margin. For example:

- taxes,

- delivery costs,

- bottle depots,

- tips.

Example: Aeroplan and Uber Eats

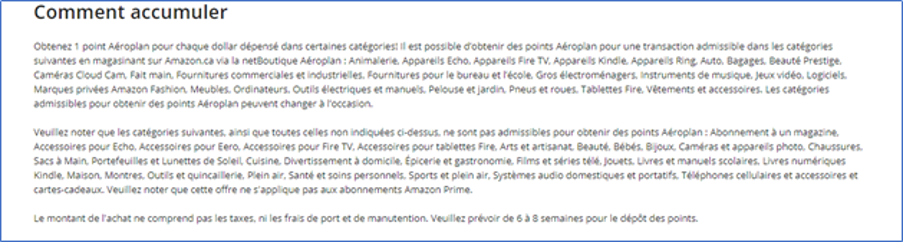

Category exclusion

Merchant may also specifically include or exclude product categories/ranges.

The main reason is that the business does not make enough profit margin on the sale, for example public transport tickets, stamps, etc.

Example: Aeroplan and Amazon

Exclusion of gift cards

For a merchant, there is a big difference between selling a gift card from another banner (e.g. Netflix, Amazon) and a gift card from their own banner.

In the first case, we are talking about a product like any other, the store will make a margin (between 5% and 15%) when selling.

In the second case, the store will not make any money on the transaction, it will simply receive a payment from the customer that it will exchange for a gift card and place this amount in trust (the clearinghouse).

When the customer uses the gift card, the merchant will make a profit on the sale of the goods and will be paid with the money in the trust.

This is why, in most cases, the two purchases are not treated in the same way.

Exclusion from the transaction

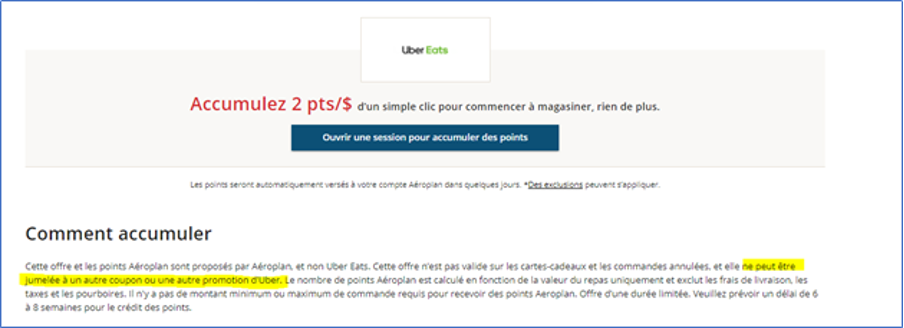

Finally, the merchant may decide to exclude the transaction entirely under certain conditions. For example, if a coupon or another promotion is used, or if the transaction is already subject to an invoice reduction such as an employee purchase or senior discount.

This is the case for Uber Eats when using the Aeroplan eBoutique.

Example: Amazon and Uber Eats

The calculation of the base points

Earning rate

Base points are calculated on the transaction once exclusions are removed, and once discounts are applied (i.e. promotions, employee discounts, etc.).

The amount calculated this way will be used to establish the number of points you will receive for the transaction according to the scale pre-set by the program for this merchant.

Earning scale

Each loyalty program has its own currency and, as with foreign currencies, each currency has its own value: for example, a PC Optimum point does not have the same value as an Aeroplan point or an AIR MILES mile.

So each program will award points based on the currency value it uses.

Some programs will have a very strong currency and only offer 1 point for $10, $20 or $25 while other programs will offer a weaker currency and even give 100 points for $1.

Example of currencies and earning rate

|

Currency

|

Approximate value of the currency | Example of earning for $100 purchase |

| AIR MILES | 10.5 cents | 5 AIR MILES bonus miles |

| Aeroplan | 2.0 cent | 100 points |

| PC Optimum | 0.1 cent | 1,000 points |

However, most programs opt for a basic earning rate of 1 point/$1.

Rounding up

Each program (and merchant) has its own rounding method when calculating the number of points you should receive.

The majority of the programs will however use a rounding down and therefore to the advantage of the merchant.

For example, if all your purchases add up to $39.99 and the basic bonus is 1 point/$1, you will get 39 points, whereas if the accumulation is 1 point/$20, you will only get 1 point for this transaction.

And if your transaction is only $19.99, in the first case, you will receive 19 points while in the second case, you will receive no points.

