What are interchange fees?

Here is Mastercard’s definition of interchange fees:

Interchange is a small fee paid by a merchant’s bank (acquirer) to a cardholder’s bank (issuer) to compensate the issuer for the value and benefits that merchants receive when they accept electronic payments. It enables banks that issue electronic payments to deliver tremendous value to merchants, governments and consumers. Interchange helps to maximize the quality of services provided to all stakeholders.

Mastercard Canada

Fees that allow for credit card rewards

These are fees charged to merchants by credit card networks (American Express, Mastercard, Visa) to accept credit card payments.

These fees charged to merchants are between 0.5 and 5% depending on the type of business, the volume of business generated, and the means of payment used by the customer.

Of course, merchants include these fees in the price of the goods or services they offer, so you won’t see these fees on your receipt.

Thus, you will pay the same price for a product or service:

- in cash,

- by cheque,

- with a debit card,

- with a credit card

Hence the usefulness of always paying with a credit card in order to earn rewards (cash back, points, miles), which is only a fair return of the fees charged and integrated into the price of the product or service you buy!

Those who pay by cash, cheque or debit do not get any returns (and therefore will actually have paid the interchange fee).

A negotiation between merchants and credit card networks

Generally, interchange fees will be higher depending on the type of card the customer uses:

- a bank will therefore have an interest in its customer having a premium card in order to obtain a higher interchange fee on each transaction made

- while a merchant will be more interested in seeing his customer pay other than with a credit card, or at least with a “basic” credit card.

As a result, merchant associations regularly put pressure on banks and networks – often through the legislature – to negotiate lower interchange fees.

In some countries, legislators have intervened to completely regulate these fees, lowering them to the strict minimum (often below 0.5%).

The other side of the coin is that credit card issuers no longer have any leeway to offer rewards to their customers. This leads to the almost complete disappearance of points and miles systems earned with credit cards (as is the case in much of Europe or Australia for example).

The minimum income requirement for certain credit cards

Why do some credit cards require an income level of $60,000, $80,000 or even $200,000?

This is a counterpart granted by networks such as Visa or Mastercard to merchants: these credit cards charge higher interchange fees because their customers, because of their income, are statistically led to spend more in shops.

The problem: Issuers (banks) have a responsibility to ensure that their customers meet these revenue requirements. Some do, others a little less.

And that’s what merchants are complaining about: seeing issuers pushing for the adoption of higher-end products, charging more interchange fees!

For example, some Tangerine customers were recently invited to make a product change from the Tangerine Money-Back Credit Card to a World Mastercard, the Tangerine World Mastercard… charging more interchange fees for merchants!

And this year, Mastercard will release a new “Muse” product line, above World Elite, to compete with the Visa Infinite PRIVILEGE line. You guessed it: Muse products will charge more interchange fees!

And what about American Express?

American Express does not publish the fees charged to merchants. These are agreements made live and vary for each business.

All that is known is that American Express, in its goal to be more and more accepted in the country, has recently lowered its fees to merchants and has embarked on various initiatives towards small merchants (such as Shop Small).

Likewise, unlike Visa or Mastercard, American Express has no revenue requirements for virtually all of its credit or charge cards. This makes it possible for many to get American Express Cards of interest to travelers such as the American Express Cobalt™ Card, the Marriott Bonvoy™ American Express® Card or even the the American Express Platinum Card®.

What about corporate credit cards?

This interchange fee regulation applies only to personal credit cards.

Thus, corporate credit cards are not impacted.

This means that financial institutions will surely encourage individuals in business (self-employed workers, professionals, small businesses) to use a CORPORATE credit card rather than their personal credit card.

We remind you in this article how to apply for a small business card from American Express for example. It is therefore not surprising to see American Express trying to capture this market, such as through the recent introduction of the American Express Business Edge™ Card, the most accessible corporate card.

According to our sources, Mastercard is about to launch a World Elite Business card.

So it wouldn’t be surprising to see cards like the BMO® AIR MILES® Business Mastercard®* or BMO® Rewards Business Mastercard®* become more prominent and even see new products being introduced!

2020, a year of change

By 2015, the average interchange fee had decreased to 1.5%. This had the effect of “killing” the World Elite level credit cards offering 2% return to their customers on all transactions such as the famous Capital One World Elite Travel.

In 2018, merchant associations have again been successful in Canada, as in 2020, interchange fees in Canada will decline to approximately 1.4%.

These fees are valid for the 2020-2025 period. So we shouldn’t see further changes for several years. Of course, the merchants’ associations say that the fees are not as low as expected.

