Credit cards Trip Cancellation and Interruption Insurance

This article is part of our COVID-19 file.

Feel free to check out the other articles below for more information, or contact the community:

- COVID-19: New American Express measures

- COVID-19 Testing for Canadian Travellers

- COVID-19 – Hotel quarantine effective February 22, 2021

- Update of the Border Reopening Plan for Canada

- COVID-19: New Requirements for Travellers Entering Canada

- Hotel quarantine in Canada: government-authorized hotels and instructions

- COVID-19: US and EU support reimbursement

- COVID-19: Air Program Status Guide

- Summary of my trip to Europe during COVID-19

- End of Mandatory Quarantine for Vaccinated Canadians

- COVID-19 – Reminder of Health Measures Related to Return From International Travel

- COVID-19: Measures taken by the travel industry

- COVID-19: credit card trip cancellation and interruption insurance

- COVID-19: Travellers and Temporary Residents Abroad, Return Home!

- COVID-19: The milesopedia community and Coronavirus

- COVID-19: Ask for a full refund, not a credit!

- COVID-19: Refund, travel credit or refundable credit?

- COVID-19: Air Canada and Aeroplan

- COVID-19: AIR MILES

- COVID-19: Marriott Bonvoy

- COVID-19: Canadian Transportation Agency decides on credits

- The chargeback procedure for credit card transactions

Relevant credit cards

Most credit cards offer trip cancellation and/or interruption insurance:

- Mastercard World Elite

- Visa Infinite / Infinite Privilege

- some American Express cards

I recommend that you refer to the insurance booklet provided upon receipt of your credit card . If you no longer have it, most bank websites offer a PDF version.

Here are links to the most common credit cards(information provided for information purposes only):

Terms and conditions

Several parameters will come into play so that your credit card ‘s trip cancellation and interruption insurance can be applied.

The terms and conditions of your credit card

Each credit card has different terms and conditions for your Trip Cancellation/Trip Interruption Insurance to take effect.

Just because you have a “World Elite” does not mean that the rule is equivalent for all “World Elite” cards offered by Desjardins, National Bank or BMO.

The conditions therefore vary from one issuer to another depending on whether you have paid:

- all or part of the amount of your trip with your card (the most generous option)

- 75% of the amount of your trip with your card

- the full amount of your trip with your card (the most restrictive option)

Similarly, for those who have used travel points, you are generally covered when you have used PROGRAM travel points offered by your credit card:

- For example, if you used BMO Rewards points and paid for the rest of the trip with the BMO World Elite Mastercard.

- Or that you used your Aeroplan credit card , such as the American Express® AeroplanPlus®* Platinum Card to pay for the taxes on your Aeroplan reward Ticket for which you have used Aeroplan Miles.

On the other hand, if you have used a credit card from one program and points from another program, it will often be difficult to trigger insurance:

- For example, if you use your AIR MILES bonus miles and pay taxes with an Aeroplan credit card

However, there too, you may benefit from flexibility from your credit card issuer, so do not hesitate to make a claim.

Government of Canada Announcement

Until very recently, only destinations that the Government of Canada had formally advised travellers not to visit (China, Italy, etc.) allowed credit cards trip cancellation or interruption insurance to be used.