Bonus points

The merchant may decide to apply a bonus (often temporarily) to the entire transaction, to a category of products in the transaction (e.g. cosmetics) or to specific products.

These bonus points are often linked to a specific campaign, and for campaign analysis and investment reasons, they are often counted separately from base points.

Multipliers

When the points on a transaction (or a category or a product) are multiplied, the principle is always the same: there is what the advert says (10x the points) and how this will be translated on the statement, i.e. the base points and a bonus to get 10x (so 9x the base).

For example: if we have a $100 transaction and the regular earning rate is 1 point/$, then we will see on the statement 100 base points and 900 bonus points for a total of 1,000 points (i.e. 10x the base total of 100 points).

Bonus points on products

There are also promotions in the form of bonus points on specific products (e.g. 5 AIR MILES bonus miles). In this case, the bonus is triggered when the specific product is purchased and is added to the points earned on the total transaction.

Bonus points on transactions

There are also some promotions that will be triggered after a certain purchase threshold, the goal always being to get you over that threshold.

Example: if the average grocery cart is $80, why not force the purchase of a few more products by offering a few extra points when the customer exceeds $100.

Questions

Are the promotions cumulative?

In most cases the answer is yes, but perhaps not as cumulative as one would like to think.

To simplify the example, we will use a base offer of 1 point/$1.

For example, if there is a 5x points promotion, and at the same time I have a coupon that gives me another 10x points after $100, and finally I buy 10 products priced $10 that give me 50 extra points per product, how many points will I have in total?

Note: unfortunately the answer is not 30,000 points (100+10 x 50) x 5 x 10

| Cumulative | |

| Regular points on $100 | 100 |

| Bonus points for 5x (so 4x) | 400 |

| Bonus points for 10x (so 9x) | 900 |

| Bonus points for products (10×50) | 500 |

| Total | 1 900 |

So the promotions are cumulative but not combinable.

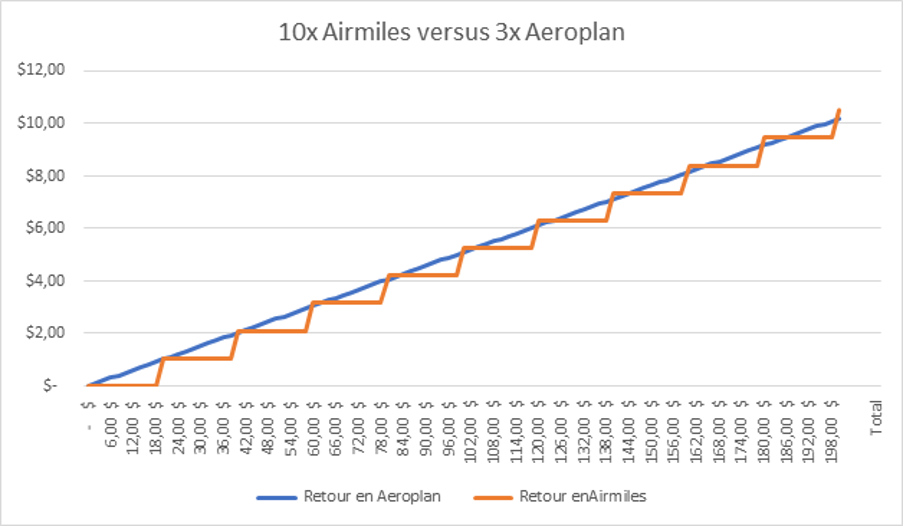

Is a bonus of 10x points good?

A 10x points is always better than no extra bonus.

In fact, the real question is:

- Are all 10x worth the same?

- Is a 10x AIR MILES promotion really better than a 3x Aeroplan?

Example parameter:

- A merchant available on the AIR MILES Shop and the Aeroplan shop (ex: Etsy)

- Basic offer

- AIR MILES: 1 AIR MILES bonus miles per $20

- Aeroplan: 1 Aeroplan point per $1

- Currency valuation

- AIR MILES: 10.5¢

- Aeroplan Point: 1.7¢

- Promotional offer

- AIR MILES: 10x miles

- Aeroplan Point: 3x points

What is the best offer?

Yes, it’s counter intuitive but in most cases on the same merchant a 10x AIR MILES bonus miles promotion is less “interesting” than a 3x Aeroplan points promotion.

This is due to the bonus structure and the “rounding up”.

Credit cards points

In the case of credit cards, the “product” on which points are given is not what is in your shopping cart but the “payment solution”, i.e. what the merchant will pay as a fee so that he can collect the money from the transaction: interchange fees.

