Earn points with groceries

Groceries are often one of our only expenses. Also, it has inflated in many budgets, inversely proportional to gas, coffee-shops or restaurants!

A few days ago, I explained how to earn points and cashback through online grocery stores.

Today, find out why the American Express Cobalt® Card is the best grocery store credit card to earn flexible rewards for your needs!

5 points per dollar

The American Express Cobalt® Card is the milesopedia community’s favorite card for two reasons:

- Accelerated earning rate:5 points per dollar for many expenses

- Flexible point redemptions: travel, cashback, hotel points, flights, Airbnb rental

With the American Express Cobalt® Card, you can get:

- 5 Membership Rewards points per dollar at the grocery store

- 5 Membership Rewards points per dollar for home food delivery

- 5 Membership Rewards points per dollar in convenience stores

- 5 Membership Rewards points per dollar at restaurants and bars

So for every $1,000 of purchases in these categories, you earn 5,000 points or $50 in travel rewards!

In Canada, only the Scotiabank Gold American Express® Card has such an earning rate of 5 points per dollar.

2,500 points per month as a bonus

With the American Express CobaltTM Card, in the first year you can earn 1,250 bonus points for every month you spend $750 on the card.

In 12 months, that’s 15,000 additional points, or $150 worth of travel credit.

The trick is to increase the monthly $750 on categories to 5 points per dollar:

- Grocery store

- food delivery at home

- convenience stores

- restaurants and bars

That way, it is a double-dip: you can earn the equivalent of 10 Membership Rewards points per dollar during the first year!

Here’s another tip with the American Express Cobalt® Card!

Take advantage of your visit to your Métro, IGA or Super C grocery store or your Couche-Tard convenience store to buy gift cards from other stores, such as..:

- SAQ/LCBO

- Amazon

- Netflix

- Simons

- Home Hardware

- Home Depot

- And more!

You will earn 5 Membership Rewards points per dollar on these purchases as well! This is perfect for those who are doing renovations or those who stock up alcohol at the SAQ 😉

60,000 Membership Rewards points in the first year?

So, by doing this double-dip technique, you can get at least 60,000 Membership Rewards in the first year, a $600 travel rewards value!

Here’s a simulation based on spending $750 on groceries each month for the first year:

| Earning rate 5 points per dollar |

Bonus After $750 in purchases |

Cumulative total | |

| April | 3,750 points | 1,250 points | 5,000 points |

| May | 3,750 points | 1,250 points | 10,000 points |

| June | 3,750 points | 1,250 points | 15,000 points |

| July | 3,750 points | 1,250 points | 20,000 points |

| August | 3,750 points | 1,250 points | 25,000 points |

| September | 3,750 points | 1,250 points | 30,000 points |

| October | 3,750 points | 1,250 points | 35,000 points |

| November | 3,750 points | 1,250 points | 40,000 points |

| December | 3,750 points | 1,250 points | 45,000 points |

| January | 3,750 points | 1,250 points | 50,000 points |

| February | 3,750 points | 1,250 points | 50,000 points |

| March | 3,750 points | 1,250 points | 60,000 points |

So in a year, you’ll have at least 60,000 points available, a $600 travel rewards value!

If you take out the cost of the membership ($12.99 per month or $155.88 over a year), that’s a net profit of $444.

Flexible point redemptions

American Express Cobalt® Card Membership Rewards points can be used in a variety of ways.

Let’s take the example of the 60,000 Membership Rewards points you could earn the first year:

| 60,000 points value | Article on milesopedia | |

| Travel statement credit | $600 | Details |

| Any expense credit statement | $420 | Details |

| Fixed Points Travel Program | $1,200 | Details |

| Marriott Bonvoy Points Transfer | 72,000 points (a $648 value according to milesopedia) |

Details |

Travel statement credit

The easiest way to use the card is to purchase any type of travel with the American Express Cobalt® Card.

This may be:

- a flight

- a hotel stay

- a train ticket

- a car rental

- apartment rental on Airbnb

- and much more!

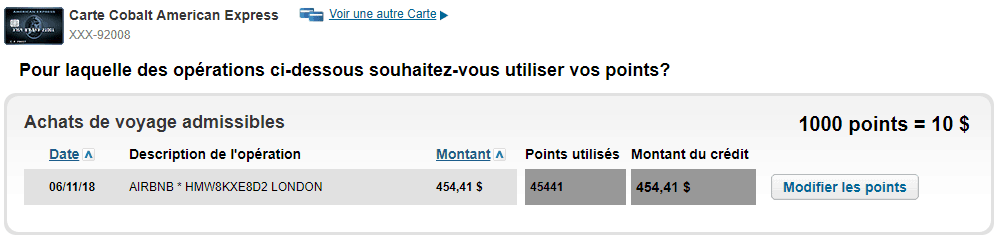

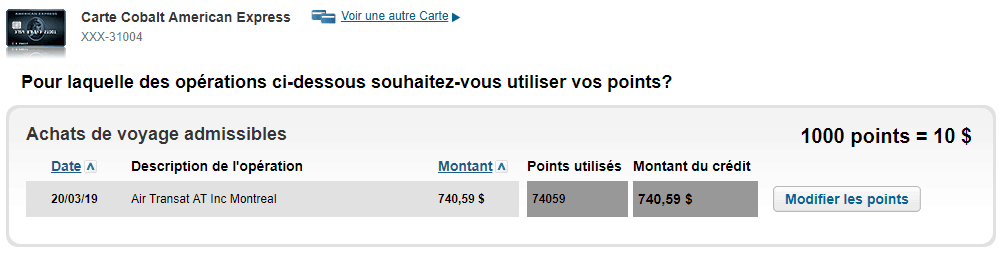

For example, here’s an apartment rental on Airbnb(see our strategy to save on Airbnb):

