As a follow-up to our article on credit cards for beginners, it is important to remember that this is a marathon, not a sprint! It is necessary to calm down at the beginning to avoid negative repercussions on your credit rating.

When starting, the norm is to apply for 1 or 2 credit cards every six months. Then, apply for two cards every four months when you are more used to it.

This list was compiled based on our analysis, personal experiences and those of Milesopedia readers. When you have experience with credit cards, these are the best cards we recommend most often.

We assume you already have one or two cards from the Beginner Level article : Which credit card(s) to get? These best mid-level credit cards are for people with a little experience were chosen based on:

- their profitability

- medium and long term benefits

- and the ability to earn rewards at an higher level than the previous ones

To sum up, here are our picks for the best credit cards to start this new stage:

| Card | Why |

| Marriott Bonvoy® American Express®* Card | Thanks to its points that give free nights and its annual free night certificate |

| TD® Aeroplan® Visa Infinite* Card | For its Aeroplan points and benefits that make travel easier |

| BMO Ascend World Elite Mastercard | Gives away 5x points for every dollar spent on travel and 4 free admissions to VIP airport lounges. |

| Bonus: American Express Platinum Card®. | For its refined travel benefits such as unlimited access to airport lounges |

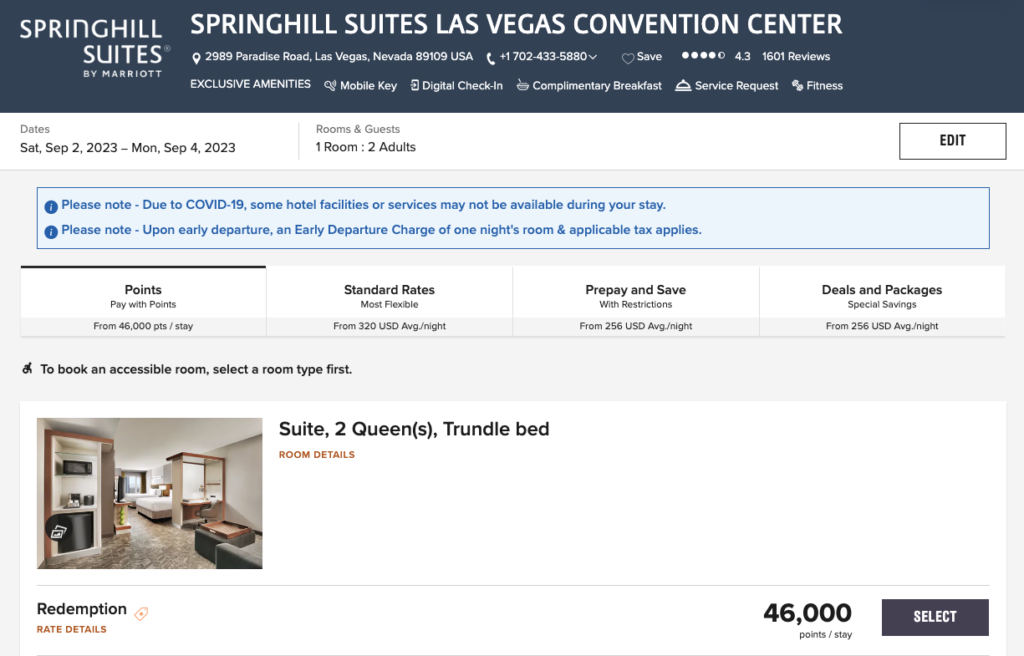

Marriott Bonvoy® American Express®* Card

Why hold the Marriott Bonvoy® American Express®* Card?

- Excellent 50,000 point welcome bonus with reasonable minimum spend

- One free night at a Marriott Bonvoy hotel after one year of card ownership (more than offsets the $120 annual fee)

- Benefits for Marriott Bonvoy members

- No minimum income required

- Excellent customer service from American Express

It’s perfect for a long weekend in Las Vegas, breakfast included!

The myth that American Express cards are not accepted anywhere is very persistent. However, this is not true and you can check in our article where these cards are accepted. Don’t miss out on significant savings because of an urban legend.