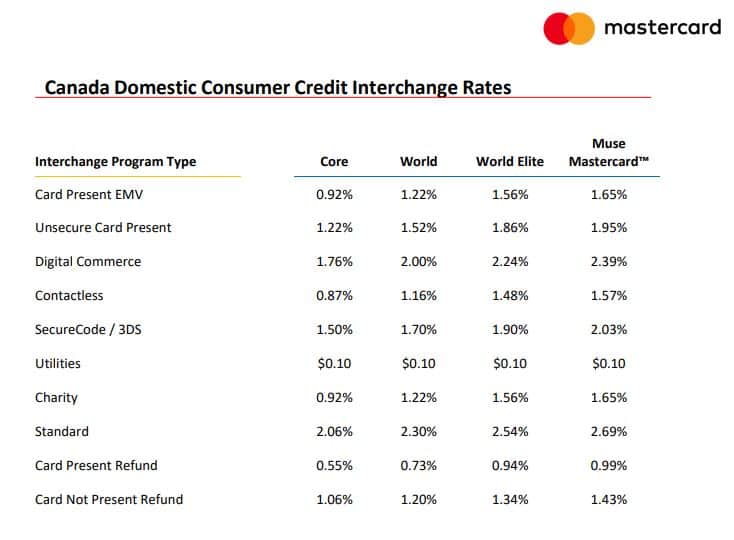

Mastercard's interchange fees

Mastercard has announced the interchange fees effective May 1, 2020 on this page.

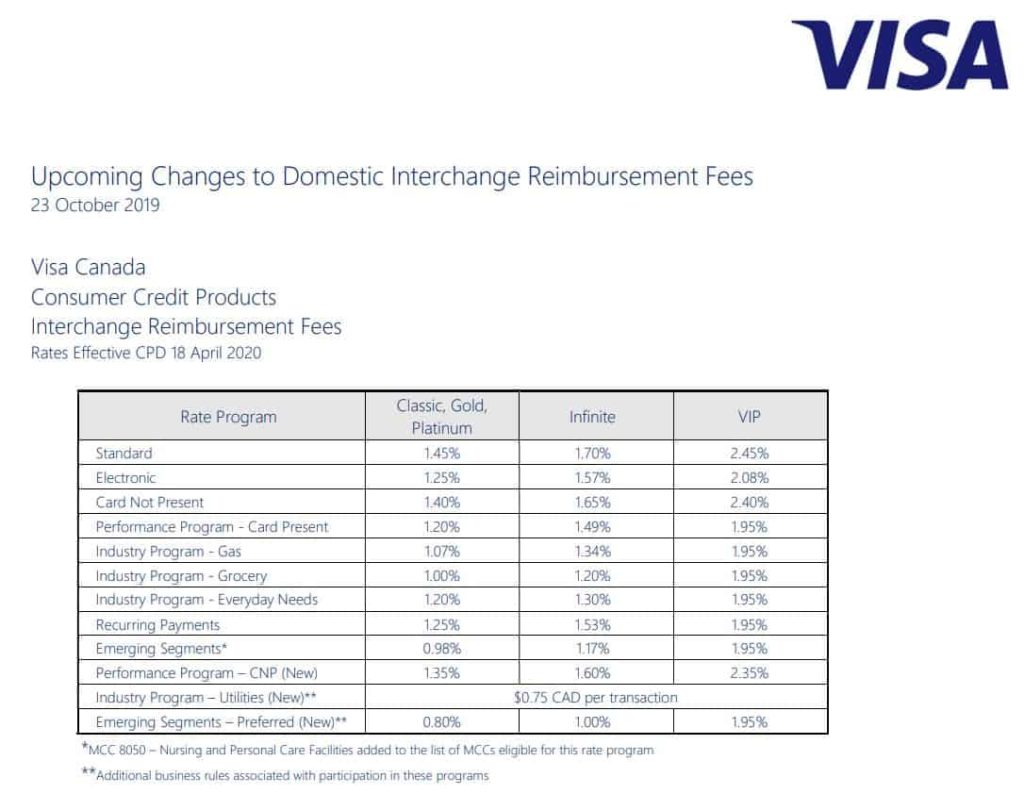

Visa's interchange fees

Visa has announced the interchange fees effective April 18, 2020 on this page.

Credit card issuer adjustments

To cope with this decline in interchange fees, credit card issuers are adjusting the rates of rewards issued to their customers, as well as welcome bonuses.

Each institution has therefore started to contact its clients since the beginning of 2020.

We have seen it for example with Rogers credit cards.

Rather than write an article on each change, we have therefore preferred to summarize the actions taken by the credit card issuers below.

This text will therefore be regularly updated.

As a reminder, institutions have several adjustment variables such as:

- adjust reward accrual rates

- alter the point usage schedules for rewards

- lower welcome bonuses

- modify the qualification criteria for applying on a card

Rogers Bank

Card affected: Rogers World EliteMD MastercardMD

| Before | After |

| 4% discount on transactions in foreign currency |

3% discount on transactionsin U.S. dollars |

| 2% on purchases with Rogers |

1.5% on purchases. with Rogers |

| 1.75% on all purchases | 1.5% on all purchases. |

| no minimum annual expenditure required | 15,000 in annual expenditures required (between August 1 and July 31 of the following year) to avoid product decommissioning (World Elite to Platinum) |

| – | Added unlimited Wi-Fi with Boingo |

| Rogers has decided to adjust all discount rates downward. The most drastic cut is on purchases in foreign currencies (only 1.5% instead of 4%, which previously excluded US dollars).

