PaySimply service to pay bills

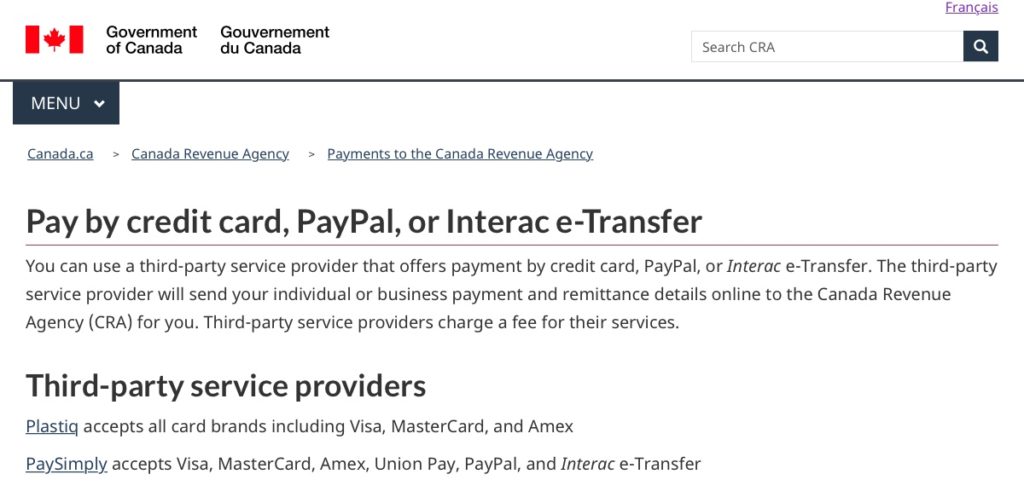

With PaySimply – a Canadian company- you can pay many bills with a credit card.

Named as one of Canada’s best managed companies, it is a partner with theCanada Revenue Agency, Revenue Quebec and Canada Post.

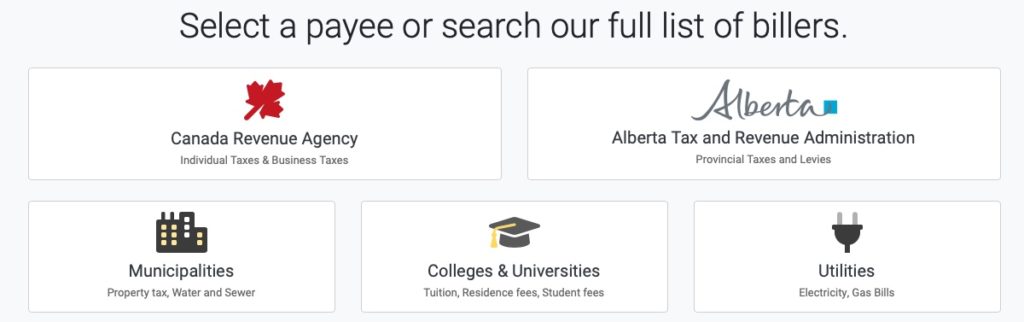

Payees on PaySimply

With PaySimply, you can pay many types of bills with a credit card:

- Canada Revenue Agency(source deductions, GST/HST, T2 corporation, excise tax, excise duty, air travellers security charge, tax on insurance premiums, information returns, fuel charge, Nova Scotia Workers’ Compensation Board, Part XIII – non-resident withholding tax, T1 individual, and benefits and credits repayments, Canada emergency benefit repayment)

- Municipalities: Property taxes, school taxes, water and sewer taxes, etc.

- Colleges and universities: tuition, residence fees, student fees, etc.

- Utilities: electricity and gas bills, etc.