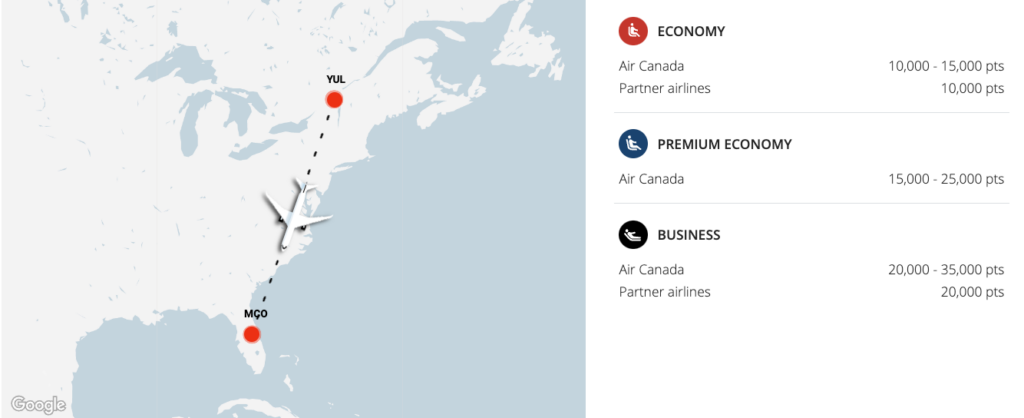

TD® Aeroplan® Visa Infinite* Card

To book flights with Aeroplan points, there is this very interesting card.

Why subscribe to the TD® Aeroplan® Visa Infinite Privilege* Card?

- 10,000 Aeroplan Points earned on just the first purchase made with this card

- 15,000 additional Aeroplan points can be earned with an average monthly spend of $1,250 during the 180 days following card opening.

- To get one free checked bag on Air Canada flights

- First year’s annual fee waived

- Exclusive benefits and experiences with Visa Infinite

- TD Auto Club Membership for Roadside Assistance

For example, these 25,000 Aeroplan points, plus the 7,500 points accumulated on the expenses required to obtain the welcome bonus, make it possible to travel at a lower cost for a vacation in Orlando.

Alternative

The TD® Aeroplan® Visa Infinite* Card requires an annual income of at least $60,000. For a card that doesn’t require a minimum income, you can apply for its cousin, the TD® Aeroplan® Visa Platinum Card.

BMO Ascend World Elite Mastercard

Why apply to this BMO Ascend World Elite Mastercard®*?

- Up to 100,000 points thanks to this never-before-seen welcome bonus;

- 4 free visits to airport lounges

- Points easily redeemable as travel credits for travel expenses (airfare, airport parking, hotel rooms, all-inclusives, etc.);

- One of the best travel insurances;

- Earn 5X BMO Rewards points per dollar on all travel purchases (air, car rental, hotel, cruise, train, travel agency, etc.) made with the card;

- Earn 3X BMO Rewards points per dollar in restaurant, entertainment and recurring bill payments.

Alternatives

The BMO Ascend World Elite Mastercard requires a minimum annual income of $80,000.

Here’s another option that gives you effortless free entry to airport lounges:

- CIBC AventuraMD Visa Infinite* Card ($60,000 minimum annual income required)

- CIBC AventuraMD Gold Visa* Card: ($15,000 minimum annual income required)

American Express Platinum Card®

If 2024 or 2025 is going to be a busy travel year for you, treat yourself to the American Express Platinum Card®. Access a higher level as a traveler and be a VIP wherever you are.

- No minimum income required (it is the only premium card in Canada that does not require a minimum income)

- Unlimited access to airport lounges for the cardholder and one guest

- Gold status at Hilton and Marriott Bonvoy hotels

- Access to the Fine Hotels & Resorts program

- $200 Annual Travel Credit

- $100 credit for NEXUS

- Transfer points to airline and hotel partners (a good complement to the American Express CobaltMD Card recommended for beginners)

- Very advantageous travel insurance

Bottom Line

But most importantly, whatever you choose, you must pay your credit card balances in full every month! Otherwise, all your profits will be wiped out by interest charges.

Also, be sure to read all credit card terms and conditions carefully.