2022 Update: This article is from January 2019, but all resolutions are still valid for the year 2022! Enjoy your reading!

It’s my turn to wish you a great 2019. In light of several articles published earlier this year and because of recurring questions appearing in the Milesopedia – Credit Cards and Rewards” facebook group, I came up with the idea of writing these 7 resolutions for any good Travel Hacker!

1) I define MY goals

Jean-Maximilien also reminds us in his article milesopedia, loyalty programs and you… in 2019!

What are your plans and objectives for the next 6 – 12 – 18 months?

- Anall-inclusive trip to the south or a family getaway to DisneyWorld?

- The famous mini-tour of the world with Aeroplan that many people talk about on a regular basis(with many examples of itineraries)?

- Aroad trip in Europe for which multiple hotel reservations are required?

- Maximize cash back?

It is important to define your own goals.

I emphasize this point because the rest of the underwriting strategy will be based on this starting point. This way, you’ll stay on track and won’t necessarily be tempted to sign up for all the offers and promotions like a headless chicken!

Here are some other factors to consider:

- Are you in a solo process for collecting points?

- Is it more of a couple thing?

- And the trip(s) will be “solo”, “as a couple”, “with friends”, “with family with young children, teenagers, older children”…

2) I identify my expenses for the year 2019

The card purchase process requires a good deal of planning.

In fact, the application process takes several days or even weeks from application to card activation. It usually takes a good 2 weeks on average from application to first use of the card.

- Sometimes the response (approval) is not instantaneous and the application is in analysis, which may take a few days. I suggest that you usually subscribe at the beginning of the week, for example on Monday or Tuesday. This will allow you to quickly reach the approval department, should a follow-up call be required as it is sometimes more difficult to talk to the “right person” on the weekend!

- Some cards are delivered by courier (therefore faster) while others are delivered by regular mail (and a postal strike is always possible…)

- Some cards require an in-branch visit (activation, identity verification)

In short, there are several elements that slow down the process.

And why address the process in the identification of expenses? Because often you take too much at the last minute and you ask us in the group for a card suggestion when there is a payment to be made the following week.

Many expenses are easily identifiable well in advance:

- Municipal taxes (March 1 and June 1)

- School taxes (August 1st and November 1st)

- Annual renewal of car insurance, home insurance (instead of making monthly bank withdrawals which give you nothing in return, know that most insurers accept a full annual payment via credit card)

- Annual renewal of life insurance (same as above)

- Tuition fees, daycare

- Renovations (see example below)

- Dentist (e.g.: orthodontics or crowns, which can be planned)

- Purchase of a car (down payment on credit card)

- Etc…

Moreover, as it is preferable to concentrate your subscription requests (2 or 3 on the same day) and ideally during the week . Indeed, on non-working days, all systems are not at the same “date”. Some will be on the calendar date while others will be on the next business day. So it’s best to plan ahead.

Then, you may also need to consider the time frame for payment of your expense. For example, if the payment is made by check through Plastiq, it will take an additional 7-10 days for the supplier to receive payment.

So, make a calendar and synchronize your card requests with your big expenses (i.e. a few weeks before the expense arrives).

The goal here is to avoid going into debt and ensure that you trigger all your sign-up bonuses. This way, you’ll be less likely to fall back on buying gift cards just to reach a spending threshold.

3) I read, I read and I reread

Travel hacking is not a game. Let’s say it’s a “hobby”. So take the time to read everything:

- Initially, the articles on milesopedia.com

- Discussions in the Milesopedia” facebook group

- Directly on the credit card issuer’s website

- The welcome kits you receive with your new credit card

I come back to these welcome kits.

Why do you think issuers are sending you this information? To inform you of all your privileges! It should be noted that governments are forcing issuers, following pressure from consumer groups, to disclose all elements related to your programs. It is therefore important to read them.

We often see basic questions asked on the group about your privileges. A simple reading or rereading would have allowed you to find the answer. Take charge of your life and develop some autonomy. You’ll also become more familiar with all your benefits!

Also be curious and read the news, discussion forums. It’s a constantly changing world and although we try to share as much as possible with you, there will always be content that we will miss.

4) I learn to use research tools

We often have simple questions that are easily answered on the blog or in the group.

It is true that we (the bloggers and the community) are here to answer questions. Nevertheless, learn how to use the search tools.

There are 2 places to search.

