The American Express Cobalt® Card does not require a minimum income. That doesn’t stop it from having many advantages:

An impressive welcome offer

The welcome bonus is split monthly for the first 12 months. You’ll earn 1,250 Membership Rewards points for every $750 in purchases charged to your card during the month (whether in the 1X, 2X, 3X or 5X category).

For the monthly welcome bonus, it is best to shop in the 5X categories:

- 1,250 points for the monthly welcome bonus

- 3,750 points for purchases in a category with 5 points per $.

That’s a minimum return of 6.7% for the first 12 months on each of your first $750 in purchases in 5-point-per-dollar categories like groceries.

Here’s how you could earn 60,000 points in your first year by optimizing your purchases in the 5x the points spending categories:

| Month | Purchases | 5x Categories | Bonus | Total |

| 1 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 2 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 3 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 4 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 5 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 6 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 7 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 8 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 9 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 10 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 11 | $750 | 3,750 points | 1,250 points | 5,000 points |

| 12 | $750 | 3,750 points | 1,250 points | 5,000 points |

| Total | $9,000 | 45,000 points | 15,000 points | 60,000 points |

60,000 points for $9,000 in purchases over 12 months represents a minimum return of 6.7% if you use your points for an account credit on any purchase. That’s a value of $600!

If you remove the cost of the card fee ($12.99 per month or $155.88 over 12 months), you have a net worth of approximately $444 in the first year!

One way to do this is to do your grocery shopping. And if you don’t have $500-$1,000 worth of groceries a month, you could buy gift cards there for other businesses you regularly frequent like Amazon, SAQ, GAP, Old Navy, etc. Another way to earn 5x the points for these purchases.

A monthly fee

To our knowledge, American Express is the only institution in Canada that has introduced a monthly fee on a credit card instead of an annual fee!

Thus, the monthly fee for the American Express Cobalt® Card is $12.99.

This allows you to be much more flexible: if you want to cancel your card after 6 months, you will have paid only $77.94 instead of $150 for a similar card. But I don’t think you’ll cancel your card as you’ll earn a lot of points even beyond the first year!

Earn rewards at a fast pace

With the American Express Cobalt® Card, you can earn between 1 and 5 points per dollar:

| Category | Points per dollar |

| Grocery | 5 |

| Food delivery | 5 |

| Restaurants and bars | 5 |

| Convenience stores | 5 |

| Streaming subscriptions | 3 |

| Gas station | 2 |

| Transportation | 2 |

| Travel | 2 |

| Other | 1 |

To maximize your card, you can purchase gift cards (Amazon, SAQ, Netflix, etc.) in grocery stores or at your 7-eleven / Couche-Tard convenience store. You will get 5x the points for these purchases.

5 points per dollar on groceries

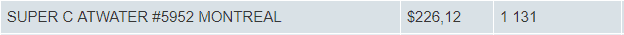

With the American Express Cobalt® Card, you earn 5 points per dollar in groceries.

For example, here is a $226.12 grocery invoice at Super C, where I earned 1,131 Membership Rewards Points:

And don’t forget: grocery stores are a great place to find gift cards!

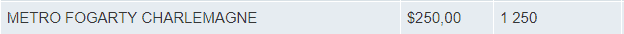

Here, for example, is a $250 purchase of SAQ gift cards I made on my American Express Cobalt® Card at a Metro grocery store right next to an SAQ Dépôt branch:

So I earned, thanks to this SAQ gift card purchase in grocery stores, 5 points per dollar on my SAQ purchase!

5 points per dollar on convenience stores purchases

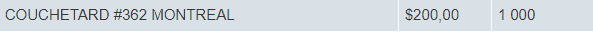

With the American Express Cobalt® Card, you earn 5 points per dollar at convenience stores (Couche-Tard in Quebec, Macs-Circle K / 7-eleven elsewhere in Canada).

This is exciting because convenience stores sell a lot of gift cards. So you can earn 5 points per dollar on many other businesses purchases!

For example, with a $200 Amazon.ca gift card purchase, I earned 1,000 Membership Rewards Points:

5 points per dollar on restaurants and bars purchases

Also, with the American Express Cobalt® Card, you get 5 points per dollar at restaurants and bars.

