In a monthly budget, rent is often considered one of the biggest expenses. Until recently, it wasn’t possible to pay your rent with a credit card, let alone get cash back or rewards on this expense.

This has changed in recent months with the arrival of Chexy, a Canadian company that allows tenants to pay their rent by credit card. Here are the details.

Apartment or house rental - Get cash back on your rent

The concept is simple: you pay your monthly rent to Chexy by credit card, and Chexy takes care of sending an Interac transfer to your landlord. Depending on the credit card selected for your payment, you’ll earn reward points or cash back on this payment. Best of all, it’s all automated. Read our guide for full details:

Chexy not only allows you to earn rewards on your rent dollars as a tenant, but also to unlock welcome bonuses from certain credit cards.

What’s more, payments made through Chexy have recently been categorized as “recurring payments” by credit cards. With some credit cards, you can get a higher discount on this category.

Up to 10% cash back on rent

The choice of credit card for payment at Chexy is very important. To maximize cash back, we recommend using The Scotia Momentum® Visa Infinite* Card for your Chexy payments.

The Scotia Momentum® VISA Infinite* card is recognized year after year as one of the best cash-back credit cards in Canada.

Currently, there is no annual fee in the first year, including on additional cards. And you can earn 10% cash back on all purchases for the first three months (up to $2,000 in total purchases).

With the Scotia Momentum® VISA Infinite* card, you get:

- 4% on groceries and recurring payments

- 2% on gas and daily transit

- 1% on all other purchases

For example, if you spend $1,000 per month on groceries and/or recurring payments, you’ll earn $40 cash back per month, or $480 cash back per year with this card for this category of purchases! And that’s not counting the other purchases you’ll make with this card and the advantages it offers (particularly in terms of insurance).

The Scotia Momentum® VISA Infinite* card is an excellent Visa credit card for cash back.

And its insurance benefits are excellent!

Example of cashback on rent

Here’s an example of how you can use your Scotia Momentum® Visa Infinite* Card to pay your rent with Chexy for a full year:

| Month | Monthly rent | Cash Back | Cash back value |

| January | $1,000 | 10% (welcome offer) | card |

| February | $1,000 | 10% (welcome offer) | card |

| March | $1,000 | 4 % | $40 |

| April | $1,000 | 4 % | $40 |

| May | $1,000 | 4 % | $40 |

| June | $1,000 | 4 % | $40 |

| July | $1,000 | 4 % | $40 |

| August | $1,000 | 4 % | $40 |

| September | $1,000 | 4 % | $40 |

| November | $1,000 | 4 % | $40 |

| December | $1,000 | 4 % | $40 |

| Total | $12,000 | 5 % | $600 |

For example, if your rent costs $1,000 a month, you could earn $600 cash back inthe first year by taking advantage of the Scotia Momentum® Visa Infinite* Card welcome offer and paying with Chexy.

Chexy charges a fee of 1.75%, so it would cost you $210 to use Chexy ‘s services for one year. In the end, you still get a net cash back of $390 on your rent, based on this example.

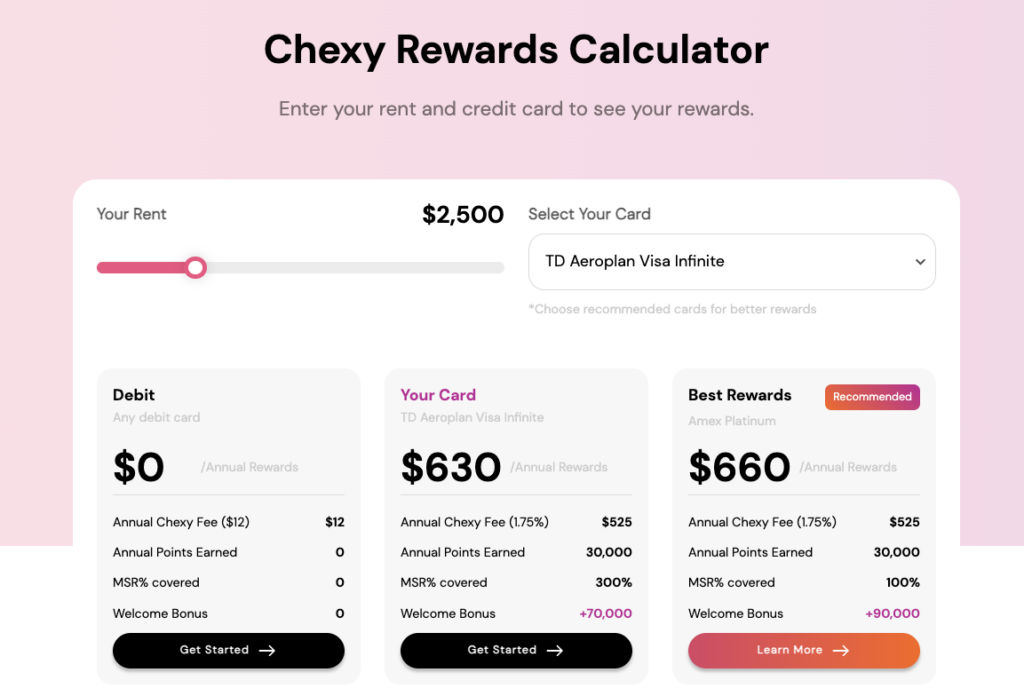

You can do the same exercise using the calculator available on the Chexy website to find out how much cash back you could earn based on the price of your rent and different credit cards:

The Scotia Momentum® VISA Infinite* Card has no annual fee for the first year, and pays out the cash back in November. This makes December or early January the ideal time to apply and start using it, to make the most of the first year with no annual fee.

To find out how to maximize your welcome offer, read this article:

Bottom Line

Landlords can revise your rent every year. If you’ve had a rent increase lately, there are ways to remedy the situation by earning rewards or cash back on every dollar you spend on rent.

The combination of Chexy and the Scotia Momentum® Visa Infinite* Card is the best way to get optimum cash back on every dollar spent on rent. With rent prices on the rise, this strategy can help you stay within your budget and ease the high costs of daily living.