When you receive points through your credit card, the card issuer has much less information than the merchant to calculate the number of points to credit.

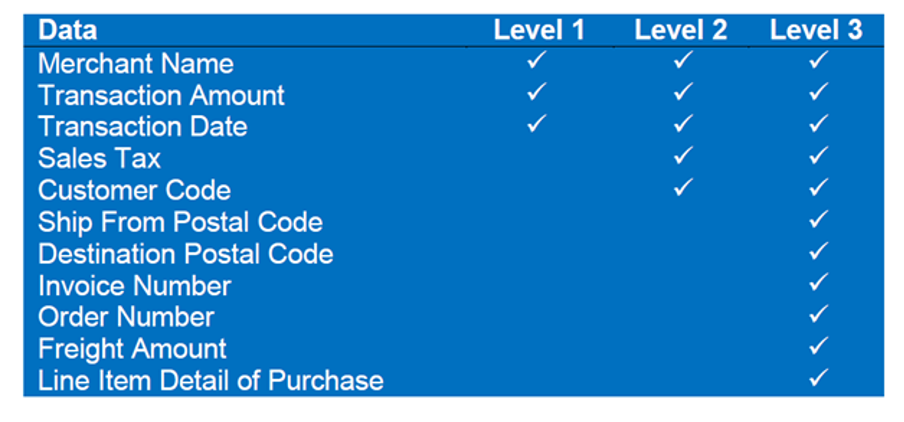

The myth of Level 3 information

Let’s dispel a myth right away: in Canada, the credit card issuer does not have access to the contents of the shopping cart (the “Line Item Detail of Purchase”).

Although Level 3 processing exists in theory, it does not apply to our Canadian credit cards (unlike American credit cards).

The vast majority of the information transmitted is Level 2 information between the merchant and the card issuer.

Indeed, it takes two conditions for the credit card issuer to have access to the famous Level 3 which contains the information of each product purchased from a transaction, the “Line Item Detail of Purchase”.

Condition 1: It must be a “Corporate” credit/payment card . These cards are not available to the general public, they are different from the SME or personal cards and are intended for large companies or government enterprises.

Condition 2: The store must support the transfer of Level 3 information. We won’t go into details, but it’s an investment for the merchant that will only pay off if they do a lot of corporate cards transactions (mainly by saving on the interchange fees for those transactions).

Exclusions

In the case of a credit card, exclusions and calculations are therefore made at the transaction level.

As when a merchant credits points, some transactions may be excluded.

Exclusions are mainly as follows:

- Interest charges

- The card ‘s fees

- Cash advances (e.g. ATM withdrawals)

- Payments on online casino platforms (e.g. Loto Quebec)

- Payments on international money transfer platforms, currency purchases.

In addition, there may be certain clauses, such as those for American Express:

- Transactions processed manually or by means of a paper process (for example, transactions processed by means of a credit card printout)

- Purchase for which the merchant category is not defined.

The calculation of the base points

Contrary to the merchant’s part, when calculating a transaction, the whole transaction is either eligible or not.

So, for example, at the restaurant, it is the total amount paid, including taxes and tip, that is sent to the card issuer and on which the calculation is made.

For the same reason, you can earn points via your credit card on the purchase of medication even in Quebec.

Bonuses by type of purchase

Often certain types of purchases will earn you extra points.

To do this, the issuer will use the information it receives from the merchant to determine if the transaction allows for additional accumulation (2x, 4x, 5x) whether it is for a specific merchant (Apple, Amazon, Expedia, Petro Canada, Ultramar, Walmart, Marriott, etc.) or a type of business (Grocery, pharmacy, gas station, Traveletc.).