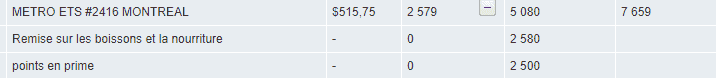

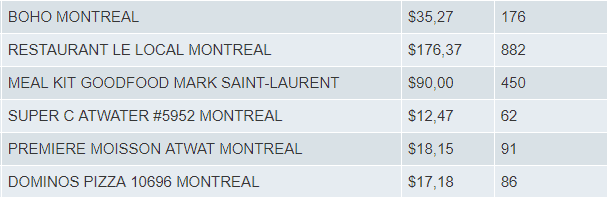

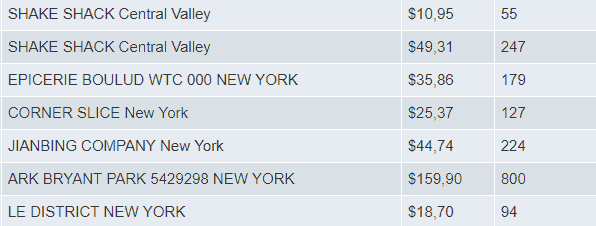

Here, for example, is a series of restaurants, grocery stores and bars on our American Express Cobalt® Card:

With all these purchases, I earned 5 points per dollar!

5 points per dollar on food delivery

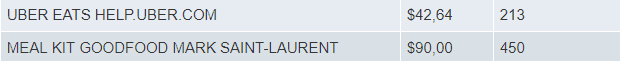

We’re big fans of home food delivery with platforms like Uber Eats or GoodFood! Here too, with the American Express Cobalt® Card, you get 5 points per dollar for home food delivery!

Here are two purchases from:

- Uber Eats for $42.64 (213 Membership Rewards Points)

- GoodFood for $90.00 (450 Membership Rewards Points)

There used to be an annual limit of $30,000 on purchases eligible for the 5X gas pedal, which has now been changed to a limit of $2,500 per month.

Between 1 and 2 points per dollar everywhere else

With the American Express Cobalt® Card, you earn 2 points per dollar on all your purchases:

- gas purchases

- travel purchases (flights, hotels, Airbnb,etc.)

- local transportation purchases (taxis, commuter trains, etc.)

Outside of all the above categories, with the American Express Cobalt® Card, you earn 1 point per dollar.

A card for your groceries and restaurants expenses abroad

Even if the terms and conditions indicate that the earning categories only apply to purchases made “in Canada,” the reality is quite different! The milesopedia community regularly demonstrates this through multiple examples, earning between 2 to 5 points per dollar!

Tested and personally approved in the following countries:

- United States

- Puerto Rico

- France

- Netherlands

- Italy

- Australia

- New Zealand

- South Africa

- Singapore

- Malaysia

- Vietnam

- Hong Kong

- South Korea

- Japan

Tested and approved by the milesopedia community in the following countries:

- Brazil

- Mexico

- Argentina

- Thailand

- Australia

- Indonesia

- And more!

Even there is a 2.5% forex fee with the card, you’ll get ahead with 5X purchases!

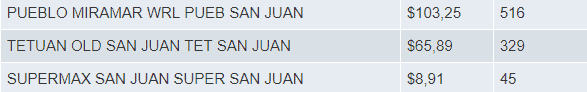

5 points per dollar on groceries abroad

Do you regularly travel to the United States or anywhere else in the world for extended stays? You can easily use your American Express Cobalt® Card in any U.S. grocery store and earn 5 points per dollar!

Here are, for example, our purchases in Puerto Rico grocery stores (Supermax and Pueblo):

5 points per dollar on restaurants and bars expenses abroad

When we travel, we spend more in restaurants and bars. With the American Express Cobalt® Card, you also get 5 points per dollar!

Here is a series of purchases in US restaurants during a stay in New York:

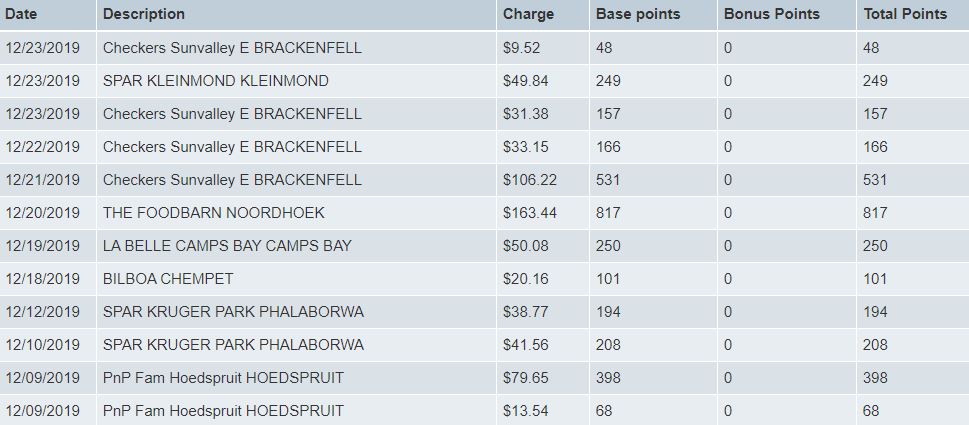

Or in South Africa:

Flexible Membership Rewards Points!