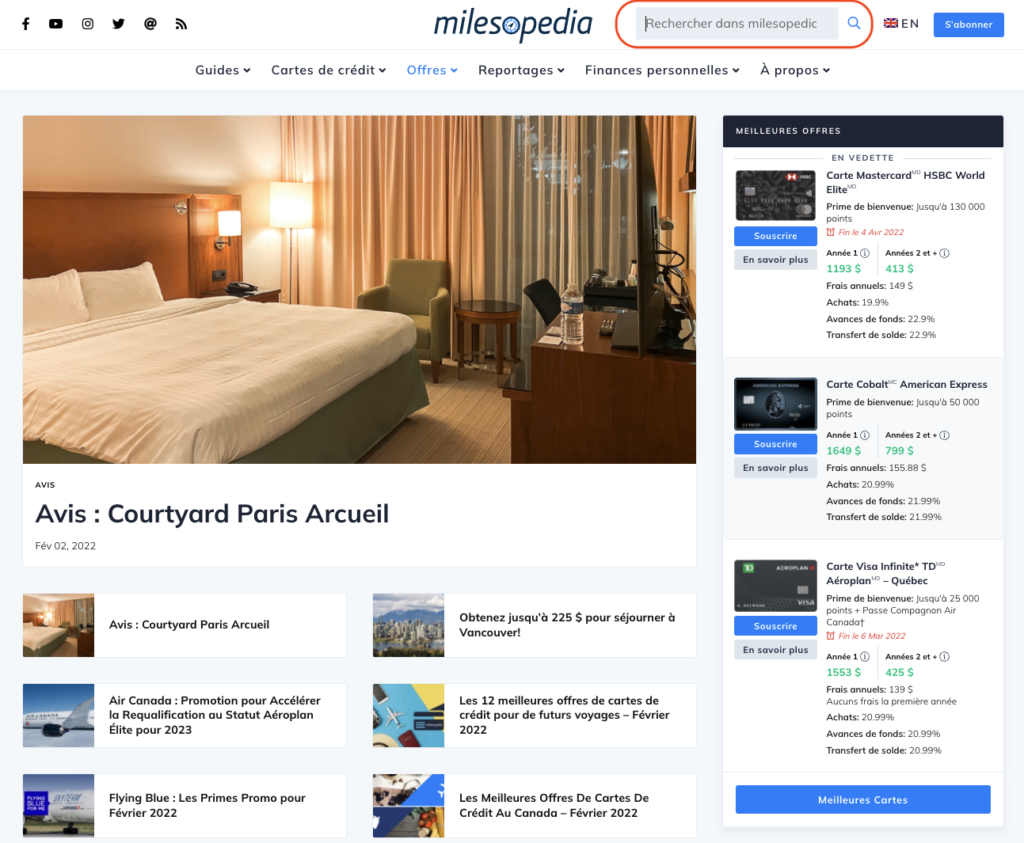

Directly on milesopedia.com

Here is an example of search results with the word “insurance”

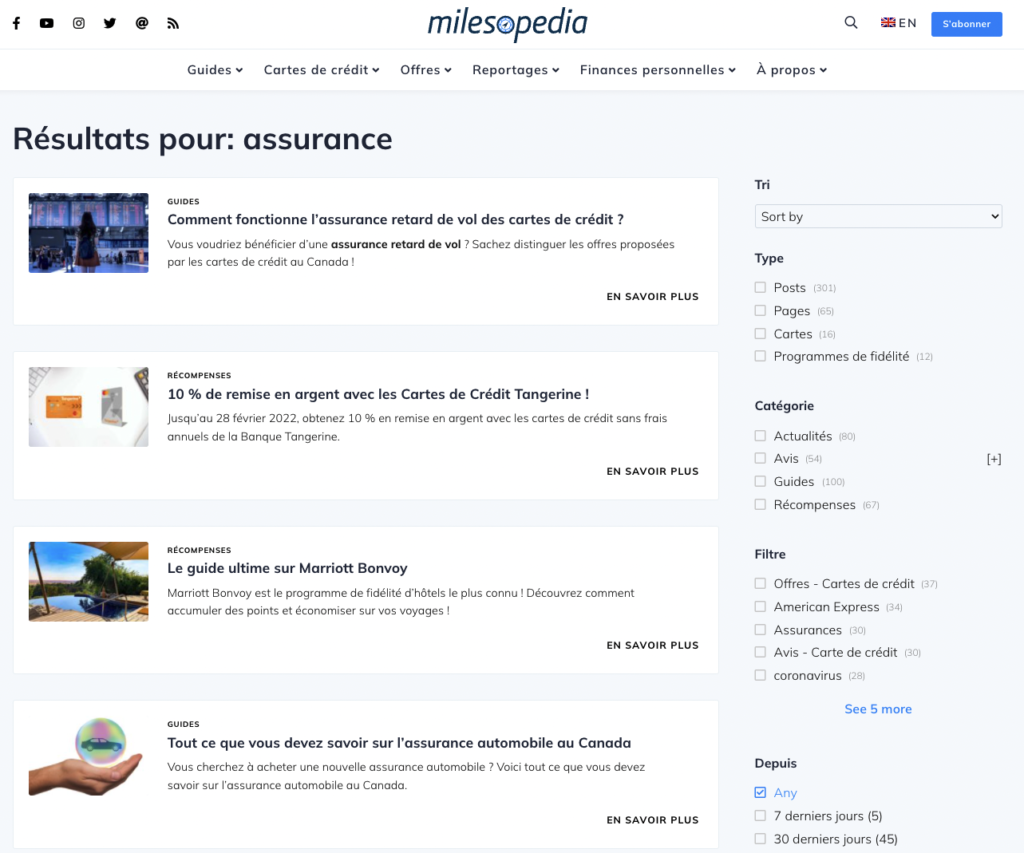

Directly in the facebook group of Milesopedia

Here is an example of search results with the word “salon”

Here is an example of search results with the publication subject “credit report”.