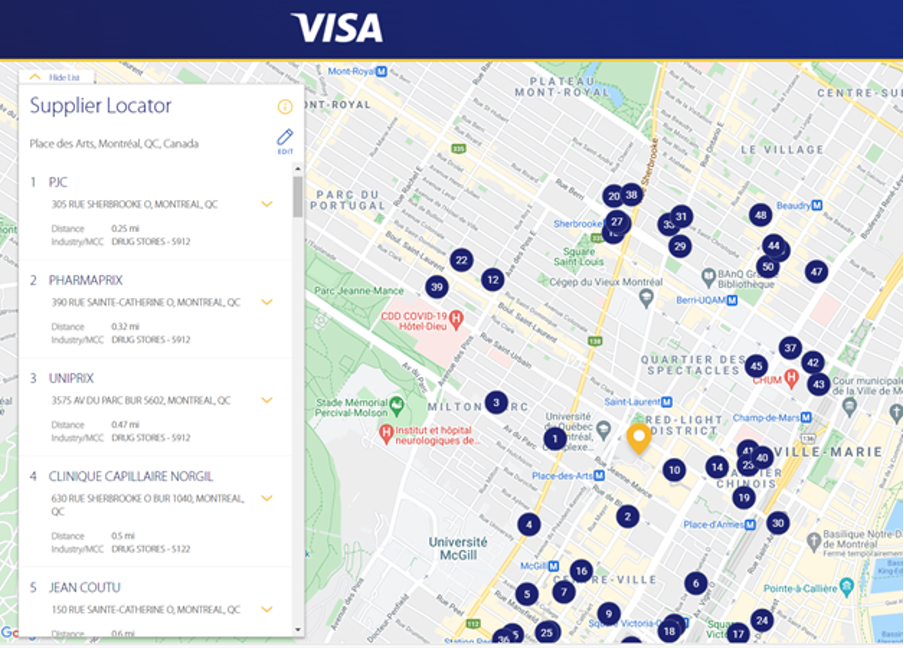

Merchant Category Codes

The Merchant Category Code (MCC) is a standard for categorizing what a business sells.

MCC codes exist in two forms: codes identifying the category of the store (5912: Pharmacies) or in the travel field, codes with the name of the company directly (3007: AIR FRANCE).

There are about 1,000 different codes to classify businesses. For example, there are two codes for restaurants (5812: Food Service Establishments, Restaurants and 5814: Fast Food Establishments) and a specific code for Bars (5813).

Communication between the purchase category and the MCC

When a credit card announces that it gives an additional bonus for a category of purchase (e.g. restaurant), it will define which MCCs are included in the bonus.

For example, when Tangerine mentions Pharmacies to Tangerine credit cardsThe following are merchants classified in category 5912 “Pharmacy” and when she talks about Restaurants these are merchants classified in categories 5812 to 5814 (“Eating and Drinking Places, Restaurants, Bars, Lounges, Nightclubs, Taverns and Fast Food Outlets”).

Reference: https://www.tangerine.ca/en/legal/credit-card-cardholder-agreement (Tangerine money-Back Program Terms and Conditions / Section 7)

The most used codes for the bonus

| Categories | Codes |

| Subscriptions |

7997: Membership Clubs 8699: Membership Organizations |

| Furniture |

5712: Floor Covering Blinds 5719: Miscellaneous Home Furnishing Specialty Stores 7641: Furniture, Furniture Repair |

| Bars | 5813: Drinking Places (Alcoholic Beverages), Bars, Tavern |

| Cellular | 4814: Telecommunication Services |

| Airlines | 3000-3299: Brands (Air Canada, Air France, KLM, Lufthansa, ..) |

| Corner Store | 5331: Variety Stores |

| Streaming | 4899: Cable and other pay television |

| Entertainment |

7941: Commercial Sports, Athletic Fields,… 7922: Theatrical Producers (Except Motion Pictures) 7996: Amusement Parks, Carnivals, Circuses 7991: Tourist Attractions and Exhibits 7929: Bands, Orchestras, and Miscellaneous Entertainers 7998 : Aquariums, Sea-aquariums, Dolphinariums 7832: Motion Picture Theaters 7829: Motion Pictures and Video Tape Production and Distribution |

| Grocery |

5411: Grocery Stores, Supermarkets 5462: Bakeries 5499: Miscellaneous Food Stores |

| Gas / Refill |

5541: Service Stations ( with or without ancillary services) 5542: Automated Fuel Dispensers 5552: Electric Vehicle Charging |

| Hotels and motels |

7011: Hotels and Motels 3500-3828 : Brands (Marriott, Sheraton, Hilton, BW, …) |

| Car Rental | 3351-3441: Brands (Hertz, Avis, Alamo, ..) |

| Warehouse stores | 5300: Wholesale Clubs |

| Digital Media |

5815 : Digital Goods: Media, Books, Movies, Music 5816 : Digital Goods: Games 5968: Direct marketing , continuity subscription merchants |

| Tolls | 4784: Toll and Bridge Fees |

| Drugstores | 5912: Drug Stores and Pharmacies |

| Home Improvement |

5200: Home Supply Warehouse Stores 5231 : Glass, Paint, and Wallpaper Stores 5251: Hardware Stores 5261: Nurseries, Lawn and Garden Supply Store 5713: Floor Covering Blinds 5714: Drapery, Window Covering and Upholstery Stores 5718 : Fireplace, Fireplace Screens, and Accessories Stores |