Since this card charges fees in foreign currencies, it is no longer interesting to use it since there are credit cards without conversion fees as alternatives. |

|

| Information about changes on the institution’s website | |

Card affected: Rogers Platinum MastercardMD

| Before | After |

| 3% discount on foreign currency transactions |

3% discount on transactions in U.S. dollars |

| 2% on purchases with Rogers |

1% on purchases with Rogers |

| 1.25 % on all purchases | 1% on all purchases |

| Information about changes on the institution’s website |

|

Scotiabank

Cards affected: Cards participating in the Scotia Rewards Points program

| Before | After |

| Statement credit $100 = 14,000 points $150 = 21,000 points $300 = 37,500 points $500 = 62,500 points |

Statement credit $100 = 14,500 points $150 = 21,500 points $300 = 43,000 points $500 = 71,500 points |

| Gift-card $25 = 3,400 points $50 = 6,700 points US$ 50 = 7,100 points $100 = 13,400 points $200 = 26,000 points $250 = 32,400 points $500 = 64,000 points |

Gift-card $25 = 3,500 points $50 = 7,000 points US$ 50 = 9,500 points $100 = 14,000 points $200 = 28,000 points $250 = 35,000 points $500 = 70,000 points |

| Apple and Best Buy items $1 = 127 points |

Apple and Best Buy items $1 = 145 points |

| Information about changes on the institution’s website | |

| Scotiabank has decided to touch the exchange structure of Scotia Rewards for a account credit, a gift card or items in the Apple and Best Buy catalogues.

No change to the travel credit: the value of the points remains at 10,000 points = $100. And that’s the best way to use Scotia Rewards points. Please note that these changes do not apply to Quebec residents! |

|

BMO

Card affected: BMO® CashBack® Mastercard®*

| Before | After |

| 1% cash back on all purchases |

0.5% cash back on all purchases |

| – | 1% cash back on bill payments ($500 limit per statement) |

| – | 3% cash back at the grocery store ($500 limit of purchases per statement) |

| BMO has changed its cash back structure for its no annual fee BMO® CashBack® Mastercard®*.

Going from 1% to 0.5% cash back on all purchases is a significant devaluation. However, in return, it offers 3% for grocery store purchases (which no other no annual fee cash back card offers), as well as 1% for bill payments. There is still a monthly limit of $500 in each of these two categories. This credit card could still satisfy cardholders with a small budget for its 3% grocery store cash back. For more information on this card, visit the BMO website. |

|

| Information about changes on the institution’s website | |

Capital One

Card affected: Aspire Travel World Elite Mastercard

| Before | After |

| 2 points per dollar of purchases | 1.5 points per dollar of purchases |

| 10,000 bonus points at renewal | deleted |

| These changes will be implemented as of August 5, 2020. | |

Desjardins

Card affected: Desjardins World Mastercard CashBack Card

| Before | After |

| 2% (contactless) | – |

| 2% (levies) | 2 % |

| 1% (entertainment) | 2 % |

| 1% (restaurant) | 2 % |

| 1% (public transit) | 2 % |

| 1% (other) | 0,5 % |

| These changes will be implemented as of October 18, 2020. | |

Cards affected: Desjardins Cash Back Visa and Mastercard credit cards

| Before | After |

| 1 % (non-contact) | – |

| 1 % (levies) | 2 % |

| 0.5% (entertainment) | 2 % |

| 0.5 % (restaurant) | 2 % |

| 0.5% (public transit) | 2 % |

| 0.5% (other) | 0,5 % |

| These changes will be implemented as of October 18, 2020. | |

Card affected: Desjardins Odyssey® World Elite®note Mastercard®

| Before | After |

| 20% additional bonus dollars per year (good management) |

abolished at the end of 2020 |

| up to 2% Bonusdollars for all purchases | 3% for groceries 2% for restaurants, entertainment, public transportation 1.5% for all purchases |

| Cancellation of Accident Insurance – Public Transport Vehicle on October 18, 2020 | |

| These changes will be implemented as of October 18, 2020. | |

Card affected: Desjardins Odyssey® Visa Infinite Privilege

| Before | After |

| 20% additional bonidollars per year (good management) |

abolished at the end of 2020 |

| 2% Bonusdollars for all purchases | 4% for restaurants, entertainment and public transport 3% for groceries and travel 1.75% for all purchases |

| These changes will be implemented as of October 18, 2020. | |

Conclusion

In North America, loyalty programs are mostly built around credit cards.

A 10-point change in the base rate of interchange fees (as here from 1.5% to 1.4%) can therefore have significant changes throughout the ecosystem, as you can see with all the adjustments made by the banking institutions.

Will we see lower prices for the products and services we buy from merchants?

You be the judge of that.