5) I free myself from the obsession of “no cost” by learning to calculate

There seems to be an obsession with “no charge”. We are often asked which card is the best no-fee card or which card has no currency conversion fees. The question should be:

Which card gives me the best PERFORMANCE?

If a card costing $150 a year gives me benefits worth $350 and more, plus discounts on purchases (and this is also true with cards costing up to $499 a year), why should I be limited to a no-fee card that gives me only discounts on my purchases? Of course, everyone does what they want.

What I’m trying to tell you here is to change the angle and instead develop the reflex of:

- MAXIMIZE your return

before seeking to

- MINIMIZE your expenses

We all agree that we are looking for discounts, savings… but it should never be at the expense of performance!

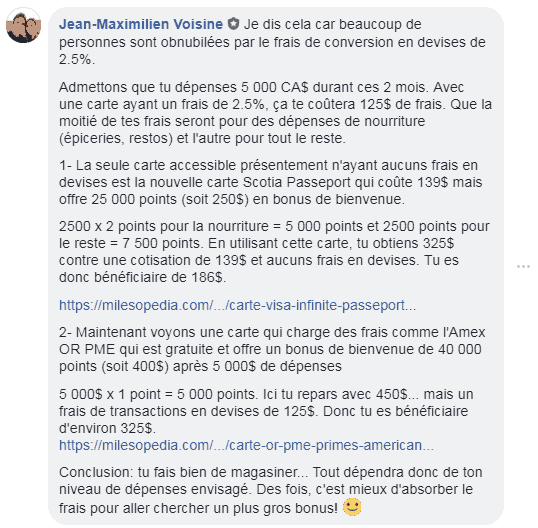

There have been many examples given in this regard.

Here is one from the

Milesopedia facebook group

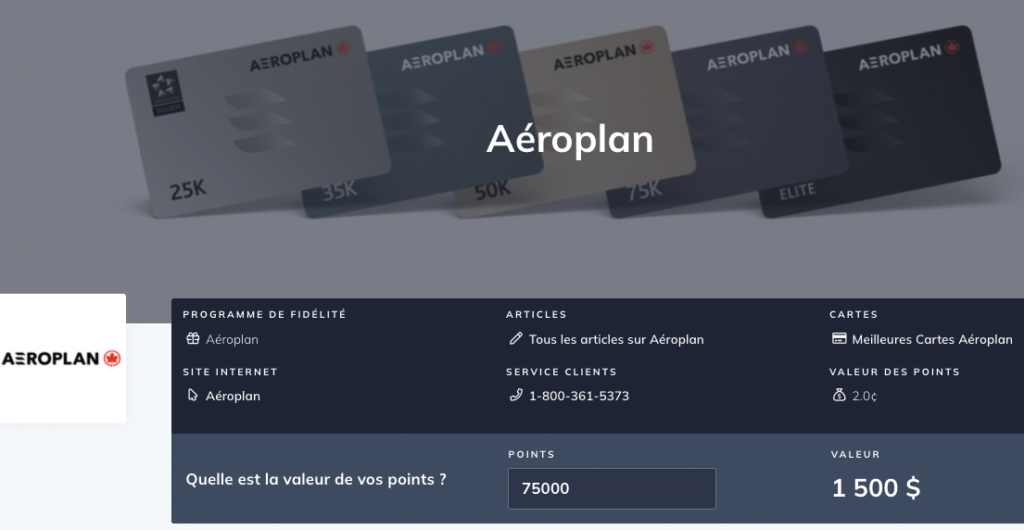

Also learn how to use the point value calculators we have developed for you. It can be found in the header of each of our guides.

6) I resist temptation – moderation tastes much better

Regularly new offers and promotions are released. From time to time, airline tickets are offered at extremely attractive prices.

We keep our calm and our focus

First of all, we all miss our shot, miss an opportunity and it’s not the end of the world. Moreover, temptation sometimes makes us too greedy. You have to know how to stay focused and accept not to compulsively take everything. I, for one, do not subscribe to all the cards. There are offers that I pass up because they don’t meet my goals.

Why amass all kinds of “currency” when I have no plan to use it in the next 12 to 18 months?

For example, if I don’t plan on going to Best Western, then I’ll pass. If I don’t have any plans for Alaska Mileage Plans, I’ll pass.

Program rules change frequently. I don’t want to expose myself to a devaluation for example.

In other words, I make choices, I stay focused and I also know how to say no.

7) I share with the community

Yes, the community is a great place to go for information and ask questions. On Milesopedia, we try to cover as many topics as possible and answer your questions, but we also learn from them regularly. And one of our sources is of course your discoveries and experiences.

So share with us all your:

- Photos and comments directly in the Milesopedia facebook group;

- Send us your testimonials by email to temoignage@mileopedia.com

- Attend our events and interact live with both bloggers and members.

➡ Happy New Year 2019 😛