It’s not all about earning a lot of Membership Rewards Points, but you have to be able to use them!

Here are the best ways to use your Membership Rewards points earned with your American Express Cobalt® Card.

Redeem Membership Rewards Points on travel purchases

It’s the easiest way to use American Express Cobalt® Card Membership Rewards points:

- You charge a trip to your card: flights, hotels, Airbnb, car rental, etc.

- You redeem your points on this purchase: 1,000 points = $10

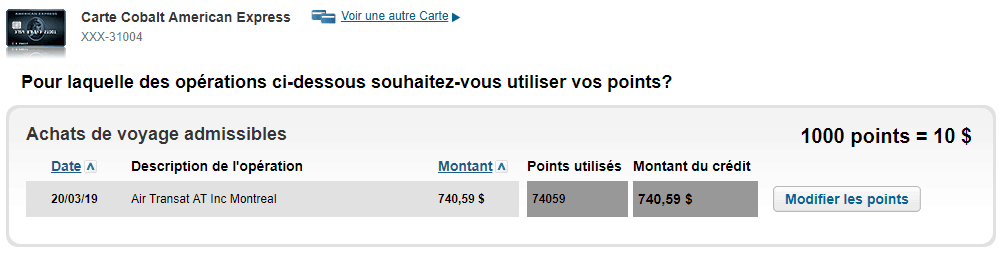

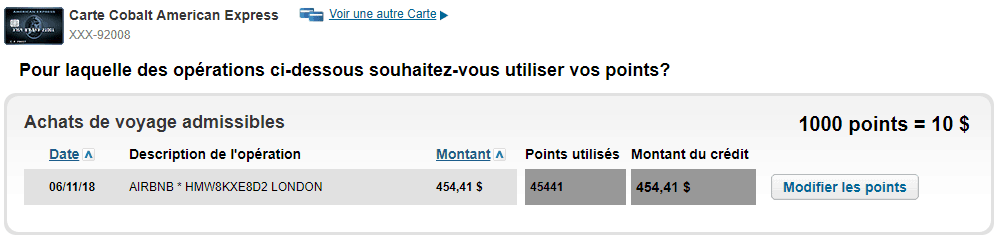

Here are two examples of travel companies without loyalty program, Air Transat and Airbnb:

Redeem Membership Rewards Points on everyday purchases

The principle is identical as above.

- You buy something with your American Express Cobalt® Card.