Or for a flight booking with Air Transat

For those who don’t like hotels, it’s a good solution to use your American Express Cobalt® Card Card Membership Rewards points to book accommodations on Airbnb!

That’s what we did on our family travel around the world.

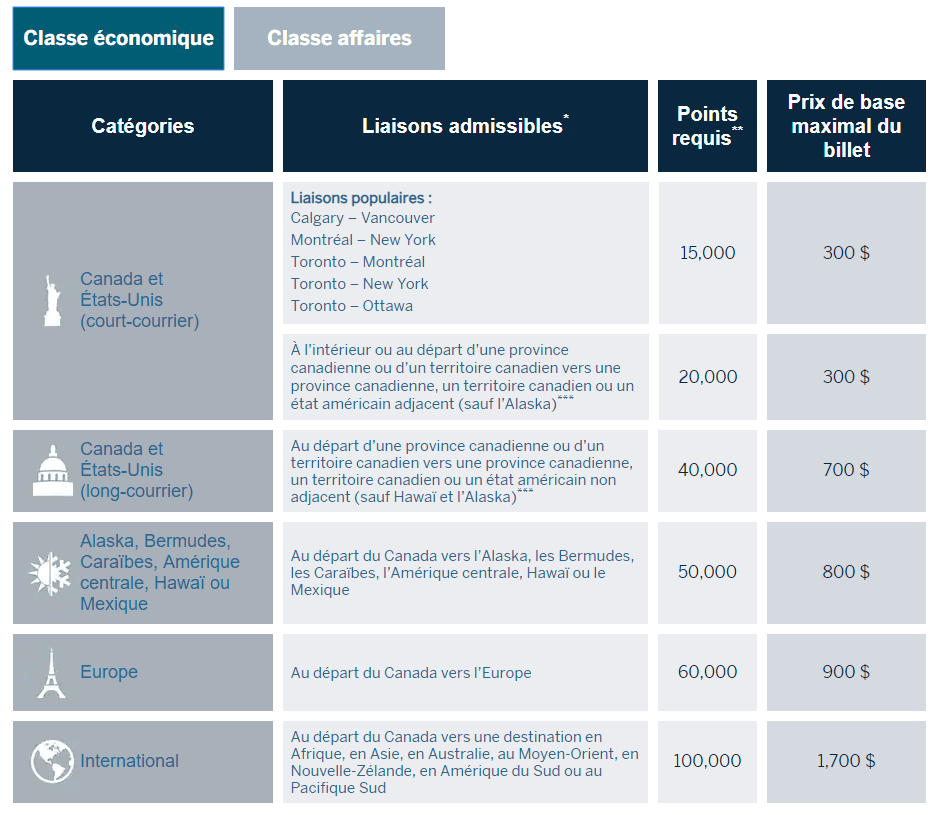

Fixed Points Travel Program

Here, it’s simply THE best use of American Express Cobalt® Card Membership Rewards points! But it will only concern very specific situations!

- Log into the American Express travel portal with your American Express Cobalt™ Card

- Book some flights through American Express’ Fixed Points Travel Program: here, 15,000 points = $300!

Here are the possible combinations:

This means that with 60,000 points, you could get up to $1,200 on flights like:

- Montreal – New York

- Montreal – Toronto

- Toronto – New York

Marriott Bonvoy points transfer

Here, this is for those who want to earn Marriott Bonvoy points for a stay in one of the group’s 7,000 hotels!

- You log on to the Membership Rewards Points transfer portal with your American Express Cobalt™ Card

- Transfer your Membership Rewards points to Marriott Bonvoy at a rate of 1:1.2(or 5:6 if you prefer)

- Book your hotel directly with your Marriott Bonvoy account

You can get 72,000 Marriott Bonvoy points with 60,000 Membership Rewards points. By doing it right (booking hotels in category 1 to 3), this can represent several free hotel nights.

For example, check out all the hotels I’ve booked in South Africa with these points!

Bottom Line

The American Express Cobalt® Card is my favorite credit card in my wallet. Even beyond the first year, I can still earn a lot of flexible points through my daily expenses.

While we are in a period where spending is limited, this is probably the best credit card to have right now.

This post was not sponsored. The views and opinions expressed in this article are purely my own.

American Express is not responsible for maintaining or controlling the accuracy of the information published on this website. For full and up-to-date product information, click on the Apply now link. Terms and conditions apply.