- Alberta Tax and Revenue Administration

- Revenu Québec: for businesses and consumers

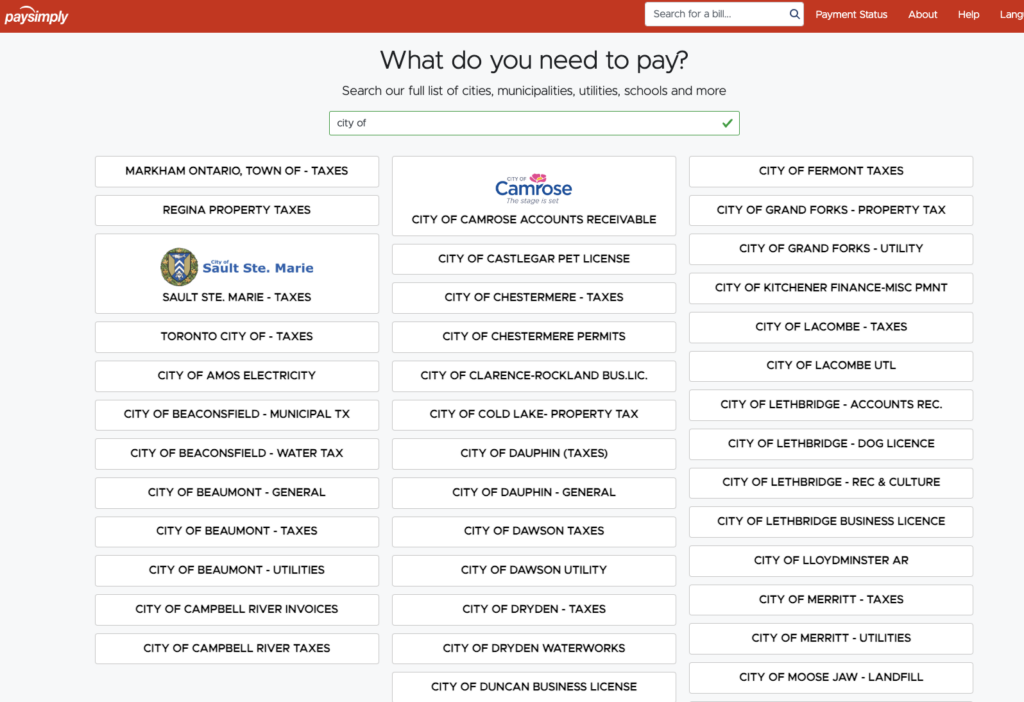

You can search the list of billers. Here’s an example of a search using the keyword“City of “:

This makes it easy to see:

- The City for the payment of property and school taxes

- Many colleges and universities

- Some companies

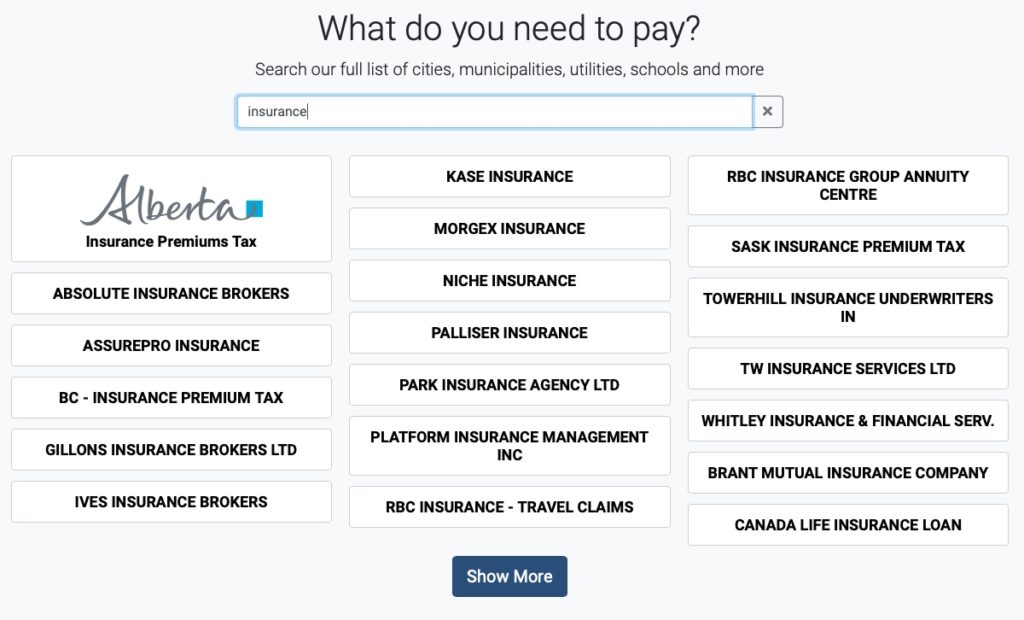

Here is another example with the keyword“insurance“:

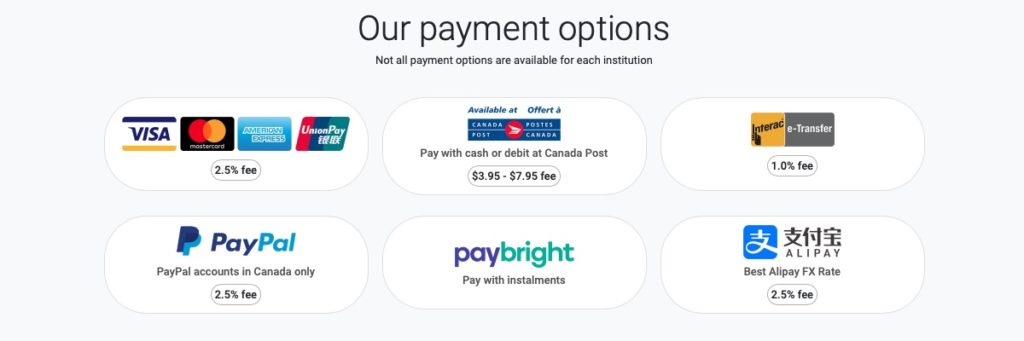

PaySimply fees and payment methods

Of course, like any credit card bill payment service, there are fees associated when using PaySimply:

| Method of payment | Fees |

| Visa, Mastercard, American Express, UnionPay Credit Cards | 2,5 % |

| PayPal | 2,5 % |

| Canada Post (cash or debit) | $3,95 – $7,95 |

| e-Transfer | 1 % |

| Alipay | 2,5 % |

| paybright | Instalments |

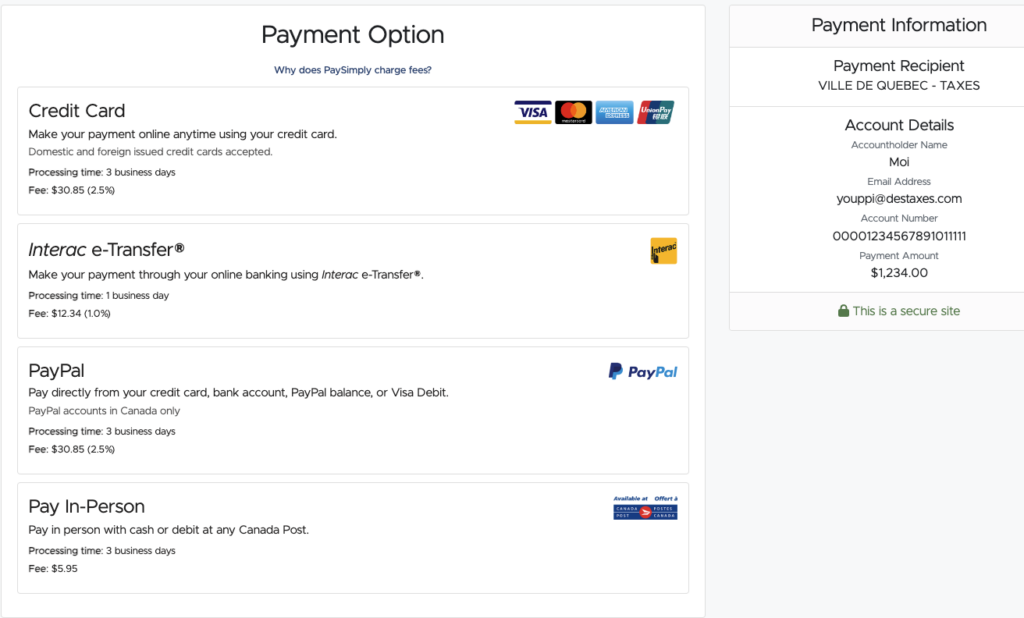

Here’s an example from Quebec City for municipal taxes paid with a credit card:

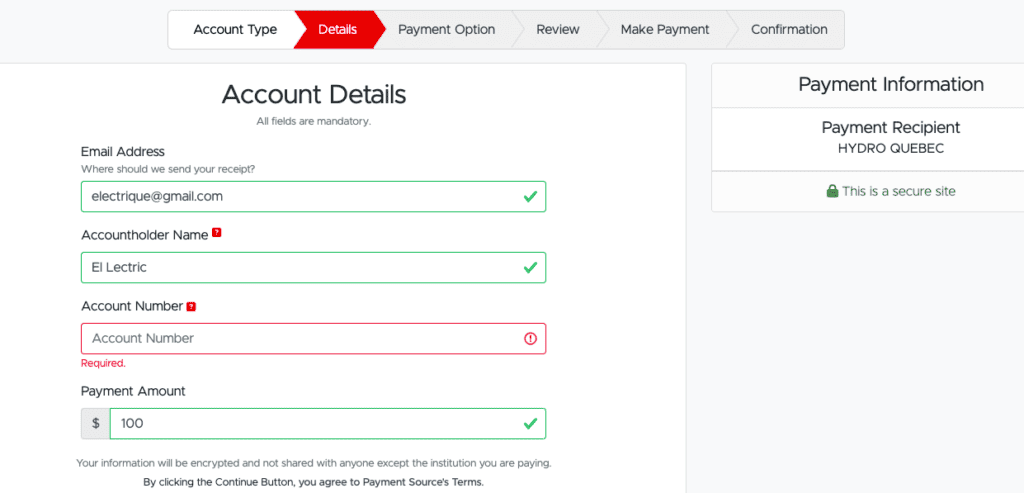

Even Hydro Québec is listed:

Or the Société de l’Assurance Automobile du Québec (SAAQ):

Credit cards to use on PaySimply

Paying bills via PaySimply is only interesting for earning reward points. Indeed, we do not recommend using a credit card if your goal is to spread your payments: the interest charges paid in addition to the PaySimply fees will be high. You might as well pay directly from your checking account.

Also, no credit card offers enough return to offset the 2.5% fee. It is therefore advisable to use PaySimply for credit cards that offer a large welcome bonus but require spending a lot of money in 3 months.

The credit cards that offer the largest welcome bonuses in Canada are from American Express – especially with the small business cards (also available to consumers ).

Here are some current offers:

The best credit cards to use right now on PaySimply

To make it all worthwhile, here are the best welcome offers available.

Synchronize your credit card application with future payments:

- Professional orders ;

- Municipal taxes ;

- Or taxes to pay.

Then use PaySimply to unlock a great bonus. In return, you’ll have collected a ton of points for your future all-inclusive trip, your next getaway to Walt Disney World or to pay for all your accommodation on a road trip.

Here are the best current offers:

Bottom Line

The PaySimply service is an alternative solution to Plastiq.com.

However, some providers still don’t accept credit cards through PaySimply (sometimes, you can bypass this when using PayPal). You will have to turn to other services like Plastiq.