- You redeem your points on this purchase: 1,000 points = $10

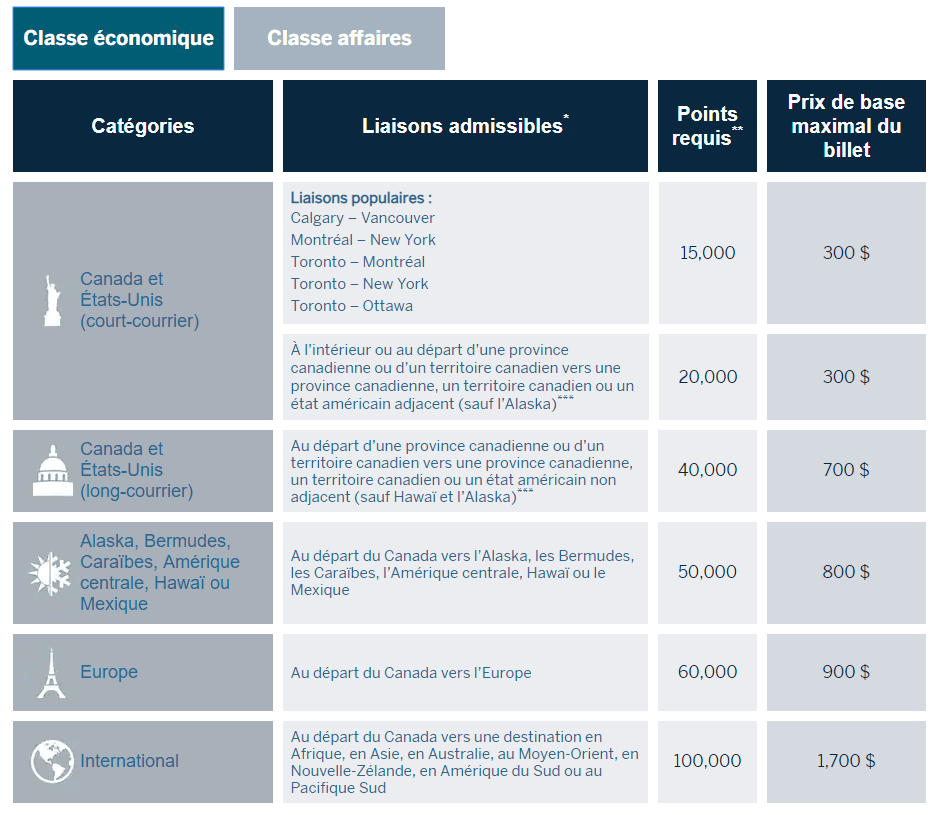

Redeem Membership Rewards Points through American Express Fixed Points Travel

Here, it’s simply THE best use of American Express Cobalt® Card Membership Rewards points:

- You browse American Express travel portal

- You book some flights at fixed-points pricing: 15,000 points = $300!

But this only applies to specific flights:

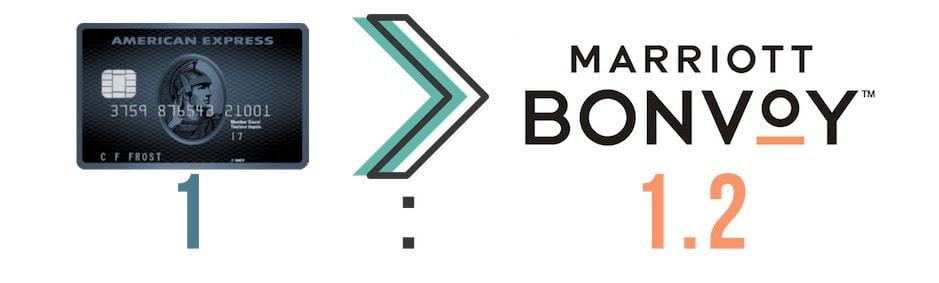

Transfer Membership Rewards Points to Marriott Bonvoy

Here, this is for those who want to earn Marriott Bonvoy points to get a free stay at one of the group’s 7,000 hotels:

- You log on to the Membership Rewards transfer portal

- You transfer your Membership Rewards Points to Marriott Bonvoy with a 1:1.2 ratio (or 5:6 if you prefer)

- Book your hotel directly with your Marriott Bonvoy account

This is a great way to earn Marriott Bonvoy points, especially when you have exhausted other solutions like with Marriott Bonvoy credit cards bonuses!

In fact, that’s why we rank the American Express Cobalt® Card and the American Express Business Edge™ Card alongside Marriott Bonvoy cards for earning Marriott Bonvoy points!

Transfer of Membership Rewards Points to Aeroplan, British Airways Executive Club, etc.

This is for those who want to earn Aeroplan points or Avios miles when booking flights with partner airlines:

- You log on to the Membership Rewards transfer portal

- You transfer your Membership Rewards points to Aeroplan points or Avios miles at a 1:1 rate

- You book your flight directly through your Aeroplan or British Airways Executive Club account

Transfer Marriott Bonvoy points to Airline Programs

Here, you use the Marriott Bonvoy program as leverage to earn airline program miles via your American Express Cobalt® Card!

So this is for those who want to earn Flying Blue, Alaska Airlines, Avios miles with purchases made on their American Express Cobalt® Card:

- You log on to the Membership Rewards transfer portal

- You transfer your Membership Rewards Points to Marriott Bonvoy with a 1:1.2 ratio (or 5:6 if you prefer)

- You transfer your Marriott Bonvoy points to airlines program with a 3:1 ratio (or 2.4:1 when you transfer in 60,000 Marriott Bonvoy points increments)

- You book your airline reward directly within the airline program

In short, with every purchase on your American Express Cobalt® Card in a 5 points-per-dollar category, you earn 6 Marriott points/$ or 2 Flying Blue – Alaska miles per dollar!

And it can be much more than that:

- When transferring your Marriott Bonvoy points in 60,000 increments: you get 5,000 bonus miles (so 60,000 points = 25,000 miles)

- Initiating this transfer during a conversion bonus period, such as occurs 3 or 4 times a year with airline programs (25 to 35% bonus)

That’s why we think the American Express Cobalt® Card is one of the best credit cards in Canada!

Many Promotional Offers during the year

Throughout the year, American Express offers promotional offers to American Express Cobalt® Cardmembers.