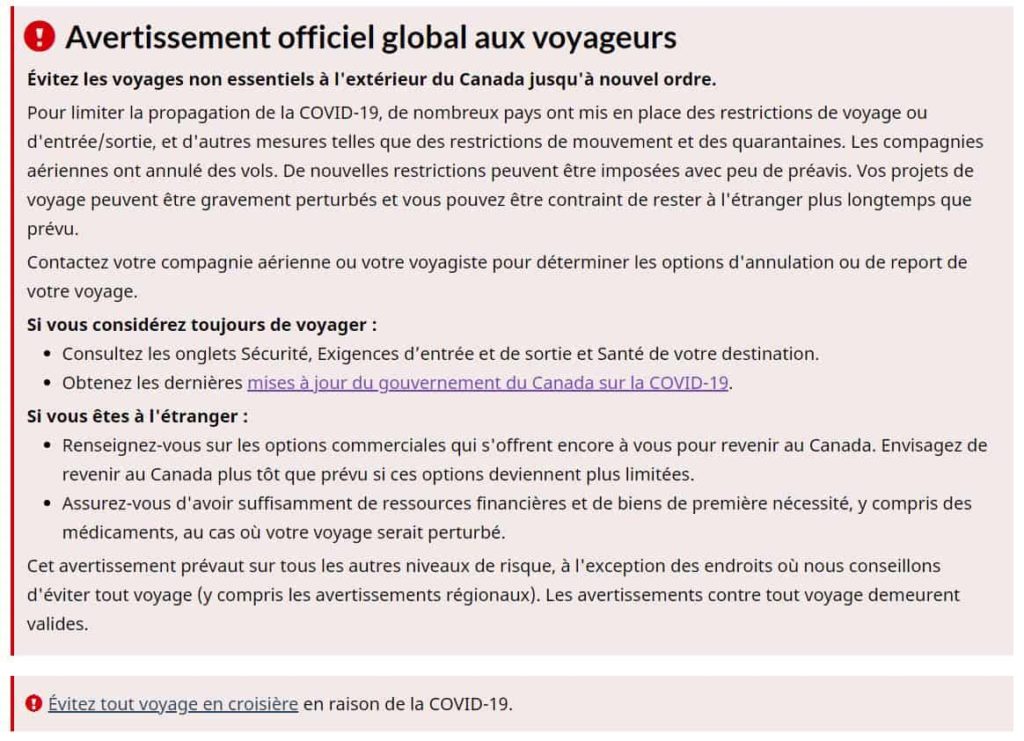

However, since March 13, 2020, the Government of Canada has formally discouraged all foreign travel.

Avoid non-essential travel outside Canada until further notice. To limit the spread of COVID-19, many countries have implemented travel or entry/exit restrictions and other measures such as movement restrictions and quarantines. The airlines have cancelled flights. New restrictions may be imposed with little notice. Your travel plans can be severely disrupted and you may be forced to stay abroad longer than you had planned.

Gouvernement du Canada - Conseils aux voyageurs

Insurance companies adjust their policies to allow you to be compensated for any trip booked BEFORE that date.

However, if you decide to book a new trip, trip cancellation and interruption insurance may not be activated for this reason! Indeed, now you are aware of the risks!

It will be interesting to see how policies will adjust once this crisis is behind us!

Are you currently travelling?

If you are currently travelling, check to see if your credit card has “trip interruption” insurance. This can be triggered under certain conditions:

- during your trip

- and until the scheduled return date

If you are currently travelling, check to see if your credit card has “trip interruption” insurance. This can be triggered under certain conditions:

- during your trip

- and until the scheduled return date

The COVID-19 situation, particularly since the Government of Canada’s call to avoid non-essential travel outside Canada and to ask travellers to return home, is part of the conditions of this insurance.

With trip interruption insurance, you could get:

- A refund of the non-refundable AND unused portion of your travel expenses (up to a certain limit),

- Coverage of the costs incurred by your early return (plane ticket, hotels, transportation costs such as taxi, food…).

Compensation will vary depending on the credit cards:

- $500 to $2,500 per insured person

- with a maximum amount for the whole family

Contact your travel provider first

It is ESSENTIAL to first contact the travel provider BEFORE contacting your credit card insurance company.

In fact, your credit card’s Trip Cancellation and Interruption Insurance will cover – up to the limit of your contract – all NON-REFUNDABLE travel expenses.

Since airlines, hotel groups and many other service providers have considerably relaxed their cancellation conditions – some of them allowing full reimbursement of the costs incurred – the insurance will first refer you to these providers BEFORE processing your file.

Useful credit card insurance numbers

Only once you are aware of the actions taken by your travel provider will you be able to contact your credit card insurance.

Here is a list of the main telephone numbers. You can also get this information by calling the number on the back of your credit card.

| Bank | Number |

| American Express | 1 800 243-0198 |

| BMO | 1 800 263-2263 |

| NBC | 1 888 235-2645 514 286-8345 |

| CIBC | 1 866 363-3338 905 403-3338 |

| Desjardins | 1 800-465-7822 or online |

| RBC | 1 800 533-2278 905 816-2581 |

| Scotia | 1 877-391-7507 416 572-3636 |

| TD | 1 866-374-1129 416-977-4425 |

A reminder of common sense

If your trip is scheduled to take place in more than a month, be patient before calling your airline or insurance company. We are in a situation never seen before: the call centers are overwhelmed!

So make room for other people whose trips are planned in the very near future (less than 15 days) and who need more help!

Don’t worry, cancellation policies won’t change overnight!