| Restaurants |

5812: Eating places and Restaurants 5814: Fast Food Restaurants |

| Utilities | 4900: Electric, Gas, Sanitary and Water Utilities |

| Parking | 7523: Automobile Parking Lots and Garages |

| Taxi | 4121: Taxicabs and Limousines |

| Public transport |

4111: Local/Suburban Commuter Passenger Transportation 4112: Passenger Railways 4131: Bus Lines, Including Charters, Tour Buses 4789: Transportation Services, Not elsewhere classified) |

| Merchant | Codes |

| SAQ / LCBO | 5921: Liquor Stores |

| Costco / Costco.ca | 5300: Wholesale Clubs |

| Walmart |

5310: Discount Stores or 5311: Department Stores For Mastercard, Supercentres 5541: Grocery Stores, Supermarkets |

The bonus is therefore calculated at the merchant level, which is why purchasing a litre of milk in a pharmacy is coded as “Pharmacy” and purchasing a toothbrush in a grocery store is coded as “Grocery”.

How to find out the list of MCCs for a purchase type

Experience helps you learn the categorization of a store, but there are some tricks to help.

The cards

First of all, Visa cards.

Even though these cards only give codes for the Visa network, normally the store is coded identically for Mastercard and American Express.

You can also use American Express cards which are much less precise in categorization but give a good idea for example for restaurants or travel.

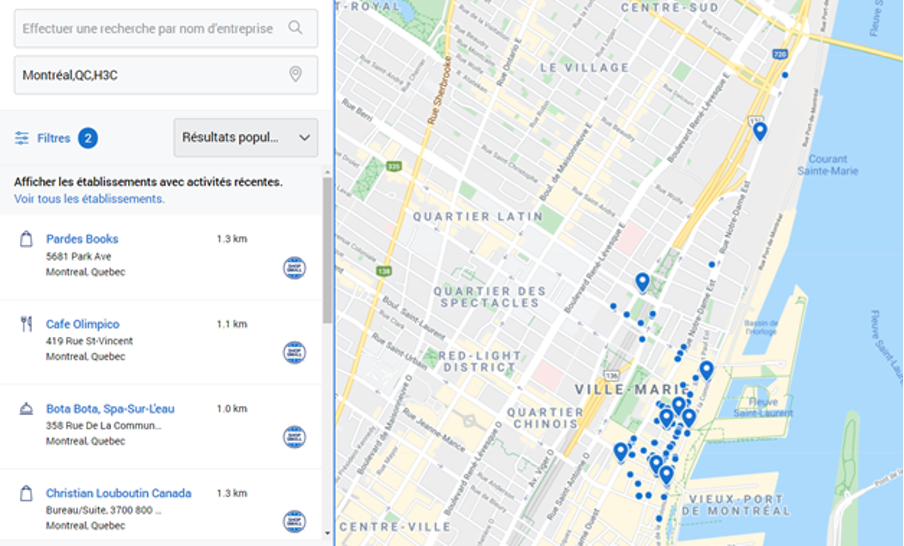

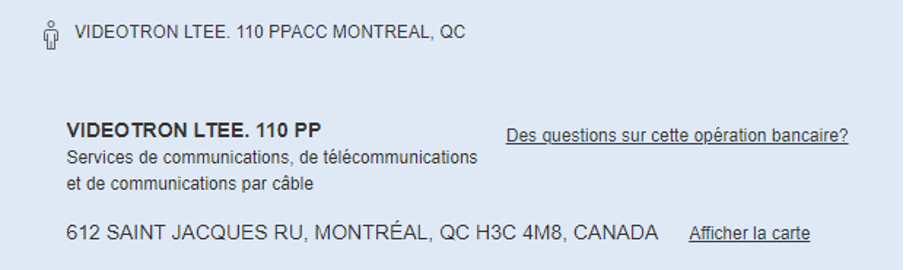

Statements

Classification information can also be found on credit cards statements when the purchase is charged to the account.

Example with CIBC:

Conclusion

The calculations are not perfect and are based on the information available from the merchant, card issuer or portal.

As the systems process millions of transaction lines per day, this results in “errors”, some of which benefit the merchant and some of which benefit the customer.

Errors that benefit the customer result in losses to the program, but those that benefit the merchant result in dissatisfaction and possibly customer churn, and that is a big risk for the card issuer.

We want to avoid frustrating clients with false positives as much as possible, which is why systems are often more permissive than what is stated in the program rules.

It is therefore important to understand the limitations in order to exploit the flaws to one’s advantage.

Join us on the Facebook group to learn more!