Here are three recent examples:

| Promotion | Value |

| 2,000 Membership Rewards Points after $75 in gas station purchases |

$20 |

| Receive $5 after $5 purchases Shop Small merchants |

$25 |

| Receive 10 points per dollar on Amazon.ca |

$50 |

| TOTAL | $95 |

Up to $95 easily accumulated, putting the $12.99 monthly fee into perspective!

Cobalt card insurance

With the American Express Cobalt® Card, you get a lot of great insurance, especially for a card that only costs $12.99 a month!

Mobile Device Insurance

You are covered for $1,000 for your mobile devices.

Car Rental Theft and Damage Insurance

Save when you travel with the flight and damage Insurance for rental cars included with your Card This insurance provides compensation for theft, loss and damage up to the market value of the rental car with a maximum MSRP of $85,000 depending on the year of the model.

To take advantage of this benefit, you simply need to refuse loss or damage protection or any other similar option offered by the rental company and bring the entire rental to your Card. There’s no additional charge for this coverage, and you save yourself the daily insurance fee (usually $16 to $23 per day) charged by the car rental company.

Baggage delay insurance

Having booked your flight with your Card you can receive up to $500 (maximum in combination with Flight Delay Insurance) for any necessary and reasonable routine purchases of clothing and minor items deemed essential that you make in a four-day periodfor essential clothing and sundry items when your baggage on your outbound trip is delayed by six hours after arrival at destination of your departure flight.

Lost or Stolen Baggage Insurance

If you carry the full amount of your airfare to your Card you are insured in case of loss or damage of your personal belongings, carry-on baggage or checked baggage while travelling up to $500 per trip for all insured people.

Flight Delay Insurance

Charge your airline tickets to your Card and get up to $500 (maximum in combination with Misdirected Baggage Insurance) for all necessary and reasonable expenses incurred within 48 hours at a hotel, motel or restaurant, or for small items, if your flight is delayed or you are denied boarding for four hours or more without providing alternative transportation.

$250,000 Travel Accident Insurance

Travel accident insurance gives you automatic coverage of up to 250,000 for accidental death and dismemberment for you, your spouse and your dependent children under age 23 when you travel on a common carrier (plane, train, boat or bus) and you charge the full price of all tickets to your Card. Supplementary card holders, their spouses and dependent children under the age of 23 are also covered.

Hotel or motel burglary insurance

Simply pay for your hotel or motel room with your card and you will receive coverage of up to $500 in case of loss of most personal belongings in the event of a burglary at your hotel or motel room.

Purchase Protection® Plan

Eligible items purchased on your card may be insured for a period of 90 days from the date of purchase against accidental property damage and theft up to a maximum of $1,000 per claim (all items purchased combined).

Buyer’s Assurance® Protection Plan

Your coverage can automatically extend the manufacturer’s initial warranty up to an additional year when you carry all eligible items to your Card.

If you need to consult the insurance booklet, it can be found at this link.

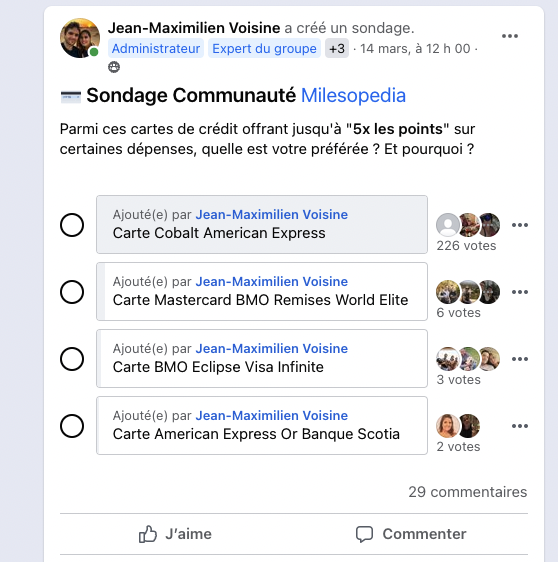

The favourite of our Milesopedia community!

On March 14, 2022, we took a poll in our Facebook group.

95% of respondents clearly preferred the American Express Cobalt card and found it worthwhile in the long run. Here’s further proof that it really is the best, both on paper and in “real life”.

Bottom Line

The American Express Cobalt® Card is one of our favorite cards for all the aspects mentioned above.

Every time someone asks “which credit card to sign up for” in the Facebook group, many enthusiastic members arrive to extol the virtues of American Express Cobalt® Card!

You would like to apply for this Card while supporting milesopedia? Click here!

This article was not sponsored. The views and opinions expressed in this article are purely my own.

American Express is not responsible for maintaining or controlling the accuracy of the information published on this website. For full and up-to-date product information, click on the Subscription link. Terms and conditions apply.

In France, American